Amkor Technology Sees Significant Dip in Short Interest

January 4, 2024

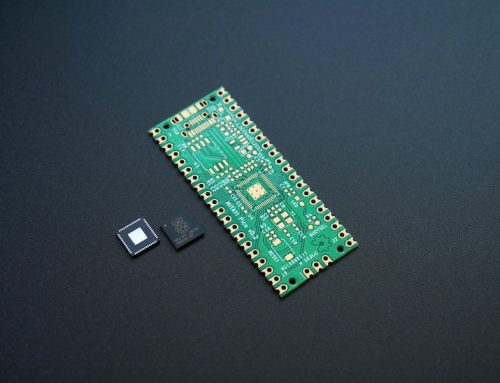

☀️Trending News

Amkor Technology ($NASDAQ:AMKR), Inc. is a global provider of semiconductor packaging and test services. Recently, Amkor has seen a significant dip in short interest. Short interest consists of the total number of shares that have been sold short, but not yet covered or closed out. This means investors have lost confidence in the stock and have chosen to take a short position on it. This suggests that investors had been expecting the stock to continue its upwards movement, but are now taking a more wait-and-see approach given the uncertainty in the markets. Overall, it appears that investors have lost confidence in Amkor Technology’s stock due to the recent market volatility. As such, they have chosen to reduce their exposure to the stock by shorting it.

However, given the company’s strong performance, it could be a good opportunity for investors who are bullish on Amkor to take advantage of this dip in short interest.

Market Price

The stock opened at $31.4 but closed at $30.8, representing a 3.9% decrease from its previous closing price of $32.0. This decrease in share value is most likely due to the large amount of short selling from traders who believe that the stock is overvalued and that it will soon decline in price. With such a steep decline in the stock’s short interest, investors have become wary and uncertain of the stock’s future performance. As a result, AMKOR TECHNOLOGY‘s share price is likely to remain volatile in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amkor Technology. More…

| Total Revenues | Net Income | Net Margin |

| 6.66k | 406.55 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amkor Technology. More…

| Operations | Investing | Financing |

| 1.25k | -980.85 | -155.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amkor Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.73k | 2.86k | 15.65 |

Key Ratios Snapshot

Some of the financial key ratios for Amkor Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.1% | 9.1% | 8.4% |

| FCF Margin | ROE | ROA |

| 6.1% | 9.2% | 5.2% |

Analysis

As a GoodWhale analyst, I conducted an analysis of AMKOR TECHNOLOGY‘s fundamentals. According to our Star Chart, AMKOR TECHNOLOGY has a high health score of 10/10, indicating that the company is capable of weathering any potential crisis without the risk of bankruptcy. AMKOR TECHNOLOGY is classified as a ‘rhino’, which we define as a company that has achieved moderate revenue or earnings growth. Investors who may be interested in this type of company will likely be looking for stability and consistency in asset, dividend, growth, and profitability, all of which AMKOR TECHNOLOGY is strong in. More…

Peers

The competition in the semiconductor industry is fierce. Amkor Technology Inc is up against Unisem (M) Bhd, ASE Technology Holding Co Ltd, Vate Technology Corp Ltd, and many other companies. All of these companies are vying for a piece of the pie in an industry that is growing rapidly. The company has a strong market share and is well-positioned to continue its growth.

– Unisem (M) Bhd ($KLSE:5005)

Unisem (M) Bhd is a semiconductor assembly and test company. It has a market cap of 4.21B as of 2022. The company’s ROE is 6.97%. Unisem is involved in the assembly and testing of integrated circuits, semiconductor components, and other electronic devices. The company has operations in Malaysia, the Philippines, China, and the United States.

– ASE Technology Holding Co Ltd ($TWSE:3711)

The company’s market cap is 400.9B as of 2022 and its ROE is 23.11%. The company is engaged in the business of developing, manufacturing and selling semiconductor products.

– Vate Technology Corp Ltd ($TPEX:5344)

Vate Technology Corp Ltd is a publicly traded company with a market capitalization of 1.41 billion as of 2022. The company has a return on equity of 1.79%. Vate Technology Corp Ltd is a leading provider of technology solutions and services. The company offers a wide range of products and services including software development, web development, e-commerce solutions, and IT consulting.

Summary

AMKOR Technology, Inc. (AMKR) has seen a significant decrease in short interest as of the most recent settlement date. This decrease in short interest could be a sign that investors are becoming more optimistic about the company’s outlook.

However, it is important to remember that short sellers may have simply closed their positions due to time constraints, as opposed to a change in sentiment.

Additionally, the stock price moved down the same day, which could indicate a lack of investor confidence in the stock. Therefore, it is important for investors to keep a close eye on AMKR and conduct proper due diligence before making any investing decisions.

Recent Posts