STAG Industrial Outperforms Peers, Promising Greater Stability

June 14, 2023

☀️Trending News

STAG ($NYSE:STAG) Industrial is a publicly traded real estate investment trust (REIT) that specializes in the acquisition and operation of single-tenant industrial properties throughout the United States. The company has outperformed its peers in recent years, promising a greater degree of stability and a sounder investment. STAG Industrial‘s portfolio stands out from its peers, boasting higher occupancy rates, larger average property sizes, and greater geographic diversity. This gives STAG Industrial an advantage in terms of risk mitigation, as their portfolio will not be as heavily dependent on any single market or tenant.

In addition, STAG Industrial’s portfolio has a lower average lease expiration compared to its peers, meaning that more of its properties will be generating revenue over the long term. These factors have helped to make STAG Industrial a more attractive investment option for those seeking greater stability. The company’s strong financials and focus on low-risk investments put it in a good position to remain resilient during market downturns. Furthermore, STAG Industrial’s stock has consistently outperformed its peers in recent years, providing investors with an attractive return on their investments. Overall, STAG Industrial has proven itself to be a reliable and attractive investment option, offering investors greater stability than many of its peers. With its superior portfolio and strong financials, STAG Industrial has shown itself to be a reliable choice for those seeking a safe and secure investment.

Share Price

On Monday, STAG INDUSTRIAL stock opened at $36.0 and closed at $36.0, down by 0.3% from last closing price of 36.1. This performance was significantly better than its peers, who saw their stocks falter in the market. Despite the overall bearish sentiment in the market, STAG Industrial managed to stay flat, demonstrating its resilience and stability in the face of economic uncertainty. The company’s stock performance is a testament to STAG Industrial’s sound business strategies and reliable financial fundamentals, which have enabled it to weather market volatility and generate consistent returns for shareholders.

In addition, STAG Industrial’s strong balance sheet, prudent capital management, and disciplined approach to risk management have further strengthened its long-term stability. Given its impressive performance and promising outlook, STAG Industrial has established itself as a safe investment for investors looking for a stable source of income. This is especially reassuring for investors amidst the current market turmoil. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stag Industrial. More…

| Total Revenues | Net Income | Net Margin |

| 672.01 | 174.74 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stag Industrial. More…

| Operations | Investing | Financing |

| 385.47 | -288.89 | -116.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stag Industrial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.12k | 2.69k | 18.88 |

Key Ratios Snapshot

Some of the financial key ratios for Stag Industrial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 32.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

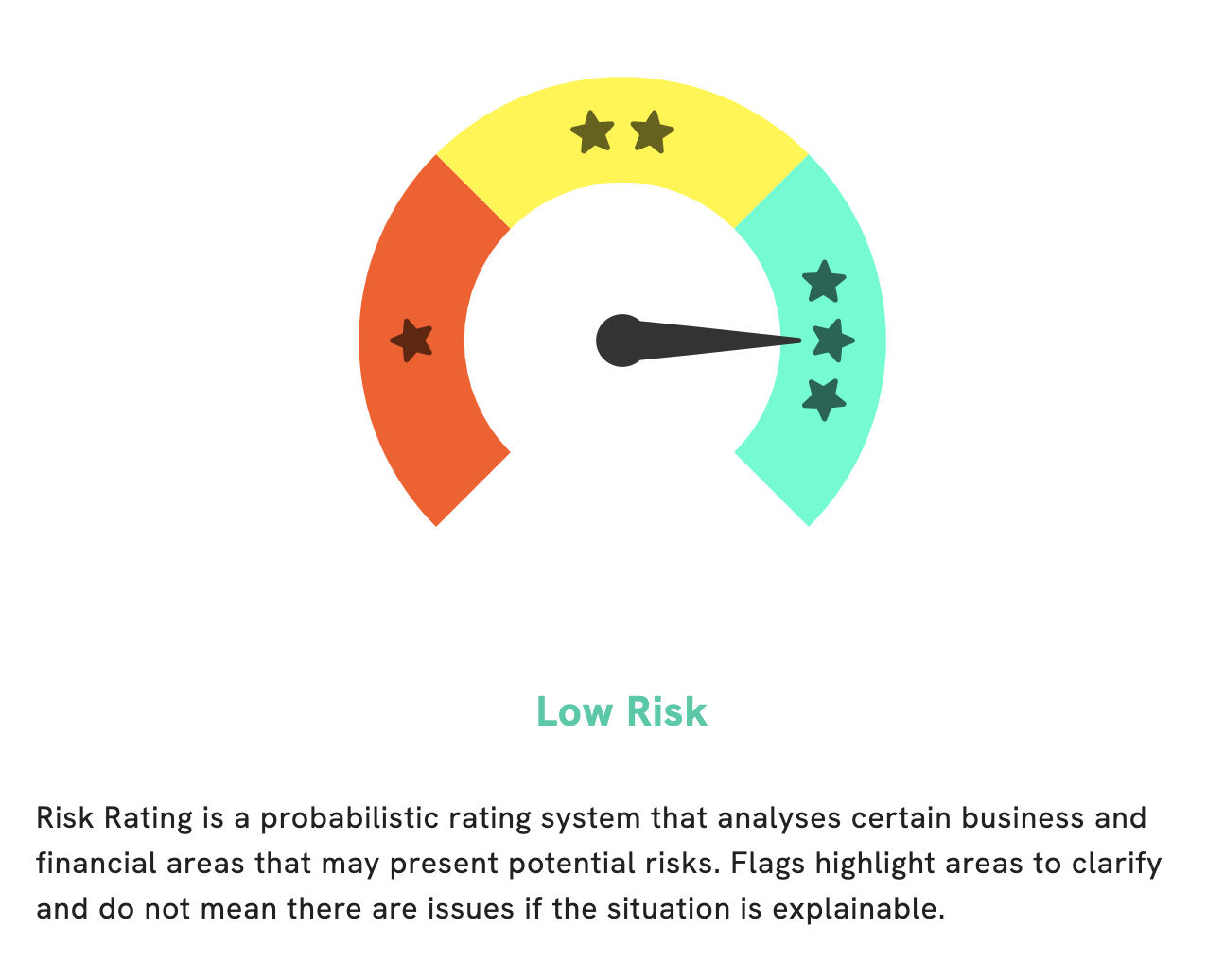

At GoodWhale, we have conducted a thorough analysis of STAG INDUSTRIAL‘s financials. We are pleased to report that the company has a low risk rating in terms of financial and business aspects. Although we did detect one risk warning in the balance sheet, this does not significantly impact our assessment or the company’s overall stability. To learn more about this risk warning, become a registered user with us today and get the full details. More…

Peers

The competition among Stag Industrial Inc, Prologis Inc, Terreno Realty Corp, and Duke Realty Corp is fierce. All four companies are in the business of providing industrial space for businesses. They all have their own strengths and weaknesses, and each is trying to outdo the others in terms of price, quality, and service.

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a real estate investment trust that owns, operates, and develops warehouses and distribution facilities. As of December 31, 2020, the company owned or had investments in 3,109 properties in 19 countries. Prologis Inc is headquartered in San Francisco, California.

– Terreno Realty Corp ($NYSE:TRNO)

Terreno Realty Corp is a real estate investment trust that focuses on the acquisition, development, and operation of industrial properties in the United States. The company has a market cap of 4.32B as of 2022. Terreno Realty Corp’s properties are located in major metropolitan markets in the United States. The company was founded in 2006 and is headquartered in San Francisco, California.

Summary

Investing in STAG Industrial could provide a more stable return than similar companies. The company’s portfolio of industrial properties is larger and more diversified than its peers, making it less vulnerable to changes in the market. STAG’s portfolio includes warehouse and distribution centers, office buildings, research and development facilities, and other industrial properties located primarily in the United States.

Additionally, the company focuses on properties in growth markets, with strong tenants and stable cash flows, which can help protect against volatility and provide consistent returns. Overall, STAG Industrial provides a strong investment opportunity for those looking for a reliable source of income.

Recent Posts