Putnam Investments LLC Sells Shares of Sabra Health Care REIT, in 2023.

March 17, 2023

Trending News ☀️

Putnam Investments LLC recently announced their sale of shares in Sabra Health Care ($NASDAQ:SBRA) REIT, Inc., a real estate investment trust specializing in the healthcare industry. This move came in 2023, after the company had succeeded in achieving a better return on their investments. The company owns and operates a diverse portfolio of skilled nursing, medical office, life science, and other senior housing properties across the nation. As a result of this sale, Putnam Investments LLC will now have an opportunity to invest in other areas of the healthcare sector that may offer more potential for growth and higher returns.

The sale is a testament to the company’s successful investments in this particular sector, and it will provide them with more opportunities to explore other areas of the healthcare industry. Putnam Investments LLC is confident that they can continue to achieve strong returns on their investments while also reducing their risk profile.

Stock Price

According to reports, media coverage has been largely positive in regards to this news. On the day of the announcement, Sabra’s stock opened at $11.4 and closed at $11.5, up by 2.9% from its last closing price of $11.2. This news has been seen as a positive indication of the company’s performance. With the sale of Putnam’s shares in Sabra, the company is well positioned to continue to grow and expand its operations in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SBRA. More…

| Total Revenues | Net Income | Net Margin |

| 624.81 | -77.61 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SBRA. More…

| Operations | Investing | Financing |

| 315.73 | -216.25 | -161.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SBRA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.75k | 2.69k | 13.23 |

Key Ratios Snapshot

Some of the financial key ratios for SBRA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 37.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

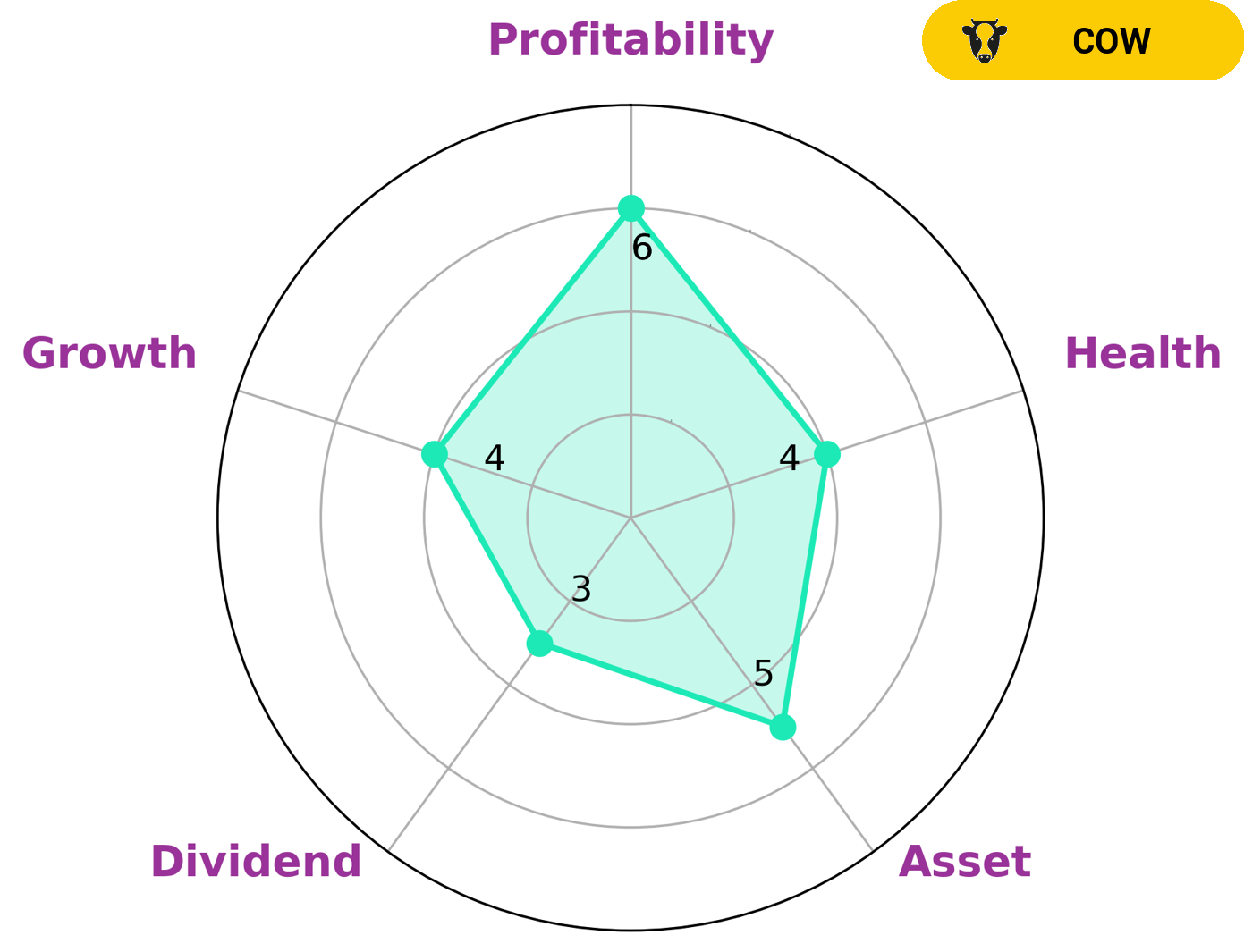

According to our Star Chart, SABRA HEALTH CARE REIT is rated “strong” in assets, medium in growth, profitability, and weak in dividend. This classification puts them into the “cow” category; companies that have the track record of paying out consistent and sustainable dividends. Investors that appreciate a stable return on investment may be particularly interested in this type of company. In terms of financial health, SABRA HEALTH CARE REIT scored 4/10 on our Cashflows & Debt health rating. This indicates that they might be able to safely ride out any crisis without the risk of bankruptcy. Thus, investors with a longer-term vision may find this company attractive, as they can expect steady returns over the long haul. More…

Peers

There are several large, publicly traded healthcare real estate investment trusts (REITs) that own and operate properties leased to skilled nursing and other healthcare operators. The largest and most prominent of these firms are Sabra Health Care REIT Inc, Healthcare Realty Trust Inc, LTC Properties Inc, and Omega Healthcare Investors Inc. These firms are all engaged in a fierce competition to acquire the best performing nursing home and assisted living properties.

– Healthcare Realty Trust Inc ($NYSE:HR)

Healthcare Realty Trust Inc is a real estate investment trust that specializes in healthcare-related properties. As of 2022, the company had a market cap of 7.2 billion dollars. The company owns and operates hospitals, medical office buildings, and other healthcare-related facilities across the United States. Healthcare Realty Trust is headquartered in Nashville, Tennessee.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a publicly traded real estate investment trust (REIT) that invests in senior housing and long-term care properties. As of December 31, 2020, LTC owned a portfolio of 260 skilled nursing, assisted living, and other long-term care properties located in 29 states.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in leasing long-term care facilities. As of March 31, 2021, the company owned 1,543 properties in 44 states and the United Kingdom. The company was founded in 1992 and is headquartered in Hunt Valley, Maryland.

Summary

Investing in Sabra Health Care REIT, Inc. (REIT) in 2023 may be a wise decision. Currently, most news coverage and analysis of the company are positive, citing their strong financials and robust portfolio of properties. REIT’s financials show a steady net income growth over the past few years, along with a healthy balance sheet and cash flow. REIT is also continuing to expand its portfolio of healthcare-related real estate investments and medical office buildings.

Its portfolio of investments includes skilled nursing facilities, senior housing, and medical office buildings across the United States. Investors can expect a potential increase in return as REIT continues to grow and diversify its income streams. With REIT’s focus on long-term sustainability and growth, it is likely to be a solid choice for investors looking to capitalize on the growing healthcare sector.

Recent Posts