INNOVATIVE INDUSTRIAL PROPERTIES Delivers Huge Returns to Shareholders Through Early Entry Into Inefficient Sector.

February 7, 2023

Trending News ☀️

Innovative Industrial Properties ($NYSE:IIPR) (IIP) is a publicly traded real estate investment trust (REIT) that specializes in providing financing solutions to qualified medical-use cannabis operators. Since then, the company has benefitted from long-term leases that are backed by tenants with strong credit, allowing it to acquire properties at premium cap rates and benefit from higher returns. IIP has been able to consistently deliver huge returns to its shareholders due to its early entry into an inefficient sector. The company was able to capitalize on the lack of competition in the market and acquire properties at attractive prices, which have allowed it to generate much higher returns than the Vanguard Real Estate ETF and S& P 500.

In addition, IIP’s long-term lease agreements with tenants with excellent creditworthiness have enabled it to benefit from a steady stream of income and further enhance its returns. The success of IIP has been further amplified by its expansion into other states and countries. Overall, IIP’s early entry into an inefficient sector and its ability to capitalize on long-term leases backed by tenants with strong credit has allowed it to consistently deliver huge returns to its shareholders and outperform the Vanguard Real Estate ETF and S& P 500. The company’s continued expansion into other countries and states will help it continue to benefit from the growing demand for medical-use cannabis and generate even higher returns in the future.

Share Price

The news has been mostly positive so far, with the stock gaining momentum over the past few months. The company has made a significant impact in the industrial property sector through its innovative approach and strategic investments. It has been able to capitalize on the inefficiencies of the sector and has made large returns for its shareholders. The company has also been able to negotiate favorable terms with owners, allowing it to maximize its returns. INNOVATIVE INDUSTRIAL PROPERTIES’ strategy has been to focus on long-term investments.

This has allowed it to gain exposure to new markets and take advantage of the inefficiencies of the sector. It has also been able to build a strong portfolio of properties that have produced higher yields than those available in other sectors. Its long-term approach and strategic investments have helped it to gain a foothold in the industry and have allowed it to generate significant returns for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for IIPR. More…

| Total Revenues | Net Income | Net Margin |

| 264.84 | 140.01 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for IIPR. More…

| Operations | Investing | Financing |

| 221.34 | -384.09 | 155.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for IIPR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.43k | 463.82 | 69.81 |

Key Ratios Snapshot

Some of the financial key ratios for IIPR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 61.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

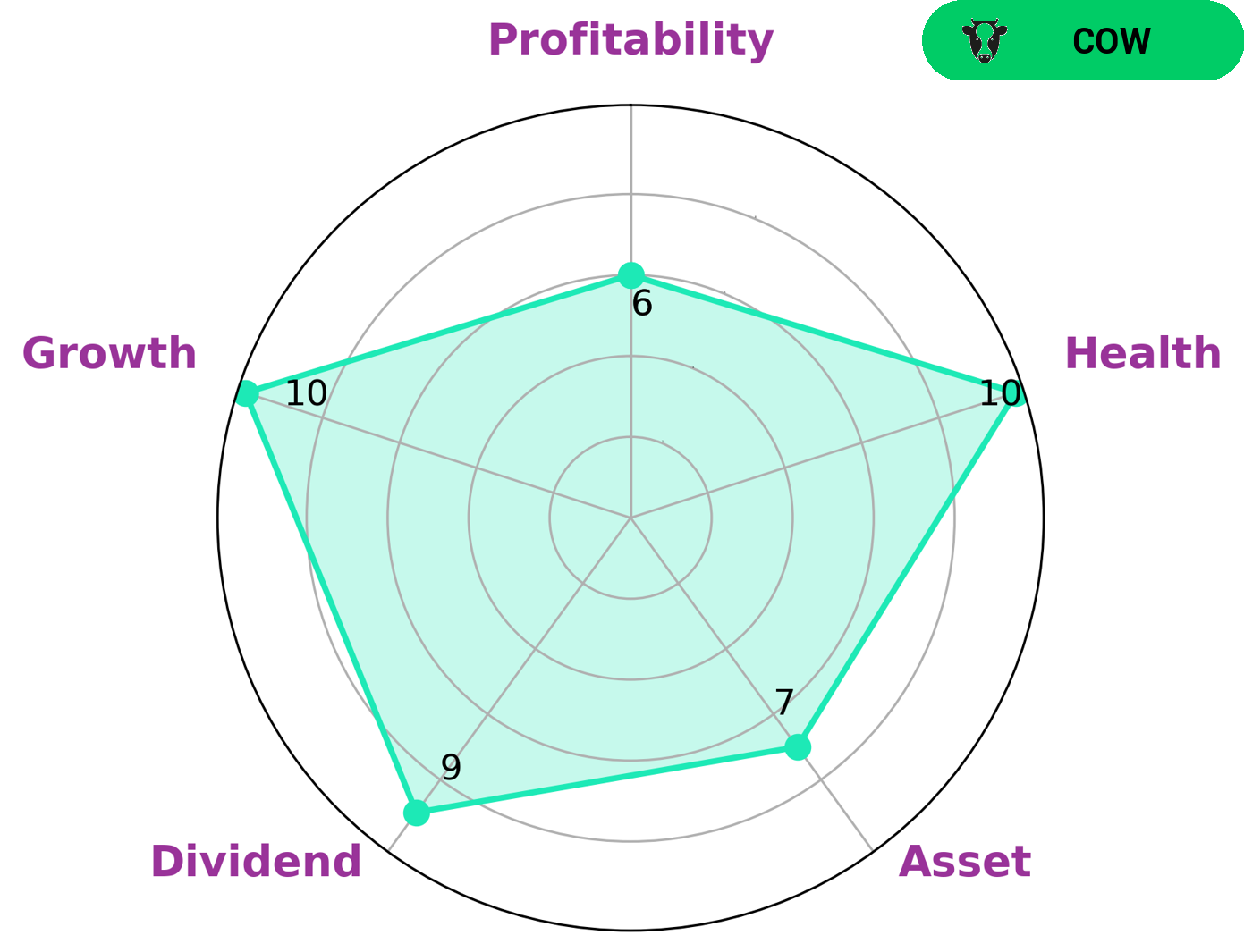

By using the Star Chart, it can be seen that INNOVATIVE INDUSTRIAL PROPERTIES has a high health score of 10/10 with regard to its cashflows and debt, indicating it is capable to sustain future operations even in times of crisis. Furthermore, INNOVATIVE INDUSTRIAL PROPERTIES is strong in asset, dividend, and growth, as well as being medium in profitability. This makes it a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes INNOVATIVE INDUSTRIAL PROPERTIES an attractive option for value and long-term investors. Those looking for long-term, steady returns may be particularly interested in this type of company. For those who are risk-averse and looking for stable returns, INNOVATIVE INDUSTRIAL PROPERTIES may be a good option. Additionally, investors who are looking to diversify their portfolios may find INNOVATIVE INDUSTRIAL PROPERTIES a good choice, as it has a low correlation with other stocks. Overall, INNOVATIVE INDUSTRIAL PROPERTIES is an excellent choice for investors looking for consistent and sustainable returns. With its high health score, strong asset and dividend strength, and medium profitability rating, it is a good option for those looking to diversify their portfolios or seeking steady returns over the long-term. More…

Peers

The company’s competitors include Realty Income Corp, Prologis Inc, and Crown Castle International Corp.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust that focuses on the ownership of net-leased commercial properties in the United States. As of December 31, 2020, the Company owned 6,573 properties across 49 states and Puerto Rico. The Company’s leased properties are primarily leased to retail (70.3%), industrial (12.8%), healthcare (9.4%), and other commercial tenants (7.5%).

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a leading global provider of logistics real estate with a focus on the industrial sector. As of 2022, the company has a market cap of 100.2 billion. Prologis owns and operates approximately 585 million square feet of industrial space in 19 countries. The company’s properties are located in key markets around the world, including North America, Europe, Asia and Latin America. Prologis’ focus on the industrial sector provides its customers with access to a wide range of logistics solutions, including warehouses, distribution centers, last-mile facilities and transshipment hubs.

– Crown Castle International Corp ($NYSE:CCI)

Crown Castle International Corp is a holding company that provides wireless infrastructure services in the United States. Its primary business is owning, operating, and leasing wireless communications towers and small cell nodes. As of 2021, the company had approximately 40,000 wireless communications towers and approximately 60,000 small cell nodes across the United States. The company was founded in 1994 and is headquartered in Canonsburg, Pennsylvania.

Summary

INNOVATIVE INDUSTRIAL PROPERTIES has been delivering significant returns to its shareholders through its early entry into a previously inefficient sector. The company has been able to capitalize on the opportunities in the market and capitalize on the potential for growth. While news surrounding the company has generally been positive, investors should weigh the potential risks associated with investing in the sector.

Analyzing the financials, understanding the industry, and evaluating management’s strategy are all important when making investment decisions. With prudent research and consideration, investing in INNOVATIVE INDUSTRIAL PROPERTIES can be a wise choice for long-term success.

Recent Posts