Cetera Investment Advisers Boosts Stake in Teradyne

December 9, 2022

Trending News ☀️

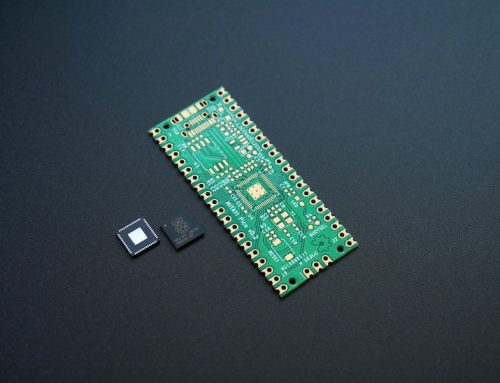

TERADYNE ($NASDAQ:TER) is a leading provider of automated test solutions for the semiconductor and electronics industries. Its products are used by leading companies in the automotive, aerospace and defense, communications, healthcare, and industrial sectors. Recently, Cetera Investment Advisers, a financial services firm, announced that it has increased its holdings in Teradyne, Inc. (NYSE: TER). This is the second consecutive quarter that Cetera Investment Advisers has increased its stake in Teradyne, Inc. Cetera Investment Advisers is one of the largest independent financial advisors in the United States. It is also a leader in wealth management and retirement services, providing comprehensive advice and solutions to individual investors and businesses of all sizes.

The recent increase in Cetera Investment Advisers’ stake in Teradyne is an indication of the company’s confidence in the company’s future prospects. With its cutting-edge products and advanced technologies, Teradyne is well-positioned to capitalize on the growing demand for automated test solutions. The company’s strong financial performance and increasing market share are also likely to be viewed favorably by investors. This could be a good opportunity for investors to consider investing in Teradyne in order to benefit from the potential upside potential of its stock.

Market Price

On Friday, Cetera Investment Advisers boosted its stake in the robotics and automation company Teradyne Inc. (TER). The stock opened at $90.1 and closed at $92.7, up by 0.4% from the last closing price of $92.3. The increase in the stake of Cetera Investment Advisers follows a period of positive news for Teradyne, which recently announced a $1 billion share buyback program. The company also recently announced a partnership with Microsoft to create an AI-driven industrial automation platform to help customers increase efficiency, reduce costs, and improve safety. Teradyne is one of the leading players in the robotics and automation industry, with a strong focus on AI-enabled solutions for industrial applications. It provides robotic systems for a wide range of industries, from automotive and electronics to aerospace and defense.

The company also has a well-developed portfolio of advanced manufacturing solutions, including vision inspection systems, test systems, and other automation products. Looking ahead, Teradyne is well-positioned to benefit from the continued growth in the robotics and automation market. Its strong portfolio of advanced solutions, combined with its partnerships with leading technology companies, will continue to drive growth for the company. Investors are likely to remain bullish on Teradyne as the company continues to expand its market share and strengthen its position in the robotics and automation industry. Live Quote…

About the Company

VI Analysis

TERADYNE is a great low risk investment according to the VI Risk Rating. This rating is determined by analyzing various financial and business aspects of the company. Through the VI App, investors can quickly and easily assess the long term potential of TERADYNE. The app highlights positive and negative factors and is an ideal tool for making an informed decision about investing in the company. The app also identifies any risk warnings that may be present in the balance sheet. These are flagged for further investigation and must be taken into account when assessing the investment. To access this information, users must become a registered user of the app. Overall, TERADYNE is a relatively low risk investment, with strong fundamentals that reflect its long term potential. The VI App makes it easy to assess the company’s financial and business aspects, as well as identify any risk warnings that may be present in its balance sheet. This makes it an invaluable tool for any investor looking to make an informed decision about investing in TERADYNE. More…

VI Peers

The competition between Teradyne Inc and its competitors is fierce. Lam Research Corp, Taiwan Semiconductor Manufacturing Co Ltd, and Apple Inc are all major players in the market. Teradyne Inc has been able to stay ahead of the competition by innovating and developing new products.

– Lam Research Corp ($NASDAQ:LRCX)

Lam Research Corporation is an American company that manufactures semiconductor processing equipment used in the fabrication of integrated circuits. The company was founded in 1980 and is headquartered in Fremont, California. Lam Research has a market capitalization of $51.81 billion as of March 2021 and a return on equity of 54.63%. The company’s products are used in a variety of applications, including memory chips, microprocessors, and graphics processors.

– Taiwan Semiconductor Manufacturing Co Ltd ($TWSE:2330)

With a market cap of 9.75T as of 2022, Taiwan Semiconductor Manufacturing Co Ltd is one of the largest companies in the world. The company’s return on equity is 22.34%, meaning that it generates a significant amount of profit for shareholders. Taiwan Semiconductor Manufacturing Co Ltd is a leading provider of semiconductor manufacturing services and one of the largest manufacturers of semiconductors in the world. The company’s products are used in a wide range of electronic devices, including computers, mobile phones, and consumer electronics.

– Apple Inc ($NASDAQ:AAPL)

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. The company’s products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of consumer and professional software applications, iCloud, and iTunes. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple was incorporated as Apple Computer, Inc., in 1977. The word “Computer” was removed from the company’s name in 2007, as its traditional focus on personal computers shifted towards consumer electronics.

Summary

Investing in Teradyne is becoming increasingly popular among financial advisors. Cetera Investment Advisers recently announced that they had increased their stake in the company, showing confidence in the future of Teradyne. With an impressive track record of innovation and strong fundamentals, Teradyne is an ideal choice for investors looking to diversify their portfolio. Teradyne operates in the semiconductor industry, providing a range of products, services, and solutions designed to meet customers’ needs. The company has a strong presence in multiple markets, including automotive, industrial, communications, healthcare, and consumer electronics. The stock has seen significant growth over the past few years, making it an attractive option for those looking for returns. Teradyne has also been able to maintain a healthy dividend payout, rewarding shareholders.

Furthermore, the company has continued to invest in research and development to stay ahead of the curve and develop innovative products. In addition to its growth potential, Teradyne also enjoys a strong balance sheet, which provides investors with a degree of security. The company has a solid cash position, meaning it is able to pay its debts and make investments without taking on additional debt. This has helped Teradyne stay competitive in the rapidly changing technology industry. Overall, investing in Teradyne is a smart move for those looking to diversify their portfolio with a reliable and profitable stock. With its impressive track record of innovation and strong fundamentals, Teradyne is an ideal choice for investors of all experience levels.

Recent Posts