Bloomin’ Brands Stock Fair Value Calculator – Bloomin’ Brands Posts Record Earnings and Revenue in Q3

April 30, 2023

Trending News 🌥️

Bloomin’ Brands ($NASDAQ:BLMN), a multibillion-dollar hospitality company, recently posted record earnings and revenue for its third quarter. The company reported a Non-GAAP earnings per share (EPS) of $0.98, which exceeded analysts’ estimates by $0.09. Revenue for the quarter also surpassed projections by $20M, coming in at $1.24B. Bloomin’ Brands is a global leader in the restaurant industry. It owns and operates the Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Prime Steakhouse & Wine Bar restaurant brands. It is publicly traded on the NASDAQ under the ticker symbol BLMN.

The results for the third quarter demonstrate Bloomin’ Brands’ commitment to growth and its ability to exceed expectations. The company has seen positive results in both its top-line and bottom-line figures, with steady improvement year over year. The success of its various brands and the focus on customer satisfaction have allowed it to remain competitive and continue to grow in a difficult market. The company’s focus on providing high quality services and products has enabled it to become a powerhouse in the restaurant industry and should ensure that its earnings and revenue continue to grow.

Market Price

On Friday, BLOOMIN’ BRANDS stock opened at $24.6 and closed at $24.8, representing a 5.1% increase from the previous day’s closing price of 23.6. This strong performance was credited to the improved performance of the company’s core brands, including Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Prime Steakhouse & Wine Bar. This included offering contactless ordering, delivery, curbside pickup, and in-store dining options, which resulted in increased demand for its products throughout the third quarter.

BLOOMIN’ BRANDS’ strong financial performance has been further bolstered by its successful expansion into international markets, such as South Korea and Mexico. The company is expected to continue its growth in the coming quarters as more people return to dining out. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bloomin’ Brands. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 101.91 | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bloomin’ Brands. More…

| Operations | Investing | Financing |

| 390.92 | -201.14 | -195.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bloomin’ Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.32k | 3.05k | 3.09 |

Key Ratios Snapshot

Some of the financial key ratios for Bloomin’ Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 18.9% | 4.6% |

| FCF Margin | ROE | ROA |

| 3.9% | 50.3% | 3.9% |

Analysis – Bloomin’ Brands Stock Fair Value Calculator

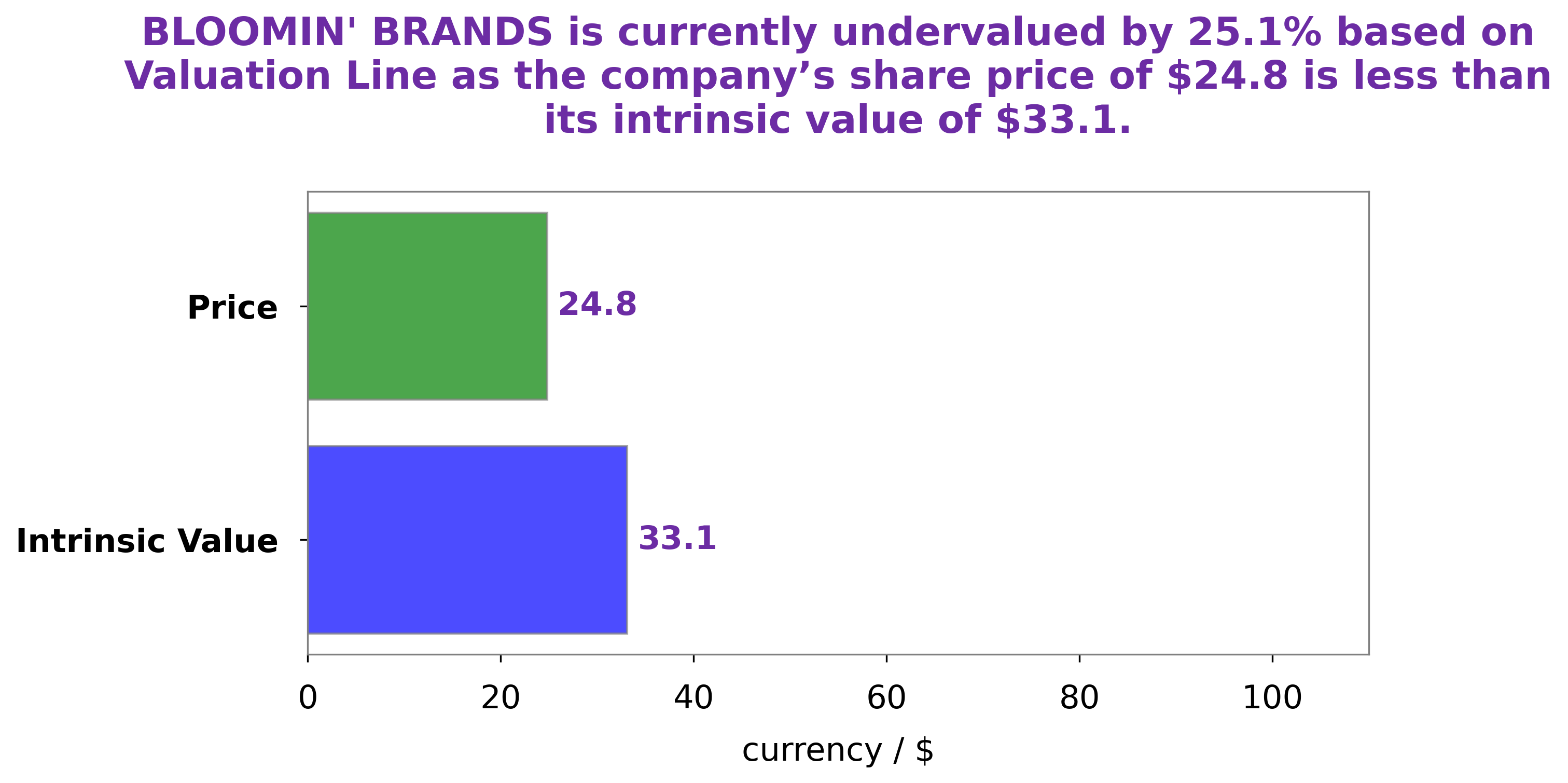

GoodWhale has conducted an analysis of the financials of BLOOMIN’ BRANDS and determined that their intrinsic value per share is approximately $33.1. Our proprietary Valuation Line was used to calculate this figure. Currently, BLOOMIN’ BRANDS stock is trading on the market at $24.8, which is undervalued by 25.2%. This suggests that there is a potential opportunity for investors to buy BLOOMIN’ BRANDS at a discounted rate and benefit from a possible increase in intrinsic value. More…

Peers

Bloomin Brands Inc. is an international restaurant company that owns and operates several casual dining restaurant chains. Its competitors include Rave Restaurant Group Inc, Alsea SAB de CV, and BJ’s Restaurants Inc.

– Rave Restaurant Group Inc ($NASDAQ:RAVE)

Rave Restaurant Group Inc is a publicly traded company that owns and operates several restaurant brands, including Pizza Inn and Pie Five Pizza Co. As of 2022, the company had a market capitalization of $31 million and a return on equity of 14.79%. The company’s restaurants are located in the United States, Canada, and Puerto Rico.

– Alsea SAB de CV ($OTCPK:ALSSF)

Alsea SAB de CV is a Mexican food and beverage company with a market cap of 1.53B as of 2022. The company has a Return on Equity of 52.23%. Alsea SAB de CV operates in Mexico, Argentina, Chile, Colombia, and Brazil. The company operates through four segments: Mexico, South America, Central America, and Direct Operations. The company offers a variety of food and beverage products under the brands of Starbucks, Domino’s Pizza, Burger King, Havanna, Pizza Hut, and others.

– BJ’s Restaurants Inc ($NASDAQ:BJRI)

BJ’s Restaurants Inc is a leading operator of casual dining restaurants in the United States. The company operates over 190 restaurants in 26 states. BJ’s Restaurants Inc offers a variety of menu items, including pizzas, burgers, sandwiches, and salads. The company also offers a variety of alcoholic beverages. BJ’s Restaurants Inc has a market cap of 764.37M as of 2022, a Return on Equity of -3.52%. The company’s focus on quality food and beverages, friendly service, and value pricing has made it a popular destination for casual dining.

Summary

The news was well received as the stock price moved up the same day. An analysis of Bloomin’ Brands investing opportunity reveals that the company is well positioned to capitalize on the increasing demand for restaurant chains and related services. The company has a solid management team, financials that are in order, and a strong presence in the industry, all of which should enable it to remain competitive and generate strong returns for investors.

Recent Posts