DA Davidson Boosts WEYERHAEUSER Stock with Buy Rating Following Pullback

April 11, 2023

Trending News ☀️

Weyerhaeuser Company ($NYSE:WY) is a leading global forest products company that supplies lumber, paper, and other building materials to construction, industrial, and retail customers worldwide. After experiencing a stock pullback, the WEYERHAEUSER stock has received a Buy rating from DA Davidson. This Buy rating follows DA Davidson’s research on Weyerhaeuser’s strong balance sheet and the potential for long-term growth in both its lumber and building materials segments. The Buy rating is indicative of DA Davidson’s belief that Weyerhaeuser has the potential for significant upside over time, as the company has taken steps to improve its competitive position in the marketplace. This includes investments in research and innovation, as well as an increase in the value of its timberland portfolio.

The company has also implemented cost-control measures to streamline operations, reduce debt, and increase value for shareholders. In addition to this Buy rating from DA Davidson, Weyerhaeuser continues to receive positive ratings from other investment firms. This is a testament to the company’s strong financial position and potential for long-term growth. With its strong balance sheet and improved competitive position in the market, Weyerhaeuser is well-positioned to take advantage of any future market opportunities that may arise.

Price History

WEYERHAEUSER opened the trading day at $30.0 and closed at $30.4, up by 1.9% from its prior closing price of $29.8. It was the first bullish ratings upgrade in two months and was seen as a sign that the company has bottomed out following a period of underperformance. The move indicates that investors are feeling confident about WEYERHAEUSER’s prospects for the future and is an indication of the company’s potential for growth in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Weyerhaeuser Company. More…

| Total Revenues | Net Income | Net Margin |

| 10.18k | 1.88k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Weyerhaeuser Company. More…

| Operations | Investing | Financing |

| 2.83k | -759 | -2.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Weyerhaeuser Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.34k | 6.59k | 14.67 |

Key Ratios Snapshot

Some of the financial key ratios for Weyerhaeuser Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 30.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

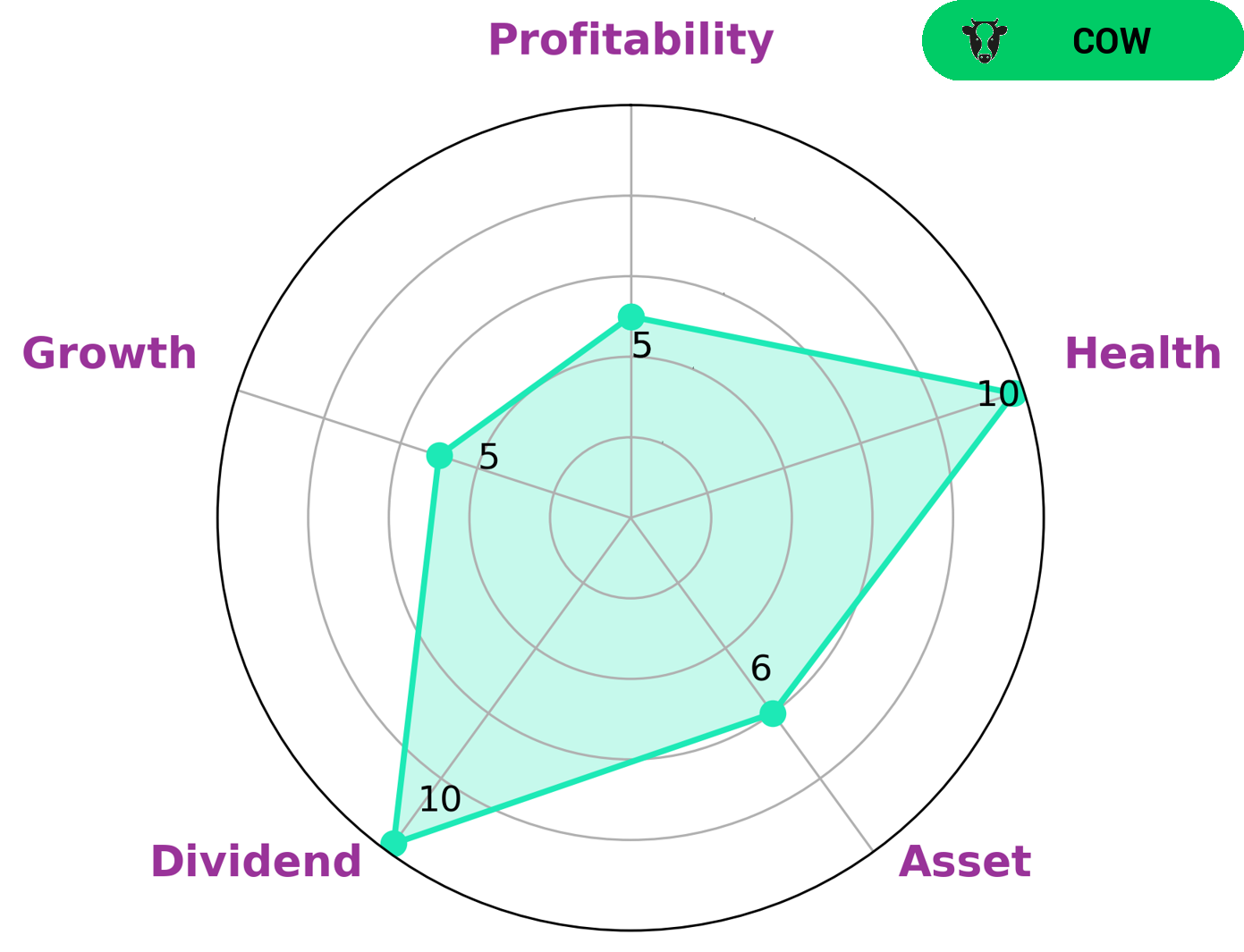

GoodWhale has analyzed the fundamentals of WEYERHAEUSER COMPANY and our Star Chart reveals that they are strong in dividend and medium in their asset, growth, and profitability. We have also determined that their health score is a high 10/10, meaning that they have the cashflows and debt required to sustain their operations in times of crisis. We have classified WEYERHAEUSER COMPANY as a ‘cow’, which is a type of company that has a track record of paying out consistent and sustainable dividends. We conclude that this company would be of interest to investors who are looking for steady dividend income. Additionally, those investors who are looking for steady long-term growth may also be interested in WEYERHAEUSER COMPANY, given their medium ratings in asset, growth, and profitability. More…

Peers

They compete with other companies in the forestry and wood products industry such as COIMA RES SpA, AREIT Inc, and IMPACT Growth Real Estate Investment Trust.

– COIMA RES SpA ($PSE:AREIT)

REIT, Inc is a publicly traded company that owns, operates, and finances a portfolio of real estate properties. The company’s portfolio includes office buildings, retail centers, apartments, and hotels. REIT, Inc is headquartered in New York City.

– AREIT Inc ($SET:IMPACT)

IMPACT Growth Real Estate Investment Trust is a real estate investment trust focused on owning and operating income-producing real estate assets in Canada. The company has a market capitalization of $17.79 billion as of 2022. The company owns and operates a portfolio of office, retail, industrial, and residential properties.

Summary

Weyerhaeuser Company, a real estate investment trust, has recently seen a pullback in its stock price. Despite this decrease, analysts at DA Davidson recently gave the stock a Buy rating. This rating indicates that they believe the stock is undervalued and is likely to appreciate in the near future, making it an attractive investment opportunity. Analysts cite the company’s high dividend yield as a key feature that makes it attractive to investors.

The company also has a strong balance sheet and a portfolio of high-quality assets that should help drive long-term growth. Finally, the company is well-positioned to benefit from a healthy housing market, which should further boost its stock price.

Recent Posts