Dine Brands Secures Refinancing for Existing Fixed Rate Notes

April 18, 2023

Trending News ☀️

Dine Brands Global ($NYSE:DIN) (DIN) is a holding company for two full-service dining franchises, Applebee’s Neighborhood Grill & Bar and IHOP Restaurants. Dine Brands is the world’s largest full-service restaurant company based on market capitalization. Recently, the company announced that it has completed a refinancing of a portion of its existing fixed rate notes. The refinancing will also help the company to extend its debt maturities, reduce its cost of capital and maintain strong liquidity position.

Additionally, the refinancing will provide Dine Brands with greater operating flexibility and further strengthen its balance sheet. This move will help to improve the company’s long-term financial performance.

Price History

On Monday, DINE BRANDS GLOBAL announced the successful refinancing of its existing fixed rate notes. The stock opened at $67.6 and closed at $66.2, down by 2.5% from previous closing price of 67.8. The new facility is expected to reduce interest expense and provide longer-term financing to the company. The new revolving facility is expected to provide the company with additional liquidity for working capital needs and other corporate purposes. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DIN. More…

| Total Revenues | Net Income | Net Margin |

| 909.4 | 78.94 | 9.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DIN. More…

| Operations | Investing | Financing |

| 89.34 | -80.9 | -108.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DIN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.88k | 2.18k | -19.3 |

Key Ratios Snapshot

Some of the financial key ratios for DIN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | -5.5% | 19.3% |

| FCF Margin | ROE | ROA |

| 5.9% | -36.4% | 5.8% |

Analysis

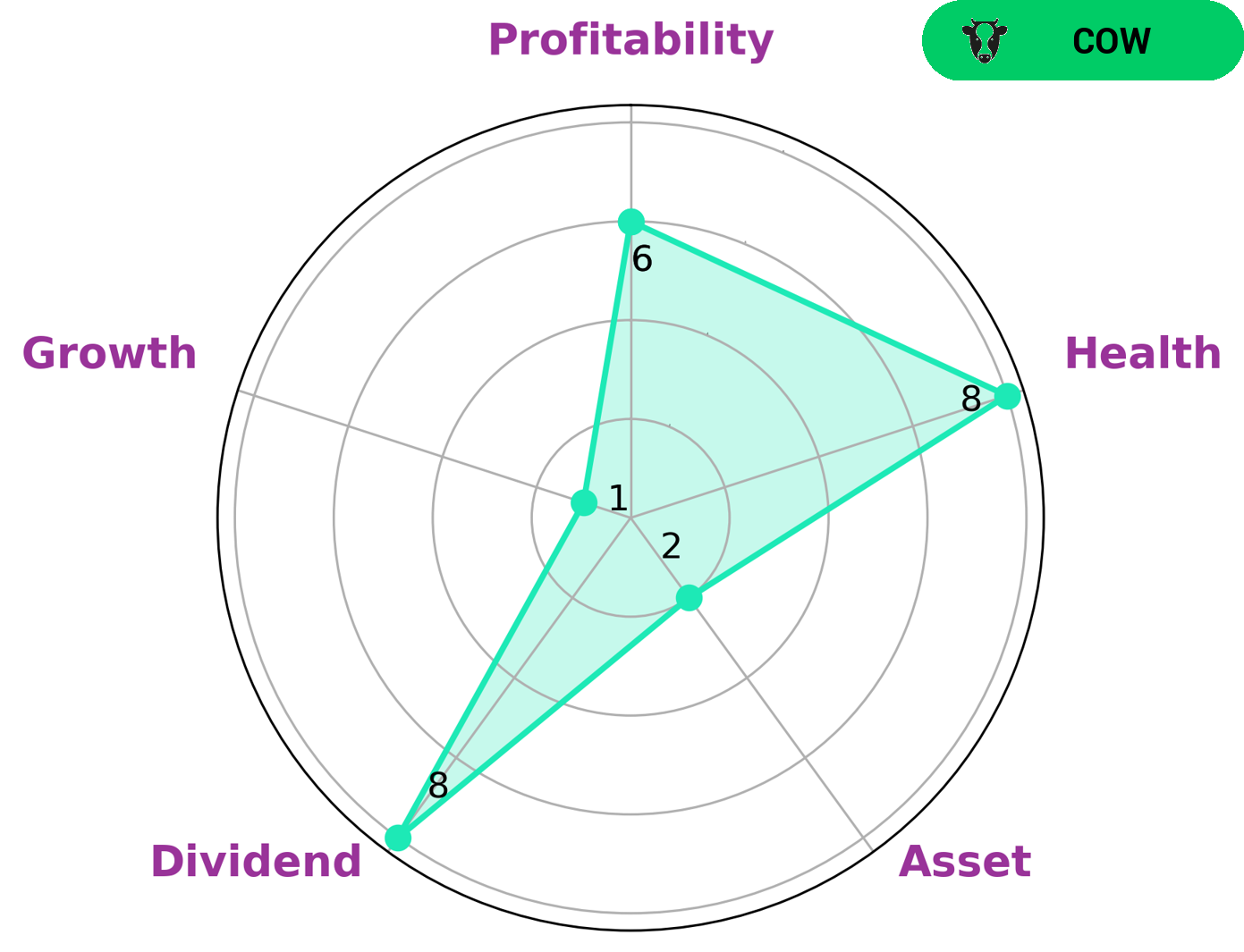

At GoodWhale, we have analyzed the fundamentals of DINE BRANDS GLOBAL and found it to be classified as a ‘cow’ according to our Star Chart. This implies that the company has a track record of paying out consistent and sustainable dividends, making it appealing to dividend-focused investors. In addition to its attractive dividend profile, DINE BRANDS GLOBAL has a high health score of 8/10, indicating that it is capable of paying off debt and adequately funding its future operations. Furthermore, DINE BRANDS GLOBAL is strong in dividend, medium in profitability, and weak in asset and growth. This provides investors with further insights into the company’s performance and strategy. More…

Peers

Dine Brands Global Inc. is one of the largest full-service restaurant companies in the world. The company operates or franchises more than 3,700 restaurants in over 100 countries. Dine Brands Global is the parent company of two of the world’s most iconic restaurant brands, Applebee’s and IHOP. Dine Brands Global competes with other full-service restaurant companies, including Recipe Unlimited Corp, Pavillon Holdings Ltd, and Jlogo Holdings Ltd.

– Recipe Unlimited Corp ($TSX:RECP)

Pavillon Holdings Ltd is a holding company that operates in the food and beverage industry. The company has a market cap of 63.14M as of 2022 and a Return on Equity of -104.65%. The company operates in the food and beverage industry and is engaged in the production and distribution of food and beverage products. The company’s products include alcoholic and non-alcoholic beverages, food, and other consumer goods.

– Pavillon Holdings Ltd ($SGX:596)

Jlogo Holdings Ltd is a company that provides services relating to the design, manufacturing, and distribution of logos. The company has a market capitalization of 445M as of 2022 and a return on equity of -32.17%. The company’s primary business is the provision of services to businesses in the design, production, and distribution of their logos. The company also provides services to businesses in the area of marketing and advertising. The company has a wide range of clients, including small businesses, large businesses, and international businesses.

Summary

Dine Brands Global Inc. recently completed a partial refinancing of its existing fixed rate notes. This move signals that the company is taking steps to secure its long-term financial stability. The company also obtained an amendment to its existing credit facility, which will provide additional liquidity and improved financial flexibility.

In addition, the company plans to use proceeds from the refinancing to pay down its revolving credit facility and for general corporate purposes. All in all, Dine Brands Global Inc.’s refinancing is a positive move for investors, as it provides additional liquidity and improved financial flexibility.

Recent Posts