Texas Permanent School Fund Trims Position in Universal Health Realty Income Trust by 3.8% in 4th Quarter.

May 20, 2023

Trending News ☀️

Universal Health Realty ($NYSE:UHT) Income Trust (UHT) is a real estate investment trust (REIT) that focuses on the acquisition and ownership of health care and human services related facilities.

Analysis

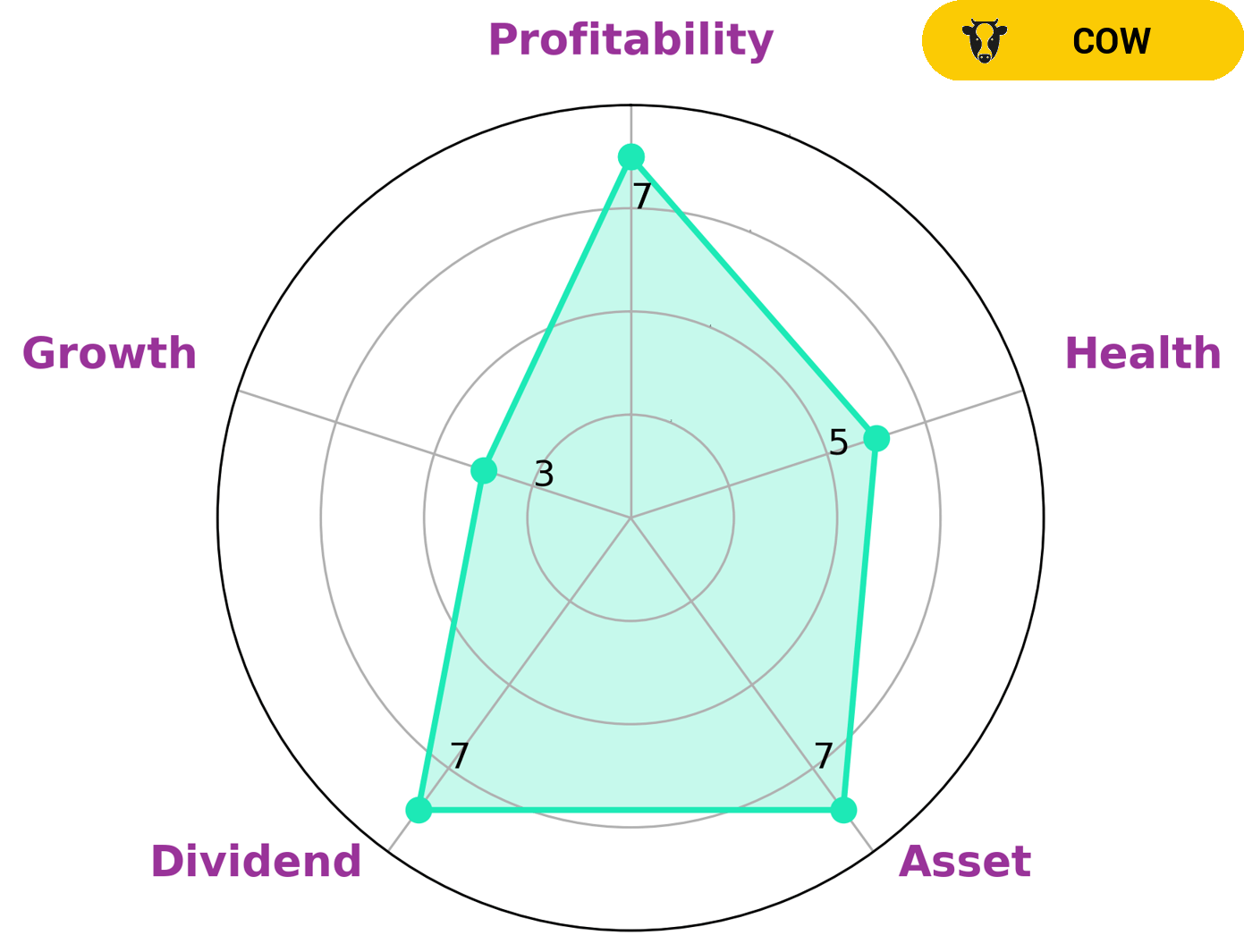

GoodWhale has conducted an analysis of UNIVERSAL HEALTH REALTY’s fundamentals and determined that it is classified as a ‘cow’ according to the Star Chart. This type of company is generally known for having a track record of paying out consistent and sustainable dividends, making it appealing to income investors. The company’s intermediate health score of 5/10 with regard to its cashflows and debt indicates that it may be able to sustain future operations in times of crisis. Additionally, the company is strong in terms of its assets, dividend, and profitability, though it does lack growth potential. Therefore, investors hoping to generate income from dividends may be interested in investing in UNIVERSAL HEALTH REALTY. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for UHT. More…

| Total Revenues | Net Income | Net Margin |

| 91.68 | 20.16 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for UHT. More…

| Operations | Investing | Financing |

| 46.8 | -36.67 | -25.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for UHT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 604.31 | 382.14 | 17.07 |

Key Ratios Snapshot

Some of the financial key ratios for UHT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 33.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Peers

The company’s portfolio consists of hospitals, medical office buildings, senior housing, and other healthcare-related properties. Physicians Realty Trust is a similar company that also invests in healthcare real estate. Healthcare Trust of America, Inc. is another healthcare real estate investment trust with a portfolio of hospitals, medical office buildings, senior housing, and other healthcare-related properties. Global Medical REIT Inc. is a healthcare real estate investment trust that focuses on owning and leasing net-leased healthcare facilities.

– Physicians Realty Trust ($NYSE:DOC)

As of 2022, Physicians Realty Trust has a market cap of 3.31B. The company is a healthcare real estate investment trust that primarily acquires, owns, manages and develops healthcare properties that are leased to physicians, hospitals and healthcare delivery systems.

– Healthcare Trust of America Inc ($NYSE:GMRE)

Global Medical REIT is a publicly traded real estate investment trust focused on owning and operating properties leased to clinical healthcare providers. As of December 31, 2020, the Company’s portfolio consisted of 126 net-leased medical facilities across the United States. The Company’s portfolio includes medical office buildings, outpatient surgery centers, freestanding emergency departments, specialty hospitals, acute care hospitals, and other healthcare facilities.

Summary

Universal Health Realty Income Trust is a real estate investment trust that invests in healthcare and human service related facilities including acute care hospitals, specialty hospitals, nursing homes, assisted living facilities, and behavioral health care facilities. An analysis of the company’s performance reveals that its stock price has remained relatively stable over the last quarter. Despite this stability, the Texas Permanent School Fund recently reduced its holdings in Universal Health Realty by 3.8%. This could be seen as a bearish signal for the stock, as it suggests that the fund may have lost faith in the company’s future prospects.

In addition, investors should be aware that the industry in which Universal Health Realty operates is highly competitive and affected by changes in policy and regulations. As such, investors should conduct their own independent research before making any decisions to buy or sell shares of Universal Health Realty.

Recent Posts