ARMOUR RESIDENTIAL REIT Rebuilds After Long Struggle With Losses

April 6, 2023

Trending News 🌧️

ARMOUR RESIDENTIAL REIT ($NYSE:ARR) is an agency real estate investment trust (REIT) that purchases, finances, and manages residential mortgage-backed securities (RMBS) issued by Fannie Mae, Freddie Mac, and Ginnie Mae. The company has experienced a long struggle with losses, but the situation is gradually improving and the company is now on the path to return to a zero balance. The company’s investment portfolio is diversified across various types of mortgages, including fixed-rate, hybrid adjustable-rate, and jumbo loans. The company has had to contend with losses due to the declining value of its RMBS investments.

However, in recent times, the company has managed to reduce its losses and is slowly rebuilding its business. The company’s success in reducing its losses has been achieved through a combination of cost-cutting measures and strategic investments. ARMOUR RESIDENTIAL REIT has tightened its expense structure and placed more emphasis on the profitability of its investments. As a result, it has seen an increase in its net operating income and is now on track to return to a zero balance. As it continues to rebuild its business, ARMOUR RESIDENTIAL REIT is focused on creating value for shareholders. The company is committed to delivering long-term returns through prudent management and strategic investments. It also continues to invest in assets that offer attractive returns and that have the potential to generate growth. With a resilient business model, ARMOUR RESIDENTIAL REIT is well-positioned to be a leader in the mortgage-backed securities industry.

Stock Price

After several years of financial struggles, ARMOUR RESIDENTIAL REIT appears to have turned a corner. On Wednesday, the company’s stock opened at $5.3 and closed at $5.4, up 1.3% from the prior closing price of 5.3. This is a sign that traders and investors are becoming increasingly optimistic about the company’s future prospects. In recent months, ARMOUR RESIDENTIAL REIT has taken steps to both restore its financial health and to expand its portfolio of residential mortgage assets. These efforts appear to be paying off as evidenced by the slight uptick in stock prices. It remains to be seen if ARMOUR RESIDENTIAL REIT can continue to rebuild and remain successful in the long-term.

However, the positive response from traders and investors is a good indication that the company is well on its way to recovery. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ARR. More…

| Total Revenues | Net Income | Net Margin |

| -225.87 | -241.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ARR. More…

| Operations | Investing | Financing |

| 124.08 | -3.89k | 3.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ARR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.44k | 8.32k | 6.83 |

Key Ratios Snapshot

Some of the financial key ratios for ARR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

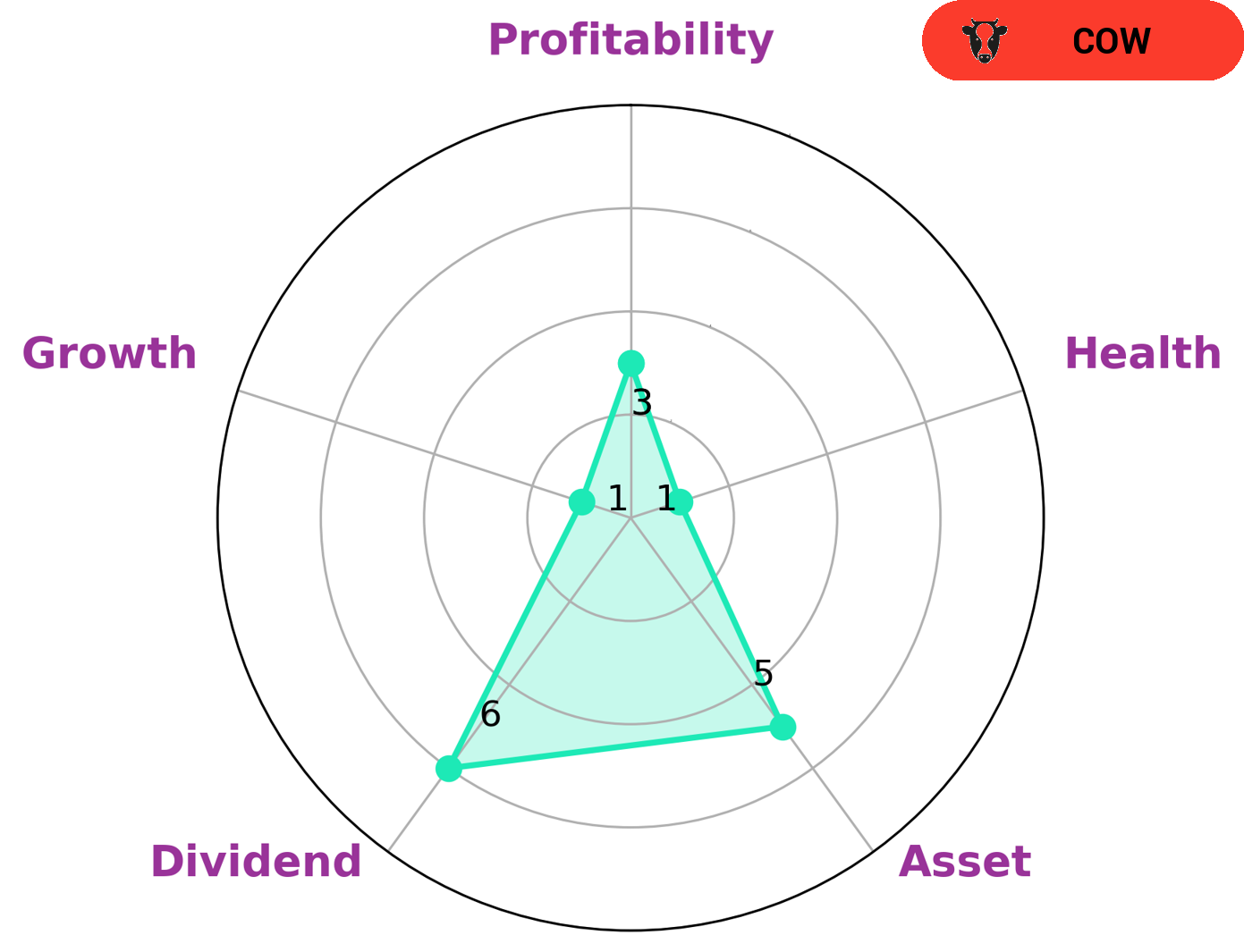

As a financial analysis tool, GoodWhale seeks to help investors make informed decisions about their investments. In this vein, GoodWhale recently conducted an analysis of ARMOUR RESIDENTIAL REIT’s financials. According to our Star Chart, ARMOUR RESIDENTIAL REIT has a low health score of 1/10 with respect to its cashflows and debt, indicating that it is less likely to sustain future operations in times of crisis. Given its track record of paying out consistent and sustainable dividends, we classified ARMOUR RESIDENTIAL REIT as a ‘cow’ type of company. This type of company may be of interest to investors who are looking for income and stability, as opposed to growth or high returns. In terms of other metrics, GoodWhale found ARMOUR RESIDENTIAL REIT to be strong in asset, medium in dividends and weak in growth and profitability. More…

Peers

The company is headquartered in Boca Raton, Florida and was founded in 2006. ARMOUR operates as a holding company that owns subsidiaries which are engaged in the business of acquiring, investing in, and managing residential mortgage-backed securities. The company competes against Chimera Investment Corp, Dynex Capital Inc, and Annaly Capital Management Inc.

– Chimera Investment Corp ($NYSE:CIM)

Chimera Investment Corporation is a real estate investment trust that primarily invests in adjustable-rate and fixed-rate residential mortgage loans, commercial mortgage loans, real estate-related securities, and other asset classes. The company has a market cap of $1.57 billion as of 2022.

– Dynex Capital Inc ($NYSE:DX)

Dynex Capital, Inc. is a publicly traded real estate investment trust. The company invests in a variety of real estate-related assets, including commercial mortgage loans, commercial mortgage-backed securities, and other real estate-related investments.

– Annaly Capital Management Inc ($NYSE:NLY)

Analysts have estimated that Annaly Capital Management Inc’s market cap would be around 10.08B as of 2022. The company’s main focus is on providing mortgage financing and servicing to the US residential and commercial real estate markets. In recent years, the company has expanded its operations into other areas such as healthcare and student housing.

Summary

ARR has seen significant ups and downs over the years, but recently, their stocks have been on the slow road to zero. Despite the difficult market conditions, ARR has returned to profitability, with strong performance in its investments, low operating costs, and successful capital raise. The company’s balance sheet remains strong and their portfolio consists of high-quality mortgage assets that are generating strong returns. Investors should be aware of the risks associated with investing in ARR, such as its concentrated portfolio and short-term maturities.

Recent Posts