Toll Brothers Reports Record-Breaking Earnings and Revenue

May 24, 2023

Trending News 🌥️

Toll Brothers ($NYSE:TOL) achieved a GAAP earnings-per-share of $2.85, exceeding expectations by $0.93. The company also reported revenue of $2.51 billion, outstripping estimates by $440 million. Toll Brothers is a publicly traded homebuilding company based in Horsham, Pennsylvania. The company builds single-family homes, townhomes, condominiums, and apartments for a variety of lifestyles and budgets.

Toll Brothers also offers mortgage financing, title insurance, and other services related to homebuilding. The company’s strong fourth quarter performance was driven by a robust demand for its homes and products, as well as cost-containment initiatives.

Earnings

In Toll Brothers‘ earning report for FY2023 Q1 ending on January 31 2023, the company reported record-breaking earnings and revenue. Total revenue for the period reached 1780.17 million USD, a 0.6% decrease when compared to the same period last year. On the other hand, the company earned 191.53 million USD in net income, an impressive 26.1% increase compared to the previous year.

When compared to three years ago, total revenue of Toll Brothers has grown significantly from 1563.38 million USD to 1780.17 million USD. The company’s strong performance in this quarter reflects the successful strategies implemented by the management team that have enabled Toll Brothers to continuously grow its revenue and profit margins.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toll Brothers. More…

| Total Revenues | Net Income | Net Margin |

| 10.26k | 1.33k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toll Brothers. More…

| Operations | Investing | Financing |

| 909.75 | -160.2 | -634.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toll Brothers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.98k | 5.77k | 55.98 |

Key Ratios Snapshot

Some of the financial key ratios for Toll Brothers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.6% | 37.2% | 17.1% |

| FCF Margin | ROE | ROA |

| 8.2% | 18.0% | 9.1% |

Market Price

The company’s stock opened at $64.0 and closed at $63.8, down by 1.5% from prior closing price of 64.7. Toll Brothers‘ strong performance in the quarter was due to strong demand for its luxury homes and higher pricing. The company is confident that its recent performance in this quarter will continue into the future as it continues to benefit from strong demand for its luxury homes and higher pricing. Live Quote…

Analysis

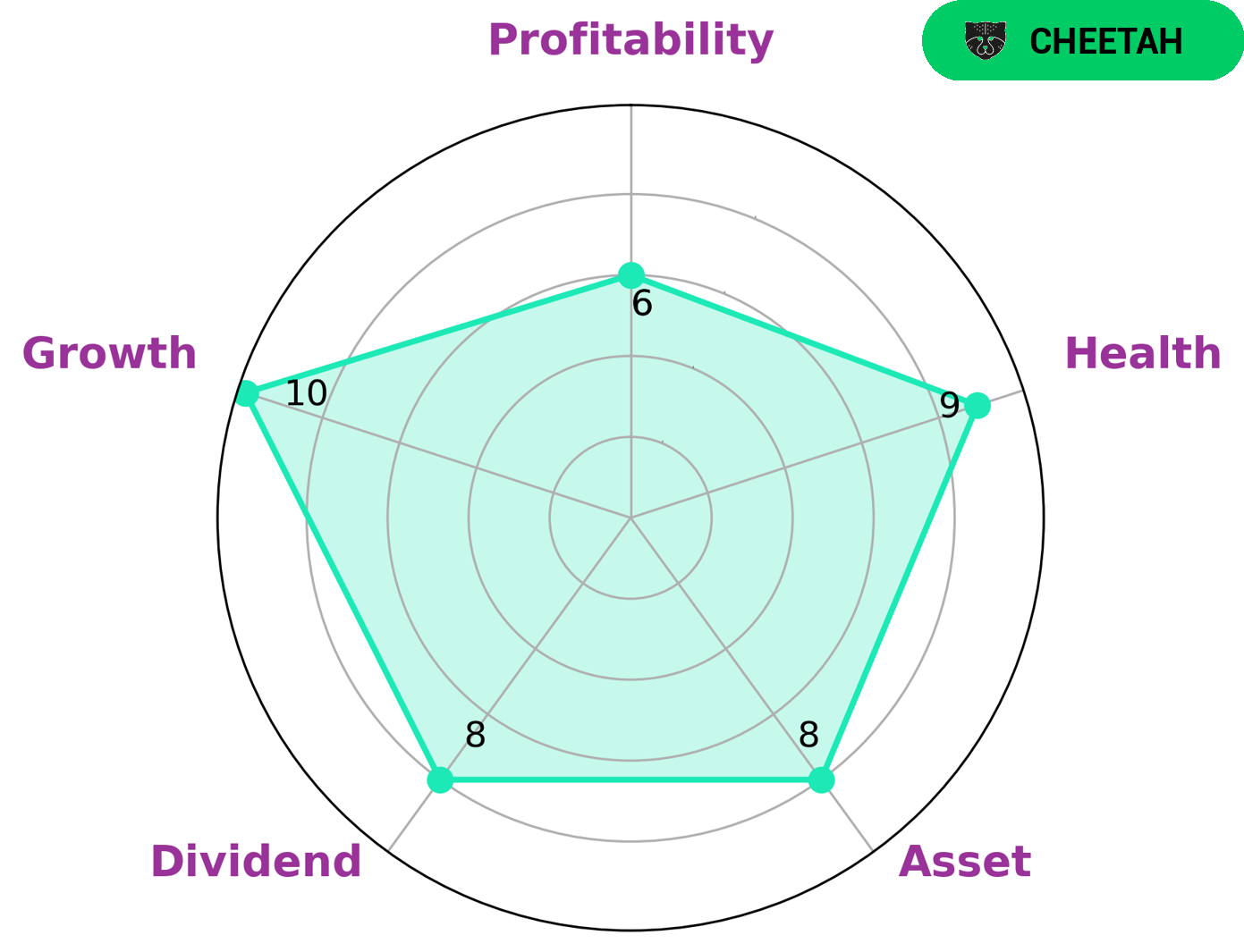

GoodWhale conducted an analysis of TOLL BROTHERS‘s financials and found that its Star Chart gave it a high health score of 9/10. This is due to the company’s good cashflows and debt, indicating that it is capable of paying off debt and funding future operations. We classified TOLL BROTHERS as a ‘cheetah’ type of company, meaning they have achieved high revenue or earnings growth but are considered less stable due to lower profitability. Given this financial profile, what type of investors may be interested in such a company? We believe that TOLL BROTHERS offers a strong asset, dividend, and growth profile, but is considered only medium in profitability. Thus, those investors looking for a higher-risk, higher-reward potential may be interested in such an investment. However, those investors looking for a more stable, low-risk option may want to look elsewhere. More…

Peers

The company is headquartered in Horsham, Pennsylvania, and operates in 22 states. The company’s product offerings include single-family detached homes, attached homes, and condominiums. The company’s competitors include D.R. Horton Inc, Redbubble Ltd, and PulteGroup Inc.

– D.R. Horton Inc ($NYSE:DHI)

D.R. Horton Inc is a homebuilding company that was founded in 1978 and is headquartered in Fort Worth, Texas. As of 2022, the company had a market capitalization of 28.86 billion and a return on equity of 25.26%. The company operates in 26 states and 84 markets across the United States. D.R. Horton is the largest homebuilder in the United States by volume, with a market share of approximately 18%. The company builds single-family detached homes, townhomes, and condominiums.

– Redbubble Ltd ($ASX:RBL)

Redbubble Ltd has a market cap of 168.95M as of 2022 and a Return on Equity of -12.32%. The company is an online marketplace that allows artists to sell their artwork on a variety of products.

– PulteGroup Inc ($NYSE:PHM)

PulteGroup Inc is one of the largest homebuilders in the United States. The company has a market cap of 9.97 billion as of 2022 and a return on equity of 24.61%. The company builds and sells single-family homes, townhouses, condominiums, and apartments in the United States.

Summary

Toll Brothers Inc. is a prominent American homebuilding company, and its recent financials have been quite successful. Its fourth quarter GAAP earnings per share of $2.85 beat previous estimates by $0.93. Similarly, the revenue of $2.51B surpassed expectations by a whopping $440M. This is great news for investors, as it shows progress and potential for growth in the coming future.

In addition, it serves as a strong indicator that the company is in a healthy financial position with great potential for further growth. The strong financials make Toll Brothers an attractive option for investors and the company appears to be in a great position to continue its success.

Recent Posts