Safehold Joins Forces with Sovereign Wealth Fund to Create Joint Venture

April 6, 2023

Trending News ☀️

Safehold Inc ($NYSE:SAFE). recently announced the formation of a joint venture with a sovereign wealth fund. This groundbreaking agreement between the two parties will see them collaborate to create a new venture to better serve their respective customers. Safehold Inc. is a publicly traded real estate investment trust based in New York City. The company specializes in buying and operating high quality, single tenant properties across the United States, including retail, industrial, office, and residential properties.

The sovereign wealth fund involved in the joint venture is a global investor managed by experienced professionals and focuses on long-term investments in real estate and other asset classes with a focus on providing sustainable returns. The new venture will provide investors with access to high quality properties at competitive prices while providing them with stability and diversification of portfolio risk. With the help of the sovereign wealth fund’s long-term investment strategy and Safehold Inc.’s expertise in the real estate sector, the new venture has the potential to provide exceptional returns for investors.

Stock Price

This news came as a surprise to many investors, as it caused the stock of Safehold Inc. to open at $28.9 and close at $28.2, down by 3.5% from its previous closing price of 29.2. The joint venture will focus on creating innovative real estate solutions that leverage technology, data, and analytics. It will also provide capital to support investments in the real estate industry. The joint venture is expected to have a significant impact on the real estate industry, creating better experiences for investors, owners, and tenants.

Safehold Inc. and the sovereign wealth fund are committed to providing value to their customers, investors, and partners through this new venture. With the joint venture in place, both companies are confident that they will be able to develop more efficient and successful real estate solutions that will benefit all stakeholders involved. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Safehold Inc. More…

| Total Revenues | Net Income | Net Margin |

| 270.31 | 135.42 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Safehold Inc. More…

| Operations | Investing | Financing |

| 64.85 | -1.15k | 1.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Safehold Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.85k | 3.69k | 34.32 |

Key Ratios Snapshot

Some of the financial key ratios for Safehold Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 81.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

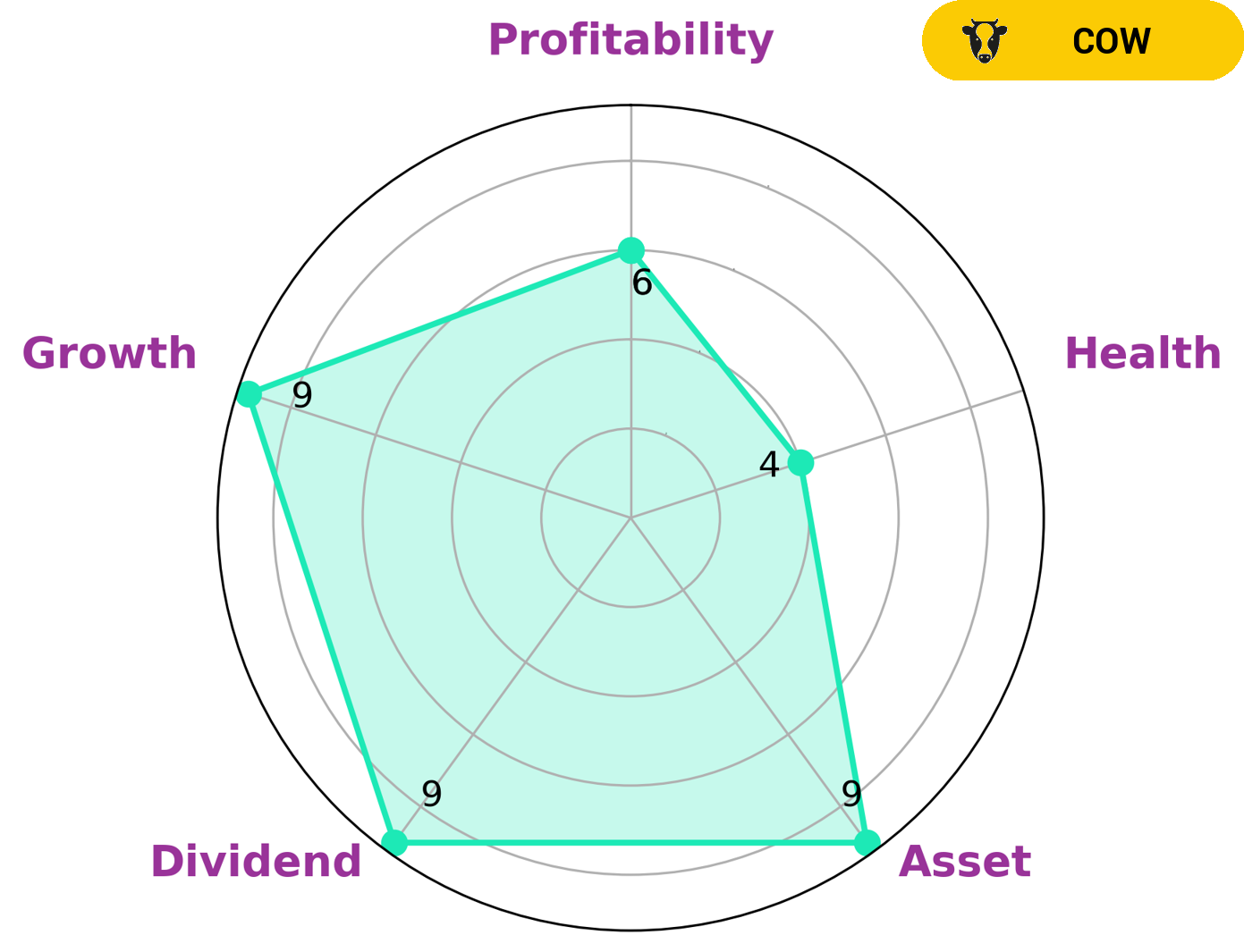

At GoodWhale, we analyze SAFEHOLD INC‘s fundamentals to help investors make an informed decision. Our Star Chart indicates that SAFEHOLD INC has an intermediate health score of 4/10 considering its cash flows and debt. This implies that the company is likely to sustain future operations in times of crisis. We also observe that SAFEHOLD INC is strong in assets, dividend, and growth, and medium in profitability. We classify SAFEHOLD INC as a ‘cow’, a type of company we conclude that has the track record of paying out consistent and sustainable dividends. Due to this, we believe that SAFEHOLD INC may be of interest to dividend investors and value investors seeking stable and steady returns. More…

Peers

Safehold’s competitors in the ground lease space include Shinhan Seobu T&D REIT, SLS Realty REIT, and iStar Inc.

– Shinhan Seobu T&D REIT ($KOSE:404990)

Shinhan Seobu T&D REIT is a real estate investment trust that invests in properties used for telecommunication and data centers in South Korea. As of 2022, the company has a market cap of 102.92 billion won. The company’s portfolio includes properties in Seoul, Daejeon, Daegu, Busan, and Gwangju.

– SLS Realty REIT ($LTS:0OI7)

As of 2022, iStar Inc has a market cap of 932M. The company is a leading real estate investment and finance firm. They are dedicated to creating long-term value for their shareholders, clients, and partners.

Summary

Investing in Safehold Inc is a risky but high-reward venture. Recently, the company has announced a joint venture with a sovereign wealth fund, which caused the stock price to dip on the same day. Although there is potential for long-term growth, investors should be mindful of the associated risks. The company’s current financial performance and outlook should be carefully considered before investing in Safehold Inc. Additionally, investors should watch for any further news related to the joint venture and other strategic initiatives that could impact the stock price.

Recent Posts