Bloomin’ Brands Stock Sees Decrease in Short Interest During November

December 31, 2022

Trending News ☀️

Bloomin’ Brands ($NASDAQ:BLMN), Inc. is a restaurant company that owns and operates several restaurant chains, including Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Prime Steakhouse & Wine Bar. The company’s stock is traded on the NASDAQ under the ticker symbol BLMN. This decline was primarily driven by a decrease in short selling activity in Outback Steakhouse and Carrabba’s Italian Grill, which together account for the majority of the company’s operations. The decrease in short interest is likely due to an overall improvement in the performance of Bloomin’ Brands’ stock.

This platform allows customers to order food from their favorite Bloomin’ Brands restaurant and have it delivered to their doorstep. The platform has been a major success, with orders more than doubling since its launch. The company’s successful reopening and digital strategies have allowed it to outperform the market, and the decrease in short interest indicates that investors are becoming more confident in the company’s future prospects.

Share Price

Data from the Financial Industry Regulatory Authority (FINRA) showed a decrease in short interest of 1.3% from the previous month. On Wednesday, the stock opened at $20.7 and closed at $20.3, down by 1.3% from the previous closing price of $20.6. The news sentiment surrounding Bloomin’ Brands is currently mostly positive, with several analysts and investors voicing their opinion on the stock in the past few weeks. Investors are also generally optimistic about the company’s future prospects, given the recent news of their expansion into new markets.

In addition, Bloomin’ Brands has seen an increase in its revenues over the past year, with revenues up by almost 20% compared to last year. This was mainly driven by increased sales of their products in new markets, as well as their focus on expanding their customer base. Overall, Bloomin’ Brands has seen a decrease in short interest during November, with investors and analysts being mostly positive about the company’s prospects. This coupled with increasing revenues and a rising stock price indicate that the company is on a good trajectory for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bloomin’ Brands. More…

| Total Revenues | Net Income | Net Margin |

| 4.37k | 104.56 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bloomin’ Brands. More…

| Operations | Investing | Financing |

| 390.79 | -157.12 | -222.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bloomin’ Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.22k | 2.98k | 2.7 |

Key Ratios Snapshot

Some of the financial key ratios for Bloomin’ Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.9% | 19.1% | 4.6% |

| FCF Margin | ROE | ROA |

| 4.9% | 49.9% | 3.9% |

VI Analysis

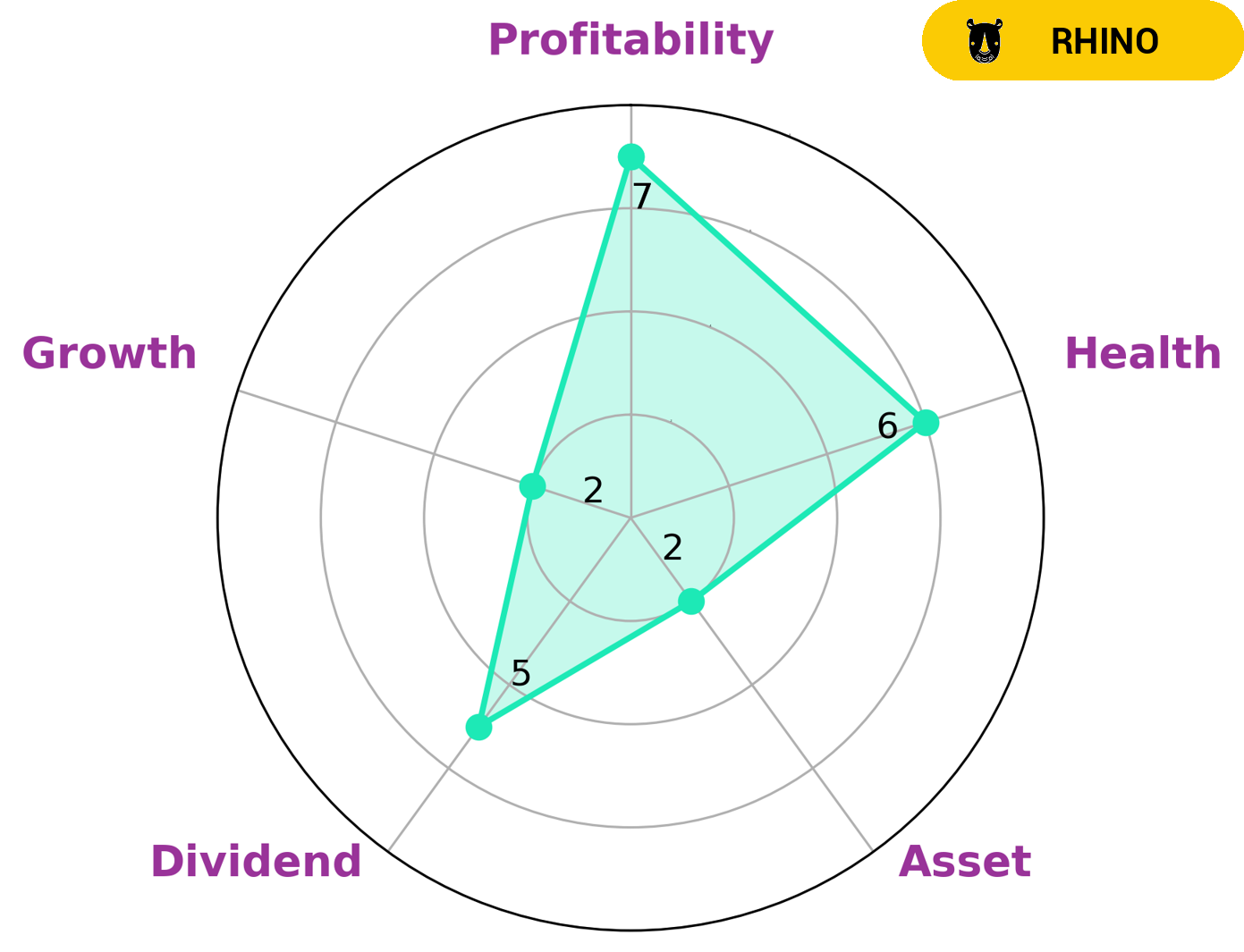

The fundamentals of a company reflect its long-term potential, and VI’s app can make this analysis simple. According to the VI Star Chart, BLOOMIN’ BRANDS has been classified as a “rhino”, meaning it has achieved moderate revenue or earnings growth. Investors interested in such a company may be looking for steady returns with a moderate amount of risk. BLOOMIN’ BRANDS is strong in profitability, has a medium dividend strength, and is weak in terms of asset growth. The company has an intermediate health score of 6/10, which indicates that it is likely to be able to pay off its debt and fund future operations. This makes it an attractive option for investors who are seeking stability and potential for growth. BLOOMIN’ BRANDS also offers good prospects for long-term investment, as its fundamentals suggest that it is capable of sustaining steady growth over time. More…

VI Peers

Bloomin Brands Inc. is an international restaurant company that owns and operates several casual dining restaurant chains. Its competitors include Rave Restaurant Group Inc, Alsea SAB de CV, and BJ’s Restaurants Inc.

– Rave Restaurant Group Inc ($NASDAQ:RAVE)

Rave Restaurant Group Inc is a publicly traded company that owns and operates several restaurant brands, including Pizza Inn and Pie Five Pizza Co. As of 2022, the company had a market capitalization of $31 million and a return on equity of 14.79%. The company’s restaurants are located in the United States, Canada, and Puerto Rico.

– Alsea SAB de CV ($OTCPK:ALSSF)

Alsea SAB de CV is a Mexican food and beverage company with a market cap of 1.53B as of 2022. The company has a Return on Equity of 52.23%. Alsea SAB de CV operates in Mexico, Argentina, Chile, Colombia, and Brazil. The company operates through four segments: Mexico, South America, Central America, and Direct Operations. The company offers a variety of food and beverage products under the brands of Starbucks, Domino’s Pizza, Burger King, Havanna, Pizza Hut, and others.

– BJ’s Restaurants Inc ($NASDAQ:BJRI)

BJ’s Restaurants Inc is a leading operator of casual dining restaurants in the United States. The company operates over 190 restaurants in 26 states. BJ’s Restaurants Inc offers a variety of menu items, including pizzas, burgers, sandwiches, and salads. The company also offers a variety of alcoholic beverages. BJ’s Restaurants Inc has a market cap of 764.37M as of 2022, a Return on Equity of -3.52%. The company’s focus on quality food and beverages, friendly service, and value pricing has made it a popular destination for casual dining.

Summary

Investing in Bloomin’ Brands can be a great way to diversify a portfolio, as the company operates a variety of different casual dining restaurants including Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Prime Steakhouse & Wine Bar. Bloomin’ Brands has seen a decrease in short interest during November. This could mean that investors are becoming more confident in the company’s future prospects and are starting to move away from betting against it. This could also indicate that more investors are buying into the stock, which would be an encouraging sign for potential investors. The company has also seen positive news sentiment over the last few months.

In addition to the decrease in short interest, Bloomin’ Brands recently announced plans to open a new restaurant concept called “Bloomin’ X” that will focus on plant-based and flexitarian options. This could be seen as a positive sign for the company’s future prospects, as catering to changing consumer preferences and dietary needs has been a winning strategy for many companies over the past few years. Overall, investing in Bloomin’ Brands could be a great way to diversify a portfolio and capitalize on the company’s potential for long-term growth. With the decrease in short interest and the new restaurant concept, Bloomin’ Brands looks to be in a good position for potential investors.

Recent Posts