Diversified Trust Co Invests in Monarch Casino & Resort, for 2023.

March 30, 2023

Trending News ☀️

Diversified Trust Co, a trust company specializing in capital management, has recently invested in the newly opened Monarch Casino & Resort ($NASDAQ:MCRI), Inc. for the upcoming year of 2023. The casino and resort is located on a large, lush property in Atlantic City, New Jersey, and promises to be one of the premier destinations in the area. Monarch Casino & Resort offers its guests numerous amenities, including a full-service hotel and spa, a wide variety of gaming options, five restaurants and bars, and an entertainment area with live shows and events. This resort is designed to provide guests with an all-inclusive experience. It offers something for everyone, from high rollers to those looking for a more relaxed stay. The investment from Diversified Trust Co will allow Monarch Casino & Resort to expand its offerings, ensuring that their guests have the best possible experience while staying at the resort.

With this injection of capital, they can add more gaming options, upgrade their restaurants and bars, and add more entertainment offerings. They can also add more hotel rooms and suites, so that more people can enjoy the luxury and amenities of the property. The investment from Diversified Trust Co is another example of how the company is committed to helping businesses grow and succeed. With this injection of capital into Monarch Casino & Resort, they are sure to reach new heights in 2023.

Share Price

At the time of writing, news sentiment surrounding the announcement was mostly positive. MONARCH CASINO & RESORT stock opened at $72.7 and closed at $72.5, up by 0.4%, indicating a positive reaction to the investment news. Analysts are confident that the investment will help to bolster the financial standing of the company, which is set to benefit from increased visitor numbers in the coming year. This move is likely to bring more stability and greater returns on investments for shareholders and investors alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MCRI. More…

| Total Revenues | Net Income | Net Margin |

| 477.87 | 87.48 | 18.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MCRI. More…

| Operations | Investing | Financing |

| 139.77 | -47.97 | -86.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MCRI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 692.94 | 153.99 | 28.23 |

Key Ratios Snapshot

Some of the financial key ratios for MCRI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.2% | 41.2% | 23.3% |

| FCF Margin | ROE | ROA |

| 21.0% | 13.2% | 10.1% |

Analysis

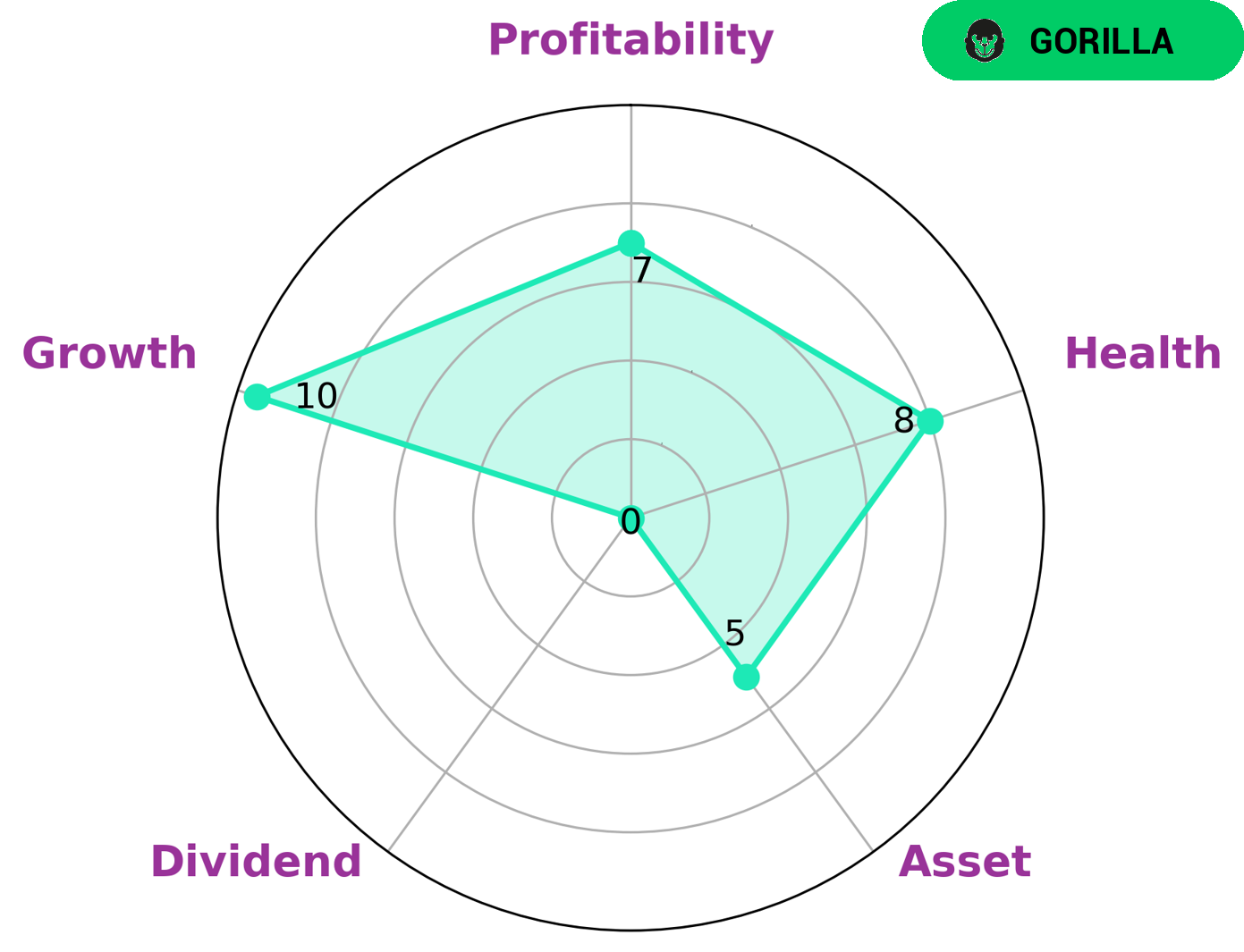

At GoodWhale, we analyze MONARCH CASINO & RESORT’s fundamentals in order to help investors make informed decisions. According to our Star Chart, MONARCH CASINO & RESORT is strong in growth and profitability, medium in asset, and weak in dividend. We categorize this company as a “gorilla” – a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes it an attractive option for investors who are looking to capitalize on the long-term growth potential of the company. Furthermore, MONARCH CASINO & RESORT has a high health score of 8/10, indicating that the company is capable of sustaining future operations in times of crisis. This financial stability makes the stock attractive to value investors who are looking for steady returns over a long period of time. More…

Peers

Monarch Casino & Resort Inc is a publicly traded company that owns and operates the Atlantis Casino Resort Spa, a hotel-casino-resort located in Reno, Nevada, USA. The company’s stock is traded on the Nasdaq Global Select Market under the ticker symbol MCRI.

NagaCorp Ltd is a Hong Kong-based holding company, the largest shareholder of which is a state-owned enterprise of the government of Cambodia. The company operates the NagaWorld hotel and casino resort in Phnom Penh, Cambodia.

Bally’s Corporation is a gaming and hospitality company that owns and operates casinos, hotels, and racetracks. The company’s properties include the Bally’s Las Vegas hotel and casino, the Bellagio hotel and casino in Las Vegas, and the Atlantic City Boardwalk Regency in Atlantic City, New Jersey.

Macau Legend Development Ltd is a gaming and entertainment company that owns and operates the Babylon Casino at Fisherman’s Wharf in Macau, China. The company also owns and operates hotels, restaurants, and retail outlets in Macau.

– NagaCorp Ltd ($SEHK:03918)

NagaCorp Ltd is a casino resort operator based in Cambodia. The company operates the NagaWorld casino resort in Phnom Penh, which includes hotels, restaurants, gaming, and entertainment facilities. NagaCorp also operates casinos in Russia and Vietnam. The company’s revenue and profit have grown rapidly in recent years, fueled by the expansion of its casino operations and the development of new hotel and entertainment facilities. NagaCorp’s market cap is $17.7 billion and its ROE is 0.7%. The company is expanding its operations in Cambodia and Vietnam and is also developing a new casino resort in Russia.

– Ballys Corp ($NYSE:BALY)

Bally’s Corporation is a gaming and hotel company that owns and operates casinos, hotels, and spas. The company was founded in 1968 and is headquartered in Las Vegas, Nevada. Bally’s Corporation has a market cap of 929.27M as of 2022 and a return on equity of 3.13%. The company owns and operates casinos in Nevada, Illinois, Indiana, Mississippi, Louisiana, and New Jersey. Bally’s also owns and operates the Hotel & Casino and the Spa at Bally’s in Las Vegas.

– Macau Legend Development Ltd ($OTCPK:MALDF)

Macau Legend Development Ltd is a gaming and entertainment company that develops, owns, and operates casino gaming and entertainment resort facilities in Macau. As of 2022, the company’s market cap is 172.22M and its ROE is -12.92%. Macau Legend Development’s primary business is operating casinos and providing related services, including hotel accommodations, restaurants, and retail shopping. The company’s casinos offer a variety of table games and electronic gaming machines, as well as VIP gaming rooms. Macau Legend Development also owns and operates a ferry terminal and a food market in Macau.

Summary

Investing in Monarch Casino & Resort, Inc. (MON) for 2023 could be a financially beneficial decision due to the company’s positive news sentiment. MON has a consistent track record of generating revenue and profits since its inception. The company has a strong presence in the hospitality and gaming industry, which is expected to continue growing at a steady rate. MON has also diversified its portfolio by investing in other businesses such as real estate, technology, and retail, providing a robust portfolio.

Additionally, the company has been successful in implementing cost-saving measures, which can help reduce expenses and increase profits. With its strong financials and an experienced management team, MON could be a promising investment for 2023.

Recent Posts