Investors Flock to Safehold (SAFE) in 2023 – Here’s Why

March 30, 2023

Trending News ☀️

Investors are increasingly turning to Safehold Inc ($NYSE:SAFE) (SAFE) in 2023 as a smart addition to their portfolios. The company, which provides a unique property insurance-linked product to the real estate industry, has been steadily gaining momentum as shares of its stock have risen since the start of the year. With a growing portfolio of customers, an innovative business model, and strong financials, it’s no surprise that investors are taking a closer look at Safehold and its potential for future growth. Safehold Inc is a leading property insurance-linked product provider to the real estate industry. The company’s products are designed to help protect property owners from risks associated with natural disasters and other types of unforeseen events. By providing coverage for losses related to hurricanes, floods, fires, and other disasters, Safehold allows property owners to protect their investments and potentially save thousands of dollars in costs associated with repairs or rebuilding.

In addition, Safehold’s unique business model has allowed it to quickly expand its customer base. With its low-cost service plans, the company is able to offer coverage to more customers than traditional insurance providers at much lower prices. Furthermore, Safehold’s online platform has made the process of obtaining coverage simpler and more user-friendly, allowing even the most novice investor to have access to the company’s services. Finally, Safehold’s financials are among the strongest in its sector. This trend is expected to continue as Safehold’s customer base continues to expand and demand for its products remains strong. With its unique product offering, innovative business model, and impressive financials, Safehold is an attractive option for investors looking to maximize their returns.

Stock Price

Investors were drawn to Safehold Inc (SAFE), on Monday when the stock opened at $29.2 and closed at $29.0, marking a slight 0.3% increase from the previous closing price of 28.9. This surge in interest has been attributed to the company’s sustained growth, high dividend yield and innovative product offerings. Safehold Inc has been making significant inroads in the real estate industry, with its innovative approach to capitalizing on the opportunities presented by the digital age. The company’s success has been driven by its ability to identify and invest in commercial real estate deals that offer attractive returns, both in the form of capital appreciation and high yields.

In addition, Safehold Inc has become a leader in the self-storage industry, with its portfolio of properties strategically located in markets across the country. Its distinctive rental agreement structures have allowed the company to remain competitive while offering customers more flexibility and choices. This has enabled Safehold Inc to outperform its peers in terms of total returns in the year 2023, making it an attractive option for investors. All in all, investors have flocked to Safehold Inc due to its strong growth prospects, attractive dividend yields and innovative product offerings. With the company continuing to make strategic investments and expand its presence, investors will likely continue to benefit from the company’s success in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Safehold Inc. More…

| Total Revenues | Net Income | Net Margin |

| 270.31 | 135.42 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Safehold Inc. More…

| Operations | Investing | Financing |

| 64.85 | -1.15k | 1.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Safehold Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.85k | 3.69k | 34.32 |

Key Ratios Snapshot

Some of the financial key ratios for Safehold Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 81.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

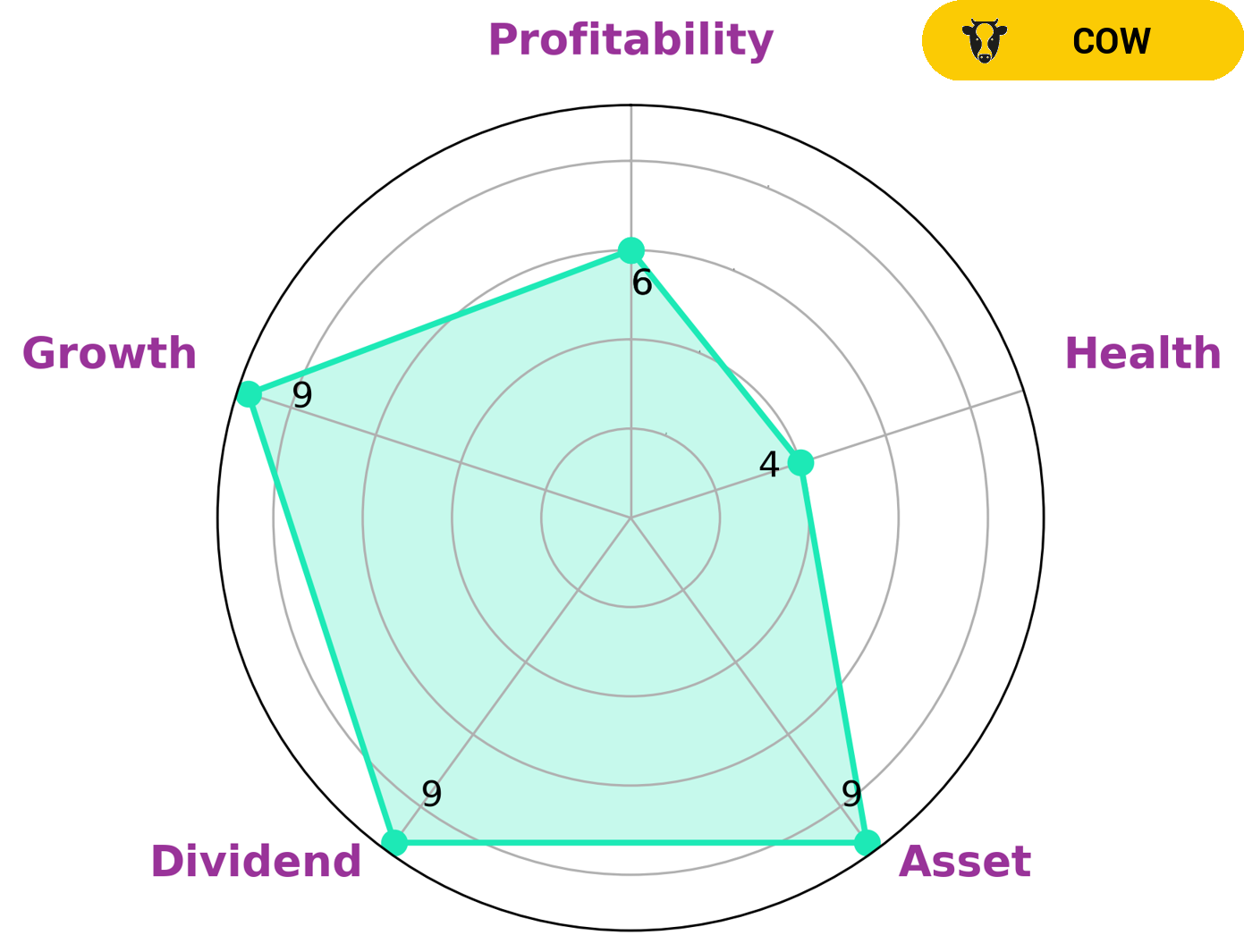

GoodWhale has conducted an analysis of SAFEHOLD INC‘s financials and the results are in. Our Star Chart rated SAFEHOLD INC an intermediate health score of 4/10, indicating that it is likely able to safely ride out any crisis without the risk of bankruptcy. SAFEHOLD INC is classified as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. This type of company may be of interest to investors looking for steady income as well as long term growth potential. SAFEHOLD INC is strong in assets, dividend, growth, and medium in profitability. This makes it an attractive option for those who are looking to invest in a secure, income-generating asset. More…

Peers

Safehold’s competitors in the ground lease space include Shinhan Seobu T&D REIT, SLS Realty REIT, and iStar Inc.

– Shinhan Seobu T&D REIT ($KOSE:404990)

Shinhan Seobu T&D REIT is a real estate investment trust that invests in properties used for telecommunication and data centers in South Korea. As of 2022, the company has a market cap of 102.92 billion won. The company’s portfolio includes properties in Seoul, Daejeon, Daegu, Busan, and Gwangju.

– SLS Realty REIT ($LTS:0OI7)

As of 2022, iStar Inc has a market cap of 932M. The company is a leading real estate investment and finance firm. They are dedicated to creating long-term value for their shareholders, clients, and partners.

Summary

Safehold Inc (SAFE) has been a popular investment option since 2023, due to its solid financial performance and potential for growth. Its revenue and profits have been steadily increasing over the years, and its dividend yields have been attractive to investors. The company’s balance sheet is strong, with ample cash reserves and low debt levels. Its assets are diversified across a wide range of industries, providing investors with a high degree of security.

Additionally, Safehold Inc has maintained a high rate of return on investments and has generated impressive returns for its shareholders. As a result, investor confidence in Safehold Inc remains strong, and the demand for its shares continues to grow.

Recent Posts