Marriott Vacations Worldwide Sees Bright Future Ahead with $136 Increase Prediction.

January 7, 2023

Trending News ☀️

Marriott Vacations Worldwide ($NYSE:VAC) is a leading global pure-play vacation ownership company. Marriott Vacations Worldwide develops, markets, and operates vacation ownership resorts and provides exchange services to owners of its resorts worldwide. Analysts have predicted that VAC’s share price will reach $136, following a 0.86 point increase on Friday, closing at $134.59. This suggests that the future outlook for VAC is positive. The company has consistently performed well in the past, and analysts believe that this trend will continue. VAC has recently seen an increase in demand for its products and services, as more people look to take vacations and enjoy leisure activities. As Marriott Vacations Worldwide has a wide range of resorts and services to offer, the company is well-positioned to capitalize on this increase in demand. Furthermore, the company has a strong presence in key markets, such as the US, Europe and Asia Pacific, which gives it access to a larger customer base. Marriott Vacations Worldwide’s strong financial performance and its focus on innovation and technology also bode well for its future. The company has invested heavily in technology, and this has enabled it to expand its product offerings and offer customers more options.

Additionally, its focus on developing new products and services has enabled the company to remain competitive in a rapidly changing environment. The future of Marriott Vacations Worldwide looks bright. With an increase in demand for its products and services, a strong presence in key markets, and a focus on innovation and technology, the company is well-positioned to capitalize on the current market conditions. Analysts expect the share price to reach $136 in the coming weeks, and this could further boost investor confidence in VAC.

Market Price

Currently, the media sentiment towards the company is mostly positive. On Tuesday, the company’s stock opened at $136.1 and closed at $133.3, a decrease of 1.0% from the previous closing price of 134.6. The company’s growth potential and current market position have been highlighted by analysts across the industry, and are expected to bring in more investors and lead to increased profits. The company has seen steady growth over the past few years, with a strong presence in both the leisure and business markets. Its portfolio of resorts, hotels, and vacation experiences has helped it to become one of the leading providers in the hospitality industry. Marriott Vacations Worldwide has also made significant investments in technology and customer service that have enabled it to offer more efficient and cost-effective services for its customers.

In addition, the company has continued to innovate and expand its offerings, which has attracted more customers and helped to increase its profit margin. Overall, Marriott Vacations Worldwide looks set to continue its upward trajectory in the coming years, making it an attractive investment opportunity for anyone looking to capitalize on the hospitality industry’s growth potential. With its strong market position, innovative products and services, and continuing investments in technology and customer service, Marriott Vacations Worldwide is well-positioned to capitalize on the opportunities presented by the current market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VAC. More…

| Total Revenues | Net Income | Net Margin |

| 4.57k | 364 | 10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VAC. More…

| Operations | Investing | Financing |

| 420 | 23 | -777 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VAC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.24k | 6.61k | 67.84 |

Key Ratios Snapshot

Some of the financial key ratios for VAC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.3% | 12.5% | 13.9% |

| FCF Margin | ROE | ROA |

| 7.8% | 14.8% | 4.3% |

VI Analysis

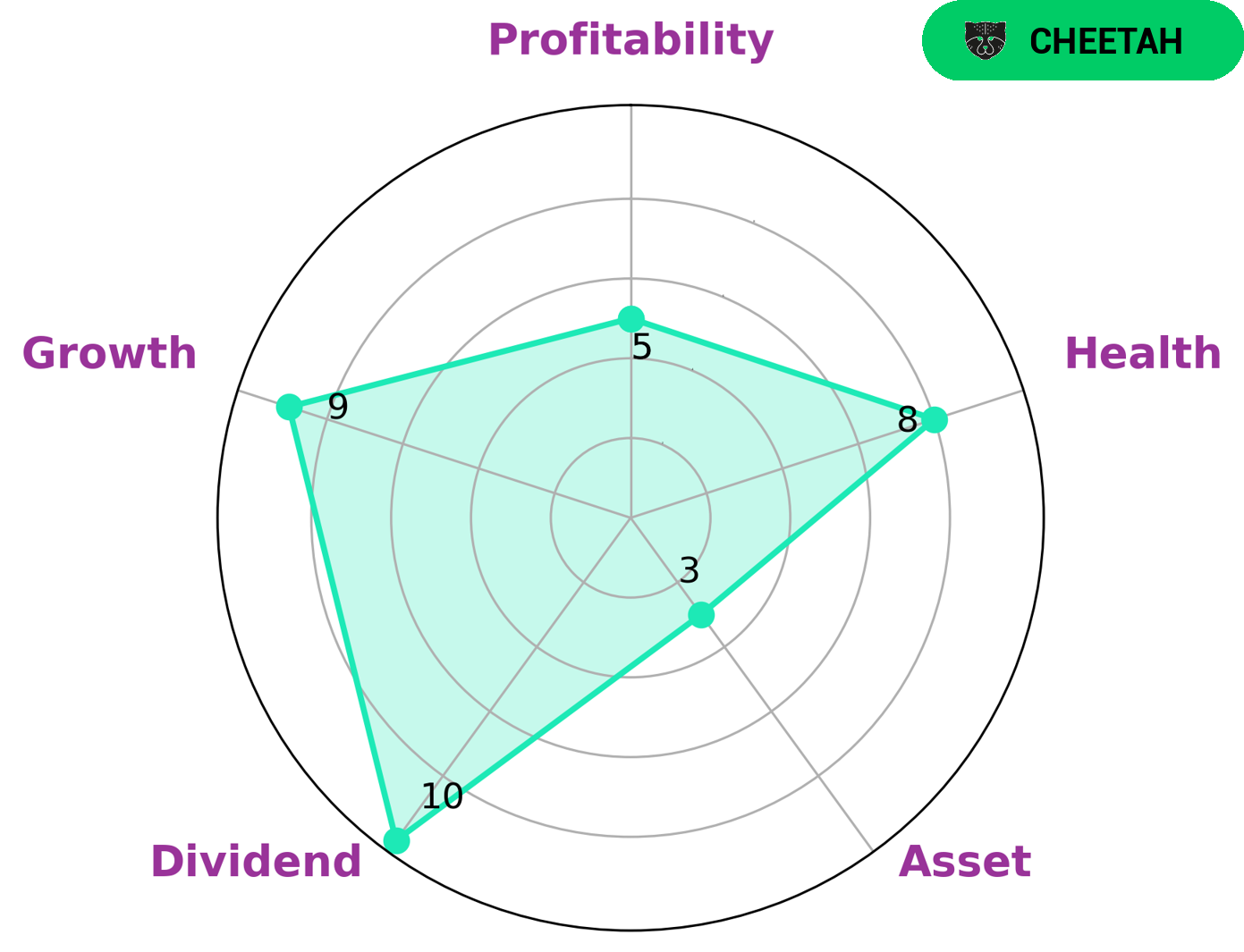

Marriott Vacations Worldwide is an attractive investment opportunity that has strong fundamentals, as indicated by its VI Star Chart. It has strong dividend, growth, and medium profitability, as well as weak asset. As a result, it is classified as a “cheetah,” a type of company that is capable of achieving high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for higher returns with the potential for short-term growth may be interested in this stock. It also has a high health score of 8/10 with regard to its cashflows and debt levels, which indicates that it is capable of paying off debt and funding future operations. In addition, its strong fundamentals suggest that it has the potential for long-term growth. Overall, Marriott Vacations Worldwide is an attractive investment opportunity for investors who are looking for higher returns with the potential for short-term growth in addition to long-term stability. With its strong fundamentals, it is well placed to achieve success in the future. More…

VI Peers

In the vacation ownership and timeshare industry, Marriott Vacations Worldwide Corp is one of the largest and most well-known companies.

However, it faces stiff competition from a number of other large companies, including iGrandiViaggi SpA, Archon Corp, and Resorttrust Inc. While each of these companies has its own strengths and weaknesses, Marriott has been able to stay ahead of the competition by offering a wide variety of vacation ownership products and experiences that appeal to a broad range of customers.

– iGrandiViaggi SpA ($LTS:0R8E)

Hai Grandi Viaggi SpA is a company that provides travel services. It has a market capitalization of 36.65 million as of 2022 and a return on equity of 0.08%. The company offers a variety of travel-related services, including air travel, hotel accommodations, car rentals, and cruises.

– Archon Corp ($OTCPK:ARHN)

Archon Corporation is a holding company that operates through its subsidiaries. The Company, through its subsidiaries, is engaged in the business of real estate investment, development, management, construction, and brokerage.

– Resorttrust Inc ($TSE:4681)

Resorttrust Inc is a Japanese company that operates resorts and hotels. As of 2022, the company had a market capitalization of 248.83 billion yen and a return on equity of 11.02%. The company operates a total of 74 hotels and resorts, including 57 in Japan and 17 overseas. In addition to hotel and resort operations, the company also provides a range of services such as golf course management, real estate development, and food and beverage operations.

Summary

Marriott Vacations Worldwide has been a strong performer in the travel and hospitality industry, and current predictions suggest the company is on track for further success. Analysts have estimated that MAR’s stock price could rise by up to $136, making it an attractive investment for those looking for a long-term return. Media sentiment towards MAR has been largely positive, with many commentators praising the company’s strong financial performance and potential for growth. With a well-diversified portfolio and experienced management team, Marriott Vacations Worldwide appears to be well-positioned to continue its success into the future.

Recent Posts