SABRA HEALTH CARE REIT soars 13.8% YTD in 2023, outperforming Equity REIT Index and S&P 500.

February 9, 2023

Trending News ☀️

SABRA ($NASDAQ:SBRA) Health Care REIT (NASDAQ: SBRA) is a publicly traded real estate investment trust (REIT) that primarily invests in skilled nursing facilities, assisted living facilities, medical office buildings and other healthcare-related real estate investments. SABRA Health Care REIT has had an impressive start to the year, showing an impressive 13.8% year-to-date return, significantly higher than the 11.5% return of Equity REIT Index and the modest 7.3% of the S& P 500. This remarkable growth can be attributed to the company’s focus on healthcare-related real estate investments, which have been particularly resilient during the pandemic. The company has also been able to capitalize on the rising demand for senior living services with its growing portfolio of senior housing properties. The company’s success has also been driven by its strong operational performance.

SABRA’s success is also due to its focus on expanding its portfolio of healthcare-related real estate investments through acquisitions, development and redevelopment of properties. Overall, SABRA Health Care REIT’s impressive 13.8% YTD performance is testament to its strong focus on healthcare-related real estate investments, operational performance and portfolio expansion. The company is well-positioned to benefit from the rising demand for senior living services, making it an attractive investment option for investors looking to capitalize on the healthcare-related real estate market.

Market Price

This success has been largely attributed to the positive news coverage that the company has received so far. On Wednesday, SABRA HEALTH CARE REIT stock opened at $13.2 and closed at $13.1, representing a drop of 1.5% from the previous closing price of $13.3. This slight decline can be attributed to investors’ cautiousness as they wait to see if the company can maintain its impressive YTD performance. It owns and operates medical office buildings, skilled nursing facilities, assisted living facilities, and hospital properties across the United States. The company has a diversified portfolio of high-quality healthcare properties located in attractive markets with strong demographic trends.

The company’s management team is highly experienced and has successfully grown the business by capitalizing on opportunities to acquire and develop healthcare properties. The team has also implemented a disciplined approach to managing its portfolio, which has helped the company to deliver strong returns for its shareholders. Overall, SABRA HEALTH CARE REIT has had a strong YTD performance in 2023 and appears to be well-positioned for continued success in the future. Investors will be monitoring the company’s performance closely over the next few months to see if it can maintain its impressive YTD gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SBRA. More…

| Total Revenues | Net Income | Net Margin |

| 595.48 | -17.01 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SBRA. More…

| Operations | Investing | Financing |

| 346.08 | -443.92 | -422.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SBRA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.84k | 2.64k | 13.89 |

Key Ratios Snapshot

Some of the financial key ratios for SBRA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 36.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

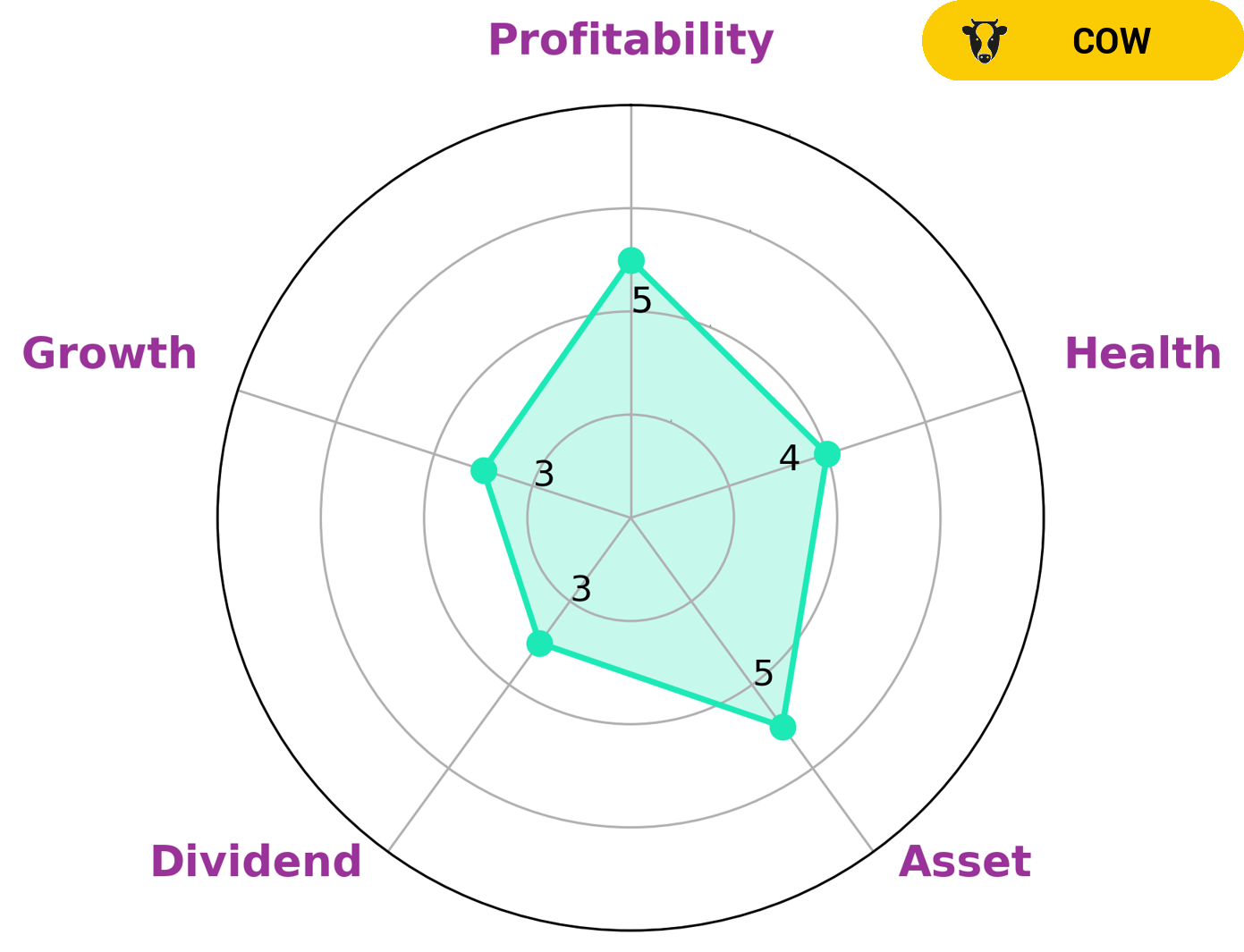

GoodWhale has conducted an analysis of SABRA HEALTH CARE REIT’s wellbeing and their Star Chart classifies the company as a ‘cow’, with a track record of paying out consistent and sustainable dividends. This type of company may be of interest to investors looking for steady returns and low levels of risk. The analysis reveals that SABRA HEALTH CARE REIT is strong in asset management, with a medium rating in profitability and a weak rating in dividend and growth. The company’s intermediate health score of 4/10 considering its cash flows and debt suggests that it is likely to be able to pay off debt and fund future operations. The analysis further reveals that SABRA HEALTH CARE REIT is well-capitalized, with a good mix of long-term and short-term debt. It has also been able to maintain strong liquidity levels, suggesting that it has the ability to meet its financial obligations in the short term. Overall, SABRA HEALTH CARE REIT is a reliable and stable company that has a long track record of paying consistent and sustainable dividends. This makes it a good option for investors looking for low-risk investments with steady returns. It also has the potential to generate strong returns in the long run due to its strong asset management and profitability scores. More…

Peers

There are several large, publicly traded healthcare real estate investment trusts (REITs) that own and operate properties leased to skilled nursing and other healthcare operators. The largest and most prominent of these firms are Sabra Health Care REIT Inc, Healthcare Realty Trust Inc, LTC Properties Inc, and Omega Healthcare Investors Inc. These firms are all engaged in a fierce competition to acquire the best performing nursing home and assisted living properties.

– Healthcare Realty Trust Inc ($NYSE:HR)

Healthcare Realty Trust Inc is a real estate investment trust that specializes in healthcare-related properties. As of 2022, the company had a market cap of 7.2 billion dollars. The company owns and operates hospitals, medical office buildings, and other healthcare-related facilities across the United States. Healthcare Realty Trust is headquartered in Nashville, Tennessee.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a publicly traded real estate investment trust (REIT) that invests in senior housing and long-term care properties. As of December 31, 2020, LTC owned a portfolio of 260 skilled nursing, assisted living, and other long-term care properties located in 29 states.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in leasing long-term care facilities. As of March 31, 2021, the company owned 1,543 properties in 44 states and the United Kingdom. The company was founded in 1992 and is headquartered in Hunt Valley, Maryland.

Summary

SABRA Health Care REIT has been a standout performer in the REIT market in 2023, with its year-to-date return of 13.8% significantly outpacing the Equity REIT Index and S&P 500. Analysts have been largely positive on the stock, citing its strong financials, attractive dividend yield, and robust balance sheet as key drivers of growth. The company is well-positioned to capitalize on an industry-wide trend of rising healthcare costs, which could help to drive future returns.

Recent Posts