AIMIRT-F dividend yield – AIM Industrial Growth Freehold And Leasehold REIT Declares 0.223 Cash Dividend.

March 20, 2023

Dividends Yield

AIM ($SET:AIMIRT-F) Industrial Growth Freehold And Leasehold REIT announced on March 2 2023 a 0.223 cash dividend per share. This marks the fourth consecutive year that the REIT has issued an annual dividend per share of 0.89, 0.87, and 0.82 THB. With this dividend, the REIT’s dividend yields from 2020 to 2022 are 7.03%, 6.91%, and 6.51%, with an average dividend yield of 6.82%.

The ex-dividend date for this declaration is March 13 2023, so if you’re looking to maximize your dividends, be sure to buy the stock before then. With the current market trends, it is likely that the REIT’s dividend yields will continue to remain strong for the foreseeable future.

Market Price

The stock opened at THB12.6 and closed at the same price on the day of the announcement. It is also an indication of the company’s confidence in its ability to generate long-term returns for investors. AIM REIT is a real estate investment trust focused on investments in industrial assets across Thailand. The company seeks to generate income through leasing of its industrial properties, as well as potential capital appreciation through strategic acquisitions and disposals.

With the announcement of this dividend, AIM REIT has once again demonstrated its commitment to providing shareholders with regular returns and long-term value. The company’s strong performance in the past year has been rewarded with this dividend, and shareholders are sure to benefit from AIM REIT’s continued success going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AIMIRT-F. More…

| Total Revenues | Net Income | Net Margin |

| 867.31 | 688.43 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AIMIRT-F. More…

| Operations | Investing | Financing |

| -221.87 | -514.45 | 257.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AIMIRT-F. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.15k | 3.78k | 12.38 |

Key Ratios Snapshot

Some of the financial key ratios for AIMIRT-F are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 78.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

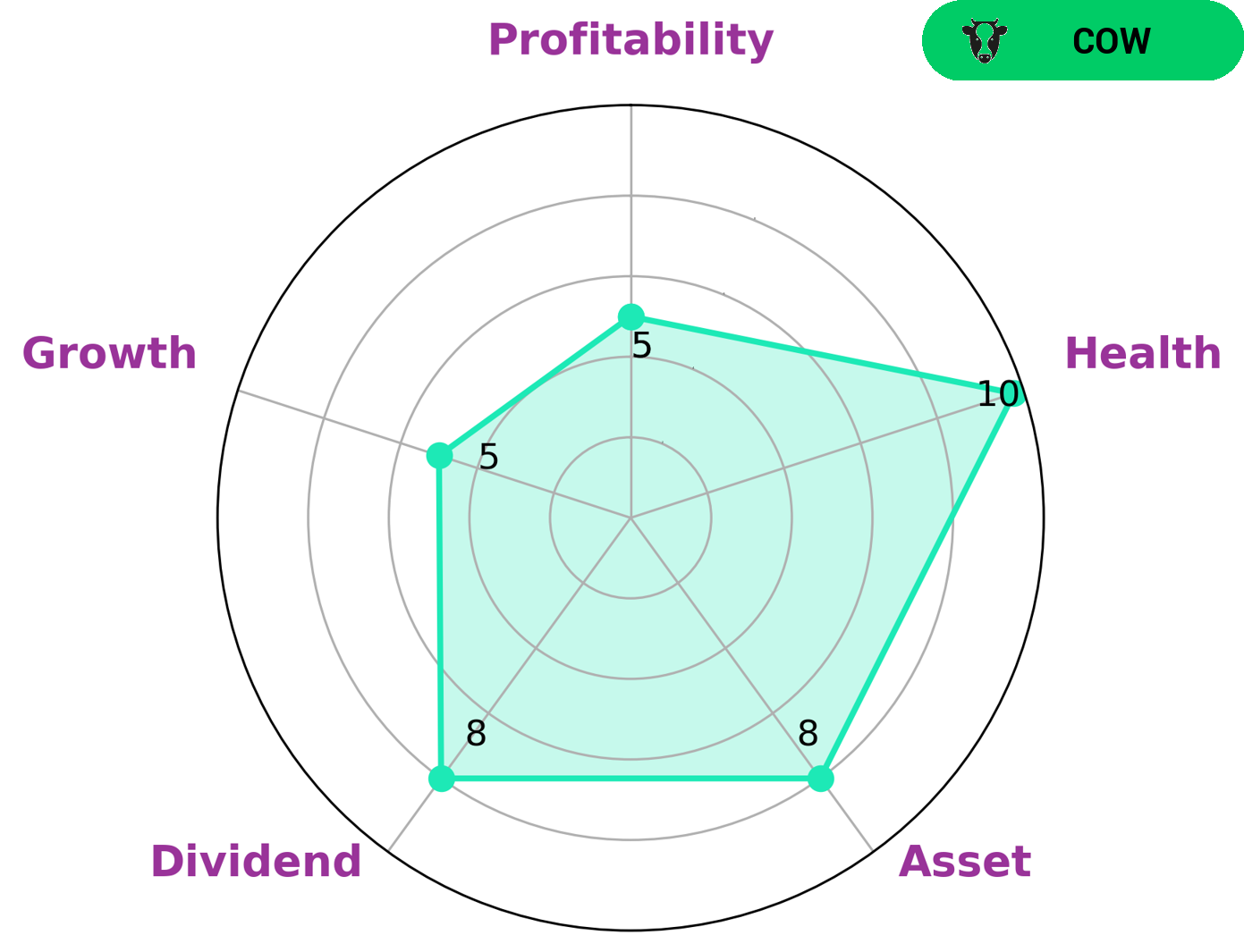

GoodWhale has conducted an analysis of AIM INDUSTRIAL GROWTH FREEHOLD AND LEASEHOLD REIT’s financials, and the results have been quite impressive. According to the Star Chart, the company is strong in asset, dividend, and medium in growth, profitability. For those looking for a steady income stream, the consistent dividend payout is ideal. For those looking for a more long-term investment, the company’s strong asset position and medium growth potential could be an attractive option. More…

Summary

AIM INDUSTRIAL GROWTH FREEHOLD AND LEASEHOLD REIT is an attractive investment option for those seeking a steady passive income stream. Its dividend per share has been increasing over the last 3 years, with an annual dividend of 0.89 THB in 2020, 0.87 THB in 2021, and 0.82 THB in 2022. The dividend yields in the respective years are 7.03%, 6.91%, and 6.51%, with an average dividend yield of 6.82%.

Recent Posts