0Q3R dividend yield – ED Invest SA Allotment Cert Declares 0.39 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On May 25, 2023, ED ($LTS:0Q3R) Invest SA Allotment Cert Declares 0.39 Cash Dividend. This dividend is notable due to its relatively high yield of 19.91%, with the ex-dividend date being May 25 2023. This has resulted in a dividend yield of 76.76%, 76.76%, and 19.91% for the respective years, giving an average dividend yield of 57.81%.

For those interested in dividend-paying stocks, this might be something to consider. With the ex-dividend date being in the near future, now may be the best time to invest in this stock to benefit from the upcoming dividend payment.

Stock Price

Thursday saw a sharp decline in ED INVEST SA ALLOTMENT CERT stock price, with the stock opening at €0.5 and closing at €0.5, a 19.5% drop from its previous closing price of 0.7. In light of this, the board of directors declared a cash dividend of 0.39 per share to all shareholders. The board of directors has taken into consideration the drop in stock prices and aims to reward current shareholders for their continued support and faith in the company. As such, investors are encouraged to continue to hold onto their stock as it is expected that the dividend will help to restore market confidence in ED INVEST SA ALLOTMENT CERT. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 0Q3R. More…

| Total Revenues | Net Income | Net Margin |

| 95.47 | 12.25 | 12.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 0Q3R. More…

| Operations | Investing | Financing |

| -24.89 | -1.57 | -16.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 0Q3R. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 97.27 | 30 | 6.79 |

Key Ratios Snapshot

Some of the financial key ratios for 0Q3R are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.5% | 19.4% | 16.1% |

| FCF Margin | ROE | ROA |

| -26.8% | 14.8% | 9.9% |

Analysis

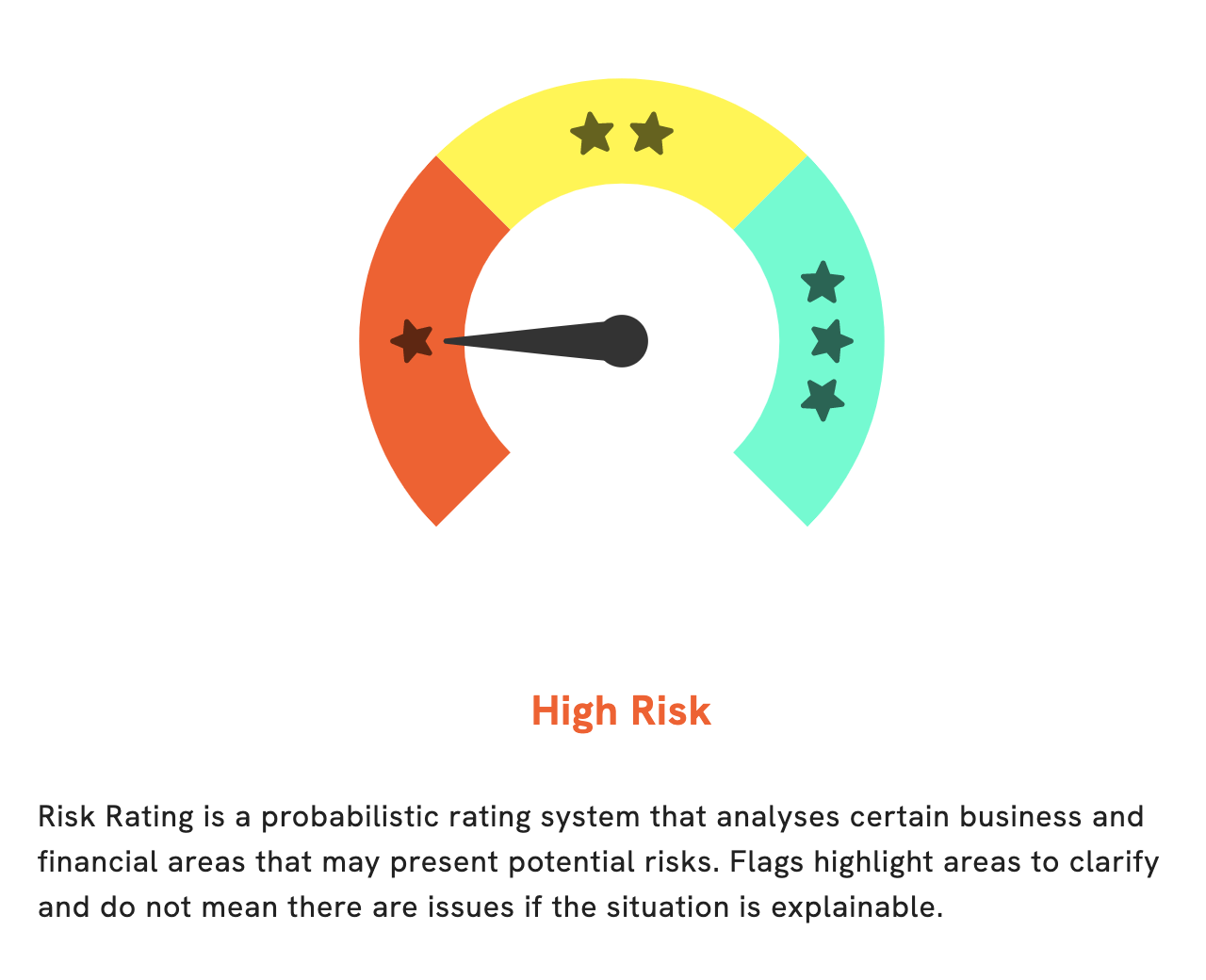

We at GoodWhale have undertaken an analysis of the fundamentals regarding ED INVEST SA ALLOTMENT CERT. As per our Risk Rating, ED INVEST SA ALLOTMENT CERT is a high risk investment in both financial and business aspects. During our assessment, we identified 3 risk warnings in the income sheet, balance sheet, and financial journal. If you would like to view these points in more detail, please register on our website: GoodWhale.com. More…

Peers

ED Invest SA Allotment cert is an innovative investment option that offers investors the opportunity to diversify their portfolio. It stands out from other similar offerings due to its unique features and competitive advantages. It competes with companies such as American Video Telec, Nihon House Holdings Co Ltd, and Cyrela Brazil Realty SA Empreend e Part, which all offer their own unique investment strategies and opportunities.

– American Video Telec ($OTCPK:AVOT)

Nihon House Holdings Co Ltd is a leading property management and development company in Japan. The company has a market cap of 15.08B as of 2023 and a Return on Equity (ROE) of 8.98%. Nihon House has a strong presence in the Japanese real estate market and is one of the largest players in the country. The company’s market cap reflects its market position, dominance and influence in the Japanese real estate sector. The company’s return on equity of 8.98% indicates that it has been able to generate positive returns on its investments and is in a strong financial position.

– Nihon House Holdings Co Ltd ($TSE:1873)

Cyrela Brazil Realty SA Empreend e Part is a leading real estate company that offers services such as sale and rental of residential, commercial, and industrial properties. The company has a market capitalization of 1.48 billion dollars as of 2023, which indicates its strong position in the industry. Its return on equity (ROE) stands at 12.89%, which is higher than the industry average and indicates that the company is very efficient in using its shareholders’ equity to generate profits.

Summary

Investing in ED INVEST SA ALLOTMENT CERT can be a good option for those looking for high dividend yields. The last three years have seen dividends of 1.01 PLN, 1.01 PLN, and 0.31 PLN, resulting in current yields of 76.76%, 76.76%, and 19.91%. This gives an average yield of 57.81%. Investors should be aware of the potential risks associated with investing in this company, such as the potential for capital losses, and should conduct thorough research before committing funds.

Recent Posts