The Manufacturers Life Insurance Company Unloads 1996 Shares of Lamar Advertising.

February 6, 2023

Trending News ☀️

The Manufacturers Life Insurance Company has recently unloaded 1996 shares of Lamar Advertising ($NASDAQ:LAMR), a publicly traded company in the advertising industry. This could mean that its profits are growing or that the company has managed to reduce its debt load. This could be beneficial to investors looking to make a long-term investment in the company. With its long history in the out-of-home advertising space, Lamar Advertising could be a lucrative investment opportunity for those looking to capitalize on the growing demand for out-of-home advertising services.

Stock Price

Media exposure surrounding the sale has been mostly positive, as analysts are expecting this move to benefit the company in the long run. On Monday, LAMAR ADVERTISING stock opened at $104.1 and closed at $103.5, down by 1.1% from previous closing price of 104.6. The stock has been on a downward trend since the announcement of the divestment, and more losses can be expected in the near term. Despite this, the company’s overall financial performance has been solid, and it is expected to improve in the coming months.

LAMAR ADVERTISING is one of the leading outdoor advertising companies in the United States, and its products are used by a wide range of businesses and organizations. The company’s services include billboard, transit and digital display advertising, and its clients include national and regional businesses, government agencies, and educational institutions. Although the stock has been on a downward trend since Monday, analysts believe that the company is well positioned to capitalize on growth opportunities in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lamar Advertising. More…

| Total Revenues | Net Income | Net Margin |

| 1.99k | 495.49 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lamar Advertising. More…

| Operations | Investing | Financing |

| 783.29 | -660.99 | -130.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lamar Advertising. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.28k | 5k | 12.53 |

Key Ratios Snapshot

Some of the financial key ratios for Lamar Advertising are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 30.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

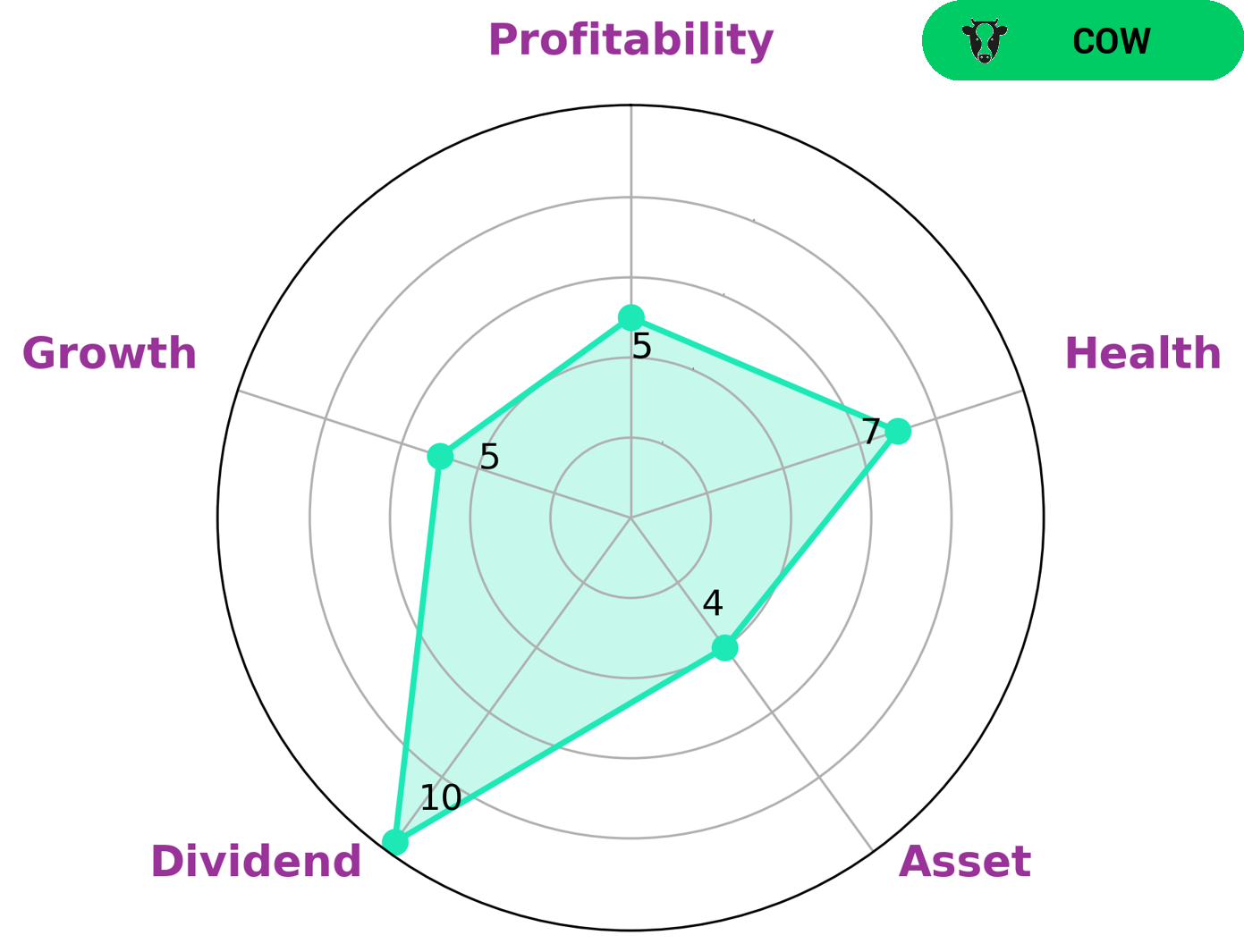

Investors looking for strong dividend yields and long-term potential should consider LAMAR ADVERTISING. With VI’s app, analyzing the company’s fundamentals is made easier. According to the VI Star Chart, the company is strong in dividend and has a medium level of asset growth, profitability, and cash flow. The health score of 7/10 indicates the company is more than capable of paying off debt and funding future operations.

Additionally, LAMAR ADVERTISING is classified as a ‘cow’ – a type of company that pays out consistent and sustainable dividends. Investors interested in such a company should also consider risk factors. This includes factoring in market volatility, economic conditions, and the quality of management. Moreover, investors may wish to diversify their portfolio by investing in a variety of companies and industries to reduce risk. In conclusion, LAMAR ADVERTISING presents an attractive option for investors seeking a long-term investment with strong dividend yields. Analyzing the company’s fundamentals with VI’s app provides a comprehensive review of the company’s performance and outlook. By understanding the risks associated with investing in this type of company, investors can make informed decisions before committing capital.

Peers

In the world of advertising, Lamar Advertising Co and its competitors are constantly vying for the top spot. Outfront Media Inc, Derwent London PLC, Great Portland Estates PLC are all major players in the industry, and each company has its own unique strengths and weaknesses. Lamar Advertising Co has been able to stay ahead of the competition by constantly innovating and adapting to the ever-changing landscape of the advertising world.

– Outfront Media Inc ($NYSE:OUT)

Outfront Media Inc is a publicly traded company that owns and operates billboard advertising space in the United States and Canada. The company was founded in 2006 and is headquartered in New York City. As of December 31, 2020, Outfront Media owned and operated approximately 148,000 billboard advertising displays.

– Derwent London PLC ($LSE:DLN)

As of 2022, Derwent London PLC has a market cap of 2.2B. The company focuses on the regeneration of areas within Central London.

– Great Portland Estates PLC ($LSE:GPE)

As of 2022, Great Portland Estates PLC has a market cap of 1.16B. The company is a real estate investment trust that focuses on properties in and around London.

Summary

Lamar Advertising Company is an outdoor advertising company with a long history of success. The company recently experienced a major event as The Manufacturers Life Insurance Company unloaded 1996 shares of Lamar Advertising stock. Despite this, the market response so far has been positive, indicating that investors remain confident in the company’s future prospects. Lamar Advertising has a strong track record of growth, with solid financials and a strong portfolio of offerings.

It has a wide network of billboard locations across the US and Canada, enabling it to reach consumers in key markets. The company has a reputation for delivering consistent returns and is well positioned to capitalize on growth opportunities in the outdoor advertising space. Investors should consider Lamar Advertising as a solid long-term investment option.

Recent Posts