Sabra Health Care REIT Reports FFO & Revenue Misses

May 4, 2023

Trending News ☀️

Sabra Health Care ($NASDAQ:SBRA) REIT, Inc. (NASDAQ: SBRA) recently reported its quarterly financial results, which fell short of expectations. Sabra Health Care REIT is an internally managed real estate investment trust (REIT) that specializes in the ownership of real estate property in the healthcare sector. The company owns and operates a portfolio of skilled nursing facilities, senior housing communities, and medical office buildings located across the United States.

Share Price

Sabra Health Care REIT released its quarterly earnings report on Wednesday, and the results were not as strong as expected. The company reported a miss in both its FFO and revenue numbers. This news caused SABRA HEALTH CARE REIT stock to open at $11.2 and close at $11.3, up by 1.6% from the prior closing price of 11.2. The stock has been volatile in recent weeks, as investors reacted to the news of the earnings report.

The company has yet to provide any explanation for the misses in FFO and revenue, leaving investors to speculate about the cause. With the stock currently trading just above its prior closing price, it remains to be seen whether investors will remain confident in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SBRA. More…

| Total Revenues | Net Income | Net Margin |

| 624.81 | -77.61 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SBRA. More…

| Operations | Investing | Financing |

| 315.73 | -216.25 | -161.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SBRA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.75k | 2.69k | 13.23 |

Key Ratios Snapshot

Some of the financial key ratios for SBRA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 37.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

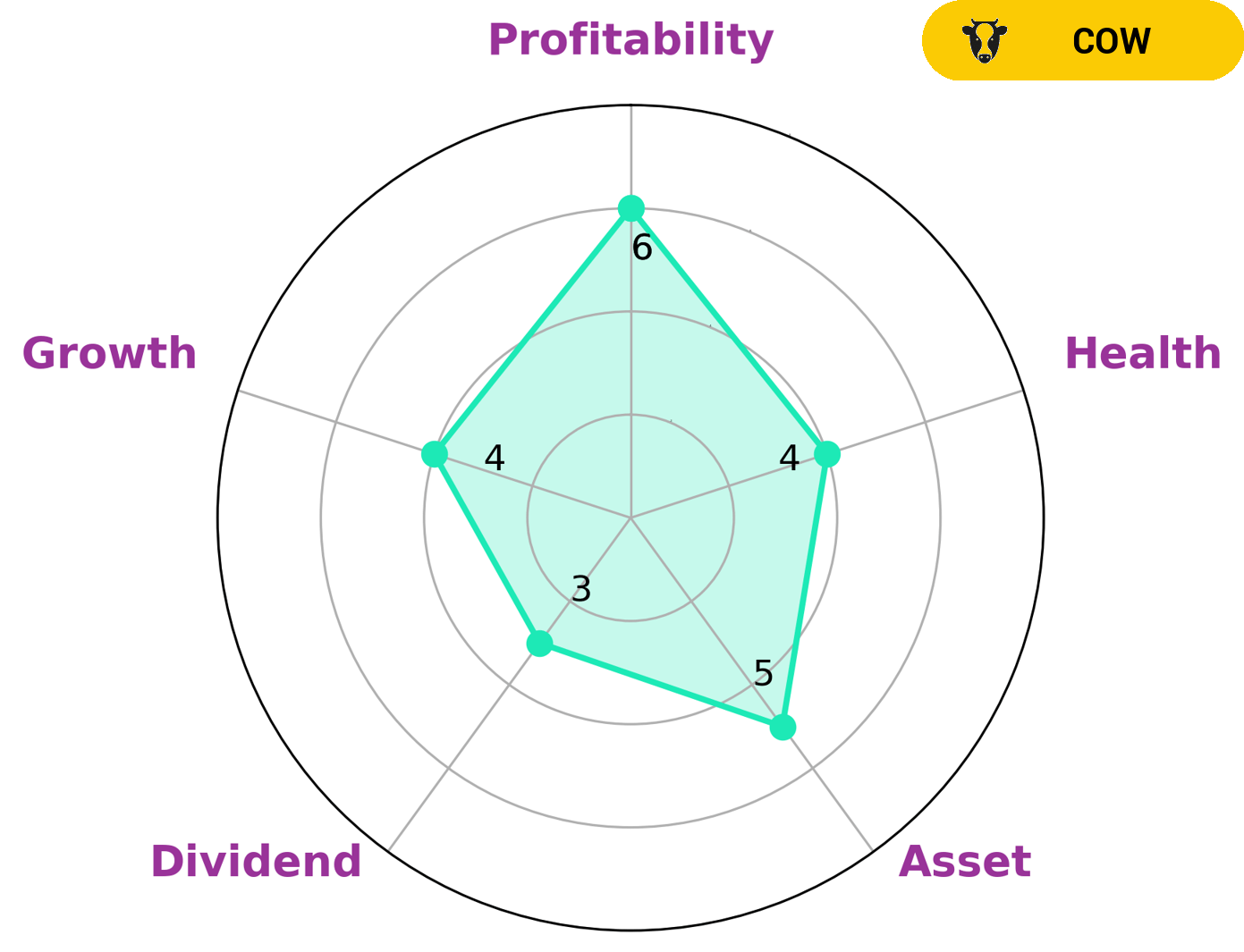

GoodWhale recently examined the financials of SABRA HEALTH CARE REIT and determined that it is classified as a ‘cow’, a type of company which has a track record of paying out consistent and sustainable dividends. Looking at the Star Chart, SABRA HEALTH CARE REIT is strong in asset, growth, profitability and weak in dividend. This indicates that the company has an intermediate health score of 4/10 considering its cashflows and debt, which is likely to pay off debt and fund future operations. This makes SABRA HEALTH CARE REIT an ideal option for investors seeking a consistent dividend stream. Investors with a long-term focus and seeking to build a dividend income portfolio would be particularly interested in this type of company. Furthermore, those investors looking to diversify their portfolios with real estate investments may also find SABRA HEALTH CARE REIT to be a good option. More…

Peers

There are several large, publicly traded healthcare real estate investment trusts (REITs) that own and operate properties leased to skilled nursing and other healthcare operators. The largest and most prominent of these firms are Sabra Health Care REIT Inc, Healthcare Realty Trust Inc, LTC Properties Inc, and Omega Healthcare Investors Inc. These firms are all engaged in a fierce competition to acquire the best performing nursing home and assisted living properties.

– Healthcare Realty Trust Inc ($NYSE:HR)

Healthcare Realty Trust Inc is a real estate investment trust that specializes in healthcare-related properties. As of 2022, the company had a market cap of 7.2 billion dollars. The company owns and operates hospitals, medical office buildings, and other healthcare-related facilities across the United States. Healthcare Realty Trust is headquartered in Nashville, Tennessee.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a publicly traded real estate investment trust (REIT) that invests in senior housing and long-term care properties. As of December 31, 2020, LTC owned a portfolio of 260 skilled nursing, assisted living, and other long-term care properties located in 29 states.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in leasing long-term care facilities. As of March 31, 2021, the company owned 1,543 properties in 44 states and the United Kingdom. The company was founded in 1992 and is headquartered in Hunt Valley, Maryland.

Summary

Sabra Health Care REIT has released its earnings report for the quarter, showing a Funds From Operations (FFO) of $0.33 per share and revenue of $161.32M. Sabra has also continued to monitor its balance sheet and implement targeted capital improvements. Overall, Sabra Health Care REIT remains a solid investment for those looking for a steady dividend yield and long-term capital appreciation potential.

Recent Posts