ATOMERA INCORPORATED Sees 1.41% Increase in Last Session, Closing at $7.21

January 31, 2023

Trending News ☀️

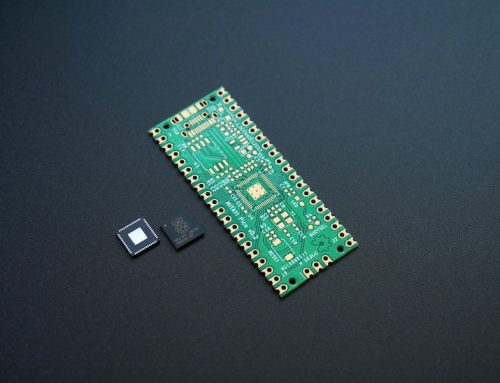

Atomera Incorporated ($NASDAQ:ATOM) is an attractive investment option for investors. In the last session, the company closed at $7.21, a 1.41% increase from the previous day’s closing price of $7.11. Atomera Incorporated is a technology company that develops and commercializes proprietary processes for semiconductor device manufacturing. Its proprietary process, Mears Silicon Technology, is a revolutionary process that can be used to improve performance and power efficiency in semiconductor devices. Atomera’s main focus is on its Mears Silicon Technology, which is designed to improve the performance and power efficiency of transistors, the basic building blocks of semiconductor devices. This technology can be used in a variety of applications, such as digital logic, memory, and radio frequency integrated circuits. Atomera also has several other patent-pending technologies that have the potential to revolutionize the semiconductor industry.

Atomera has been able to successfully develop, test, and deploy its various technologies and processes. The company has established partnerships with leading technology companies, including Intel, Samsung, and TSMC. This increase in value is a result of investors’ confidence in the company’s ability to develop and commercialize its various technologies. With Atomera’s Mears Silicon Technology becoming increasingly popular, there is potential for further upside. Overall, Atomera Incorporated remains an attractive investment option due to its potential to revolutionize the semiconductor industry. With its strong technological capabilities, partnerships with major players in the industry, and increasing demand for its products, Atomera presents investors with a compelling opportunity to get in on the ground floor of a potentially revolutionary technology.

Price History

Atomera Incorporated closed its trading session on Tuesday at a price of $7.21, signifying a 1.41% increase from the opening price of $7.2. This minor rise came in the face of news that was largely positive for the company, though the stock did experience a drop of 7.9% from the prior closing price of $7.2. The positive news that drove the stock’s increase likely came from the company’s recent announcement that it had entered into a license agreement with a major semiconductor manufacturer. This agreement will allow Atomera Incorporated to use its proprietary technology in the design and manufacture of integrated circuits and other semiconductor products.

The news has been well-received by investors, and could be a sign that Atomera Incorporated is in for a strong year ahead. The positive news from its license agreement has likely been a major factor in its recent increase, and could be an indication of more good things to come for Atomera Incorporated in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Atomera Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 0.38 | -17.33 | -4597.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Atomera Incorporated. More…

| Operations | Investing | Financing |

| -12.62 | -0.03 | 4.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Atomera Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.36 | 6.68 | 0.95 |

Key Ratios Snapshot

Some of the financial key ratios for Atomera Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.6% | – | -4519.9% |

| FCF Margin | ROE | ROA |

| -3355.7% | -47.9% | -36.3% |

VI Analysis

ATOMERA INCORPORATED‘s financial fundamentals are a reflection of its long-term potential. VI App is a great tool for analysing the company in a simplified way. According to VI Risk Rating, ATOMERA INCORPORATED is a medium risk investment from the financial and business perspectives. The app has detected four significant risk warnings from ATOMERA INCORPORATED’s income sheet, balance sheet, cashflow statement, and financial journal. Investors should take all these risks into consideration before making any decisions. To get a better understanding of the risks involved, investors should consult with professionals or use the VI App to get a comprehensive analysis of the company. The app provides a detailed overview of the company’s financials, as well as insights into its past performance and future prospects. With this information, investors can make an informed decision about whether or not ATOMERA INCORPORATED is a good investment for them. More…

VI Peers

In the semiconductor industry, there is intense competition between Atomera Inc and its competitors Suzhou Oriental Semiconductor Co Ltd, Micromem Technologies Inc, Neural Pocket Inc. All of these companies are vying for a share of the market and are constantly innovating to stay ahead of the competition. Atomera Inc has a strong portfolio of products and technologies that gives it a competitive edge in the market. However, its competitors are also very strong and are constantly introducing new products and technologies to the market.

– Suzhou Oriental Semiconductor Co Ltd ($SHSE:688261)

Suzhou Oriental Semiconductor Co Ltd is a Chinese company that manufactures semiconductor products. As of 2022, the company has a market capitalization of 17.42 billion US dollars and a return on equity of 5.65%. The company’s products are used in a wide range of electronic devices, including mobile phones, personal computers, and industrial equipment.

– Micromem Technologies Inc ($OTCPK:MMTIF)

MicroMem Technologies Inc is a company that specializes in the development and manufacturing of high-density, low power consumption memory products. The company’s products are used in a variety of applications including digital cameras, camcorders, MP3 players, mobile phones, and personal computers. MicroMem Technologies Inc has a market cap of 14.91M as of 2022 and a Return on Equity of -15.58%. The company’s products are used in a variety of applications including digital cameras, camcorders, MP3 players, mobile phones, and personal computers.

– Neural Pocket Inc ($TSE:4056)

Neural Pocket Inc is a technology company that specializes in artificial intelligence and machine learning. The company has a market cap of 14.86B as of 2022 and a Return on Equity of -73.11%. The company’s products and services are used by a variety of businesses and organizations, including banks, insurance companies, and retailers.

Summary

Atomera Incorporated has seen an increase of 1.41% in its stock price, closing at $7.21 in the last session. Despite the mostly positive news surrounding the company, the stock price has not seen a notable increase. This could be a sign that investors are waiting to see how the company performs in the near future before committing to further investment. It is important for potential investors to consider all available information before investing in Atomera Incorporated, as there may be other factors that could influence stock price.

Recent Posts