.

April 30, 2023

Trending News ☀️

Sumitomo Mitsui Trust Holdings Inc. has recently divested from NETSTREIT ($NYSE:NTST) Corp. Shares in a major move that is expected to have a significant market impact. NETSTREIT Corp. is a publicly traded real estate investment trust (REIT) that focuses on acquiring and managing a portfolio of net-leased properties. The company has a diversified portfolio of assets in the United States, with a focus on industrial, office, retail, and multi-family properties. Sumitomo Mitsui Trust Holdings Inc.’s decision to divest from NETSTREIT Corp. shares is expected to have a major impact on the REIT market, as it will reduce the company’s net asset value and could potentially cause other investors to follow suit.

Market Price

Sumitomo Mitsui Trust Holdings Inc. recently announced their divestment from NETSTREIT Corp. on Monday, causing the stock to experience a 2.1% drop from its prior closing price of $17.8. The stock opened at $17.9, but closed at $17.4 by Monday’s end. This impacted the company’s overall value, as investors began to re-evaluate the potential of the company and its products. The news seemed to have an immediate effect on NETSTREIT Corp., with their stock seeing a noticeable dip in price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netstreit Corp. More…

| Total Revenues | Net Income | Net Margin |

| 103.83 | 7.65 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netstreit Corp. More…

| Operations | Investing | Financing |

| 56.5 | -437.06 | 382.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netstreit Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.63k | 531.76 | 18.65 |

Key Ratios Snapshot

Some of the financial key ratios for Netstreit Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.7% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

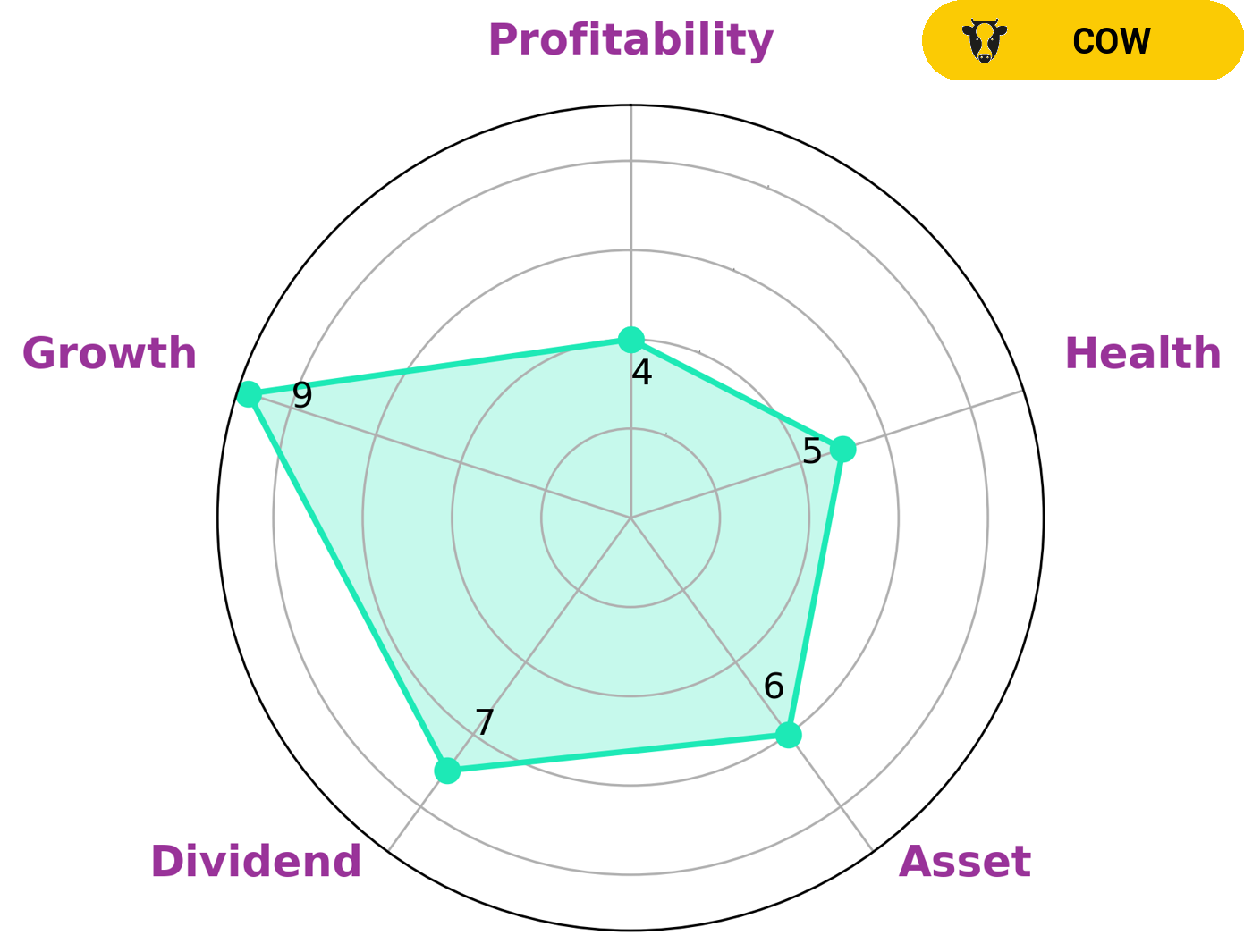

At GoodWhale, we conducted an analysis of NETSTREIT CORP‘s wellbeing. According to Star Chart, the company is strong in dividend and growth, and medium in asset and profitability. With an intermediate health score of 5 out of 10 with respect to its cashflows and debt, we believe that the company has the potential to sustain future operations in times of crisis. We have classified NETSTREIT CORP as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This is especially attractive to long-term investors who seek dividend payments and capital stability. Furthermore, those looking for capital gains may also be interested in this stock due to its strong growth. More…

Peers

The competition between Netstreit Corp and its competitors is intense. Each company is striving to be the best in the industry and to provide the best products and services to their customers. This competition is good for the consumer because it allows them to choose from a variety of companies that offer different products and services. It also keeps the prices of the products and services down because the companies are always trying to outdo each other.

– Sasseur REIT ($SGX:CRPU)

Sasseur REIT is a Singapore-based real estate investment trust that owns and operates a portfolio of four premium outlet malls in China. The company’s market cap as of 2022 is 822.66M. The company’s outlets are located in the cities of Hangzhou, Hefei, Chongqing and Kunming, and cater to a range of international brands.

– BHG Retail REIT ($SGX:BMGU)

BHG Retail REIT is a real estate investment trust that owns, operates, and develops retail properties in the United States. As of December 31, 2020, the company owned and operated a portfolio of 84 retail properties, consisting of 65 shopping centers, 15 freestanding stores, and 4 development projects. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Partners Real Estate Investment Trust ($OTCPK:PTSRF)

Partners Real Estate Investment Trust is a Canadian company that owns and operates a portfolio of income-producing real estate assets. The company has a market capitalization of $23.5 million as of March 2022. Partners REIT’s portfolio consists of retail, office, and industrial properties located across Canada.

Summary

NETSTREIT CORP. is a publicly traded real estate investment trust that is focused on acquiring a diversified portfolio of net-leased properties located throughout the United States. It is estimated that this sale has had a negative effect on the stock price, impacting investor sentiment and causing a decline in the stock. Despite this, NETSTREIT has a robust dividend payout policy and has regularly provided dividend yields above 10%.

Additionally, the company has a strong balance sheet, with low leverage ratios and significant cash reserves. Despite the recent downturn in the stock price, NETSTREIT appears to be well-positioned to generate long-term returns for its investors through the acquisition of quality net-leased properties. Investors should consider these factors before investing in NETSTREIT CORP.

Recent Posts