Applied Materials Invests Heavily in the Future of Chip Technology with $4B Research Center

May 23, 2023

Trending News 🌥️

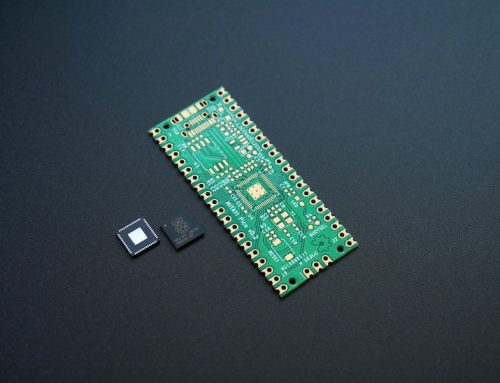

Applied Materials ($NASDAQ:AMAT) Inc., one of the world’s leading semiconductor equipment manufacturing companies, is investing as much as four billion dollars into the research and development of next-generation chip technology. The news comes on the heels of their announcement to establish a new chip research center in the San Francisco Bay Area. Applied Materials has a long and successful history in the semiconductor and electronics industry, providing the materials, processes and services to create high-end chips used in many consumer electronics. The company is responsible for a wide array of products from photovoltaic systems to display technologies, and their work is essential to the modern digital age. With this latest investment, Applied Materials aims to develop technology that will revolutionize the world of computing.

The new research center will focus on advanced materials, process integration, chip designs, and other related areas of semiconductor research. The establishment of this research center will not only propel Applied Materials into the future of chip technology but will also create a great opportunity for many in the Bay Area to gain insight into the latest developments in semiconductor technologies. This is an exciting time for the electronics industry, and Applied Materials’ continued investment into this area of research will set them up for success.

Price History

On Monday, Applied Materials Inc. opened their stocks at $127.2 and closed at $126.6, giving a 0.3% decrease from the previous closing price of 127.0. Recently, Applied Materials announced that they will be building a $4 billion research center, dedicated to research and development of new chip technology. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Applied Materials. More…

| Total Revenues | Net Income | Net Margin |

| 26.64k | 6.49k | 24.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Applied Materials. More…

| Operations | Investing | Financing |

| 6.89k | -1.43k | -4.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Applied Materials. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.09k | 14.96k | 15.88 |

Key Ratios Snapshot

Some of the financial key ratios for Applied Materials are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.9% | 28.9% | 29.3% |

| FCF Margin | ROE | ROA |

| 22.2% | 36.3% | 16.8% |

Analysis

At GoodWhale, we have carefully analysed the fundamentals of APPLIED MATERIALS and have given it a medium risk rating. This means that potential investors should be aware of the associated risks, but can feel comfortable making an investment. The financial and business aspects have been taken into account when making this assessment. We have also detected one risk warning in the company’s balance sheet. To get further insight into these findings, you can register with GoodWhale and access our detailed report about APPLIED MATERIALS. With this information, you can make a more informed decision about investing in the company. More…

Peers

Applied Materials, Inc. and its competitors, Lam Research Corporation, KLA Corporation, and ASML Holding NV, compete in the semiconductor equipment industry. This industry is capital intensive, with high barriers to entry. The four companies have similar business models, but Applied Materials has a slight edge in terms of market share.

– Lam Research Corp ($NASDAQ:LRCX)

Lam Research Corporation is a company that manufactures semiconductor processing equipment. It is headquartered in Fremont, California, and has been in business since 1980. The company has a market capitalization of $51.81 billion as of 2022 and a return on equity of 54.63%. Lam Research Corporation is a leading supplier of wafer processing equipment to the semiconductor industry. The company’s products are used in the manufacturing of integrated circuits (ICs), which are the tiny electronic components that are found in everything from computers to cell phones. Lam Research Corporation’s products are used in all stages of IC production, from the initial deposition of materials on the wafer to the final etching of the completed circuits.

– KLA Corp ($NASDAQ:KLAC)

KLA Corp is a leader in process equipment and services for the semiconductor and nanoelectronics industries. The company has a market cap of $43.23 billion and a return on equity of 126.76%. KLA Corp provides products and services that enable the manufacturing of advanced semiconductor chips. The company’s products are used by customers in the fab process of making chips, including etching, metrology, and inspection. KLA Corp’s services enable customers to optimize their productivity and yield. The company has a strong history of innovation and is a trusted partner to the world’s leading chipmakers.

– ASML Holding NV ($NASDAQ:ASML)

ASML Holding NV is a technology company that manufactures semiconductor processing equipment, which is used in the production of integrated circuits (ICs). ASML’s products are used by customers in the computer, communications, and consumer electronics industries. The company has a market cap of 187.16B as of 2022 and a return on equity of 39.55%. ASML is headquartered in the Netherlands and has offices in Europe, the United States, Asia, and Japan.

Summary

Applied Materials, a leading supplier of semiconductor and display technologies, recently announced plans to invest up to $4 billion in a new research center dedicated to chip innovation. The new center is expected to include an advanced chip-manufacturing facility and other initiatives to help drive the semiconductor industry forward. It is part of the company’s ongoing efforts to develop more efficient and advanced chip technologies.

The investment is expected to create jobs, increase Applied Materials’ presence in the chip sector, and drive long-term growth. Analysts have reacted positively to the move, with many citing the potential for Applied Materials to become a leader in the semiconductor industry.

Recent Posts