AIG Increases Holdings in UDR to $3.22 Million

June 7, 2023

🌥️Trending News

UDR ($NYSE:UDR), Inc. is a leading real estate investment trust that invests in multifamily and other residential properties. Recently, American International Group Inc. (AIG) has increased its holdings in UDR to $3.22 million. UDR’s business model is focused on creating value through the development of high-quality communities and the renovation of existing ones. This has enabled them to create strong, lasting relationships with tenants, employers, and the communities in which they serve.

The news of AIG increasing its holdings in UDR is a positive development for the company. It demonstrates that AIG has faith in UDR’s business model and that they believe UDR can continue to generate returns and create value for its shareholders. This is good news for current and potential investors as it further solidifies UDR’s status as a viable investment opportunity.

Price History

This move impacted UDR‘s stock prices, which opened at $41.0 and closed at $41.2, up by 0.1% from the prior closing price of 41.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Udr. More…

| Total Revenues | Net Income | Net Margin |

| 1.56k | 99.68 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Udr. More…

| Operations | Investing | Financing |

| 827.07 | -960.06 | 135.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Udr. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.97k | 6.14k | 11.78 |

Key Ratios Snapshot

Some of the financial key ratios for Udr are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

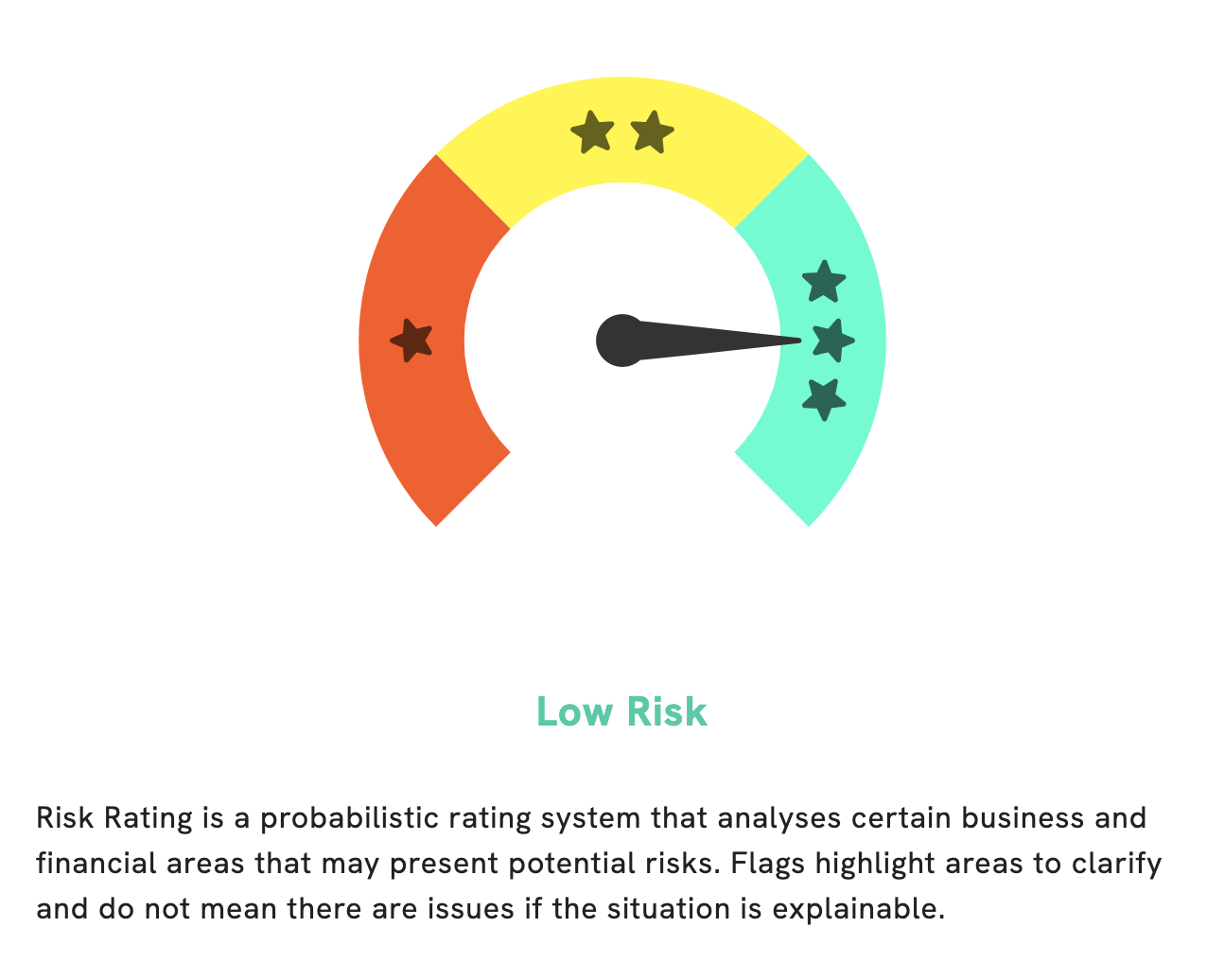

GoodWhale conducted an analysis of UDR‘s wellbeing and assessed the company as a low risk investment based on our Risk Rating. This score covers aspects such as financial health, business model and sustainability. We have detected one risk warning within UDR’s balance sheet; however, this does not significantly affect our overall assessment. To find out more about this risk warning, you will need to become a registered user so that you can access the full report. With GoodWhale’s analysis, you can be sure that you are investing in a company that is in good financial health. More…

Peers

The company was founded in 1972 and is headquartered in Highlands Ranch, Colorado. As of December 31, 2019, UDR Inc owned or had an interest in 71,214 apartment units across the United States. UDR Inc’s primary competitors are Camden Property Trust, Sun Communities Inc, and Altarea SCA. Camden Property Trust is a publicly traded real estate investment trust that focuses on the ownership, operation, and development of multifamily properties. Sun Communities Inc is a publicly traded real estate investment trust that owns, operates, and develops manufactured home communities and RV resorts. Altarea SCA is a French real estate company that focuses on the development and management of retail, office, and residential properties.

– Camden Property Trust ($NYSE:CPT)

Camden Property Trust is a publicly traded real estate investment trust focused on the ownership, management, and development of multifamily communities. The company was founded in 1993 and is headquartered in Houston, Texas. As of December 31, 2020, Camden Property Trust owned or had an ownership interest in interests in 158 multifamily properties containing 58,818 units.

– Sun Communities Inc ($NYSE:SUI)

Sun Communities Inc is a real estate investment trust (REIT) that owns and operates manufactured home communities in the United States. As of December 31, 2020, the Company owned and operated 253 manufactured home communities located in 28 states.

– Altarea SCA ($OTCPK:ATRRF)

Altarea SCA is a French real estate company with a market cap of 2.71B as of 2022. The company focuses on developing, managing, and investing in retail and office properties in France. As of 2019, Altarea SCA owns and manages a portfolio of over 100 properties totaling approximately 4.9 million square meters of space.

Summary

Investors have taken a keen interest in UDR, Inc recently, with American International Group Inc. investing $3.22 million into the company. This investment is indicative of the strong potential for UDR to generate positive returns going forward. Analysts have praised UDR’s strong fundamentals as well as its solid financial performance over the last few quarters.

With strong fundamentals and a bullish stock outlook, UDR looks to be a promising investment opportunity. While the current market environment can be unpredictable, analysts suggest that those looking to invest in UDR should do so with a long-term focus in order to maximize their potential returns.

Recent Posts