Lamar Advertising Company to Release Fourth Quarter 2022 Operating Results on December 31

January 29, 2023

Trending News 🌥️

Lamar Advertising ($NASDAQ:LAMR) Company, one of the leading outdoor advertising companies, is set to release its operating results for the fourth quarter of 2022 on December 31. The company offers a variety of services such as billboard, transit, and digital media, as well as traditional out-of-home services.

In addition, Lamar provides a variety of creative solutions for their clients that feature creative designs, and innovative technologies to help their customers reach their marketing objectives. Lamar Advertising Company is one of the top stocks within the outdoor advertising industry and is a popular choice for investors looking to benefit from the growth of the industry. The company’s financial performance will provide key insight into how the company is performing in terms of revenue and profits. The results may also provide insight into the company’s outlook for the upcoming year, which could help to determine whether or not the stock is worth investing in. The results may also provide insight into the company’s outlook for the upcoming year, which could help to determine whether or not the stock is worth investing in.

Stock Price

This news caused the price of their stock to increase 2.3% from its previous closing price of $100.1 to $102.4. The announcement of the company’s quarterly results serves as a reminder for investors that the company is continuing to grow and is on track to achieve its goals for the year. Lamar Advertising Company is an outdoor advertising company that operates in the United States and Canada. The company is known for its large selection of billboards, digital displays, and transit displays that can be used to advertise businesses in a variety of locations. The company is also known for its focus on sustainability, with many of its displays powered by renewable energy sources like solar energy. The release of their fourth quarter financial results will be an important indicator of the company’s performance this year and will provide investors with an idea of what to expect in the future.

The company’s ability to generate revenue and profits is essential to its long-term success, and investors will be closely monitoring the results of their operations. The expected increase in their stock price indicates that investors are optimistic about the company’s future performance and potential for growth. With the release of their quarterly results on the horizon, investors should keep a close eye on the company’s performance and make sure to stay up to date on any developments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lamar Advertising. More…

| Total Revenues | Net Income | Net Margin |

| 1.99k | 495.49 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lamar Advertising. More…

| Operations | Investing | Financing |

| 783.29 | -660.99 | -130.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lamar Advertising. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.28k | 5k | 12.53 |

Key Ratios Snapshot

Some of the financial key ratios for Lamar Advertising are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 30.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

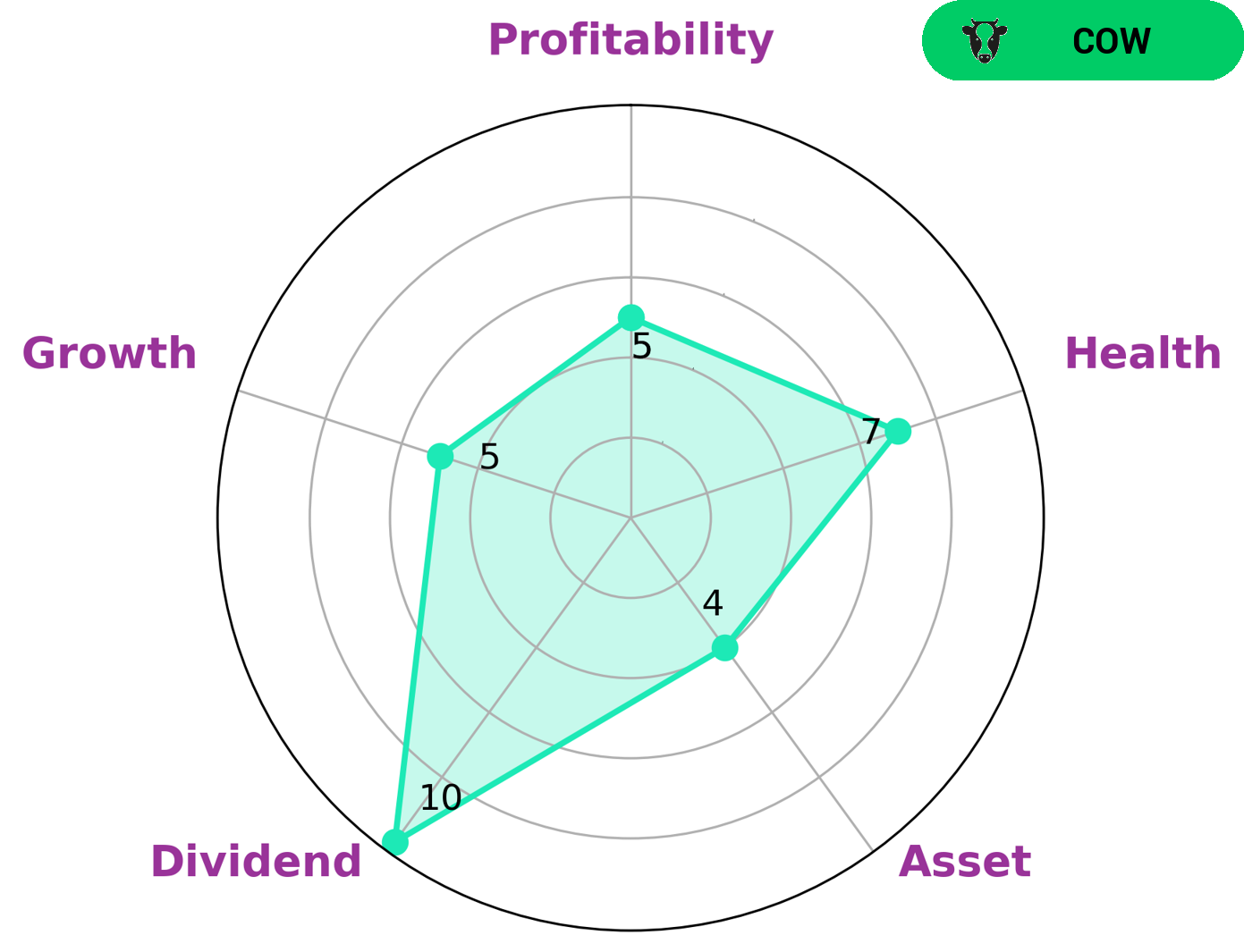

VI Analysis

LAMAR ADVERTISING is a great option for investors looking for a stable and consistent dividend-paying company. The company’s fundamentals, as assessed by the VI Star Chart, are strong in dividend and medium in asset, growth, and profitability. This indicates that LAMAR ADVERTISING has a track record of paying out reliable and sustainable dividends. It is classified as a ‘cow’, meaning it is a tried and tested company with a long-term potential for growth. In addition, its health score of 7/10 with regard to cash flows and debt indicates that it is financially secure and able to weather any crisis without the risk of bankruptcy. Investors looking for a safe and steady return on their investments can be assured that LAMAR ADVERTISING is a viable option. It is important to remember that any investment decision should be based on careful analysis and research, however, this company has the potential to provide a steady income which makes it a great option for those looking for a reliable return on their investment. More…

VI Peers

In the world of advertising, Lamar Advertising Co and its competitors are constantly vying for the top spot. Outfront Media Inc, Derwent London PLC, Great Portland Estates PLC are all major players in the industry, and each company has its own unique strengths and weaknesses. Lamar Advertising Co has been able to stay ahead of the competition by constantly innovating and adapting to the ever-changing landscape of the advertising world.

– Outfront Media Inc ($NYSE:OUT)

Outfront Media Inc is a publicly traded company that owns and operates billboard advertising space in the United States and Canada. The company was founded in 2006 and is headquartered in New York City. As of December 31, 2020, Outfront Media owned and operated approximately 148,000 billboard advertising displays.

– Derwent London PLC ($LSE:DLN)

As of 2022, Derwent London PLC has a market cap of 2.2B. The company focuses on the regeneration of areas within Central London.

– Great Portland Estates PLC ($LSE:GPE)

As of 2022, Great Portland Estates PLC has a market cap of 1.16B. The company is a real estate investment trust that focuses on properties in and around London.

Summary

Lamar Advertising Company is set to release its fourth quarter 2022 operating results on December 31. Investors may be interested in this announcement as they look to gain insight into the company’s financial performance. Analysts may be expecting to see positive results, such as improved revenues, earnings, and cash flow.

Potential risks such as fluctuating costs, customer penetration, and competitive landscape should also be considered. Investors should weigh the potential benefits and risks of investing in Lamar Advertising Company before making any decisions.

Recent Posts