Empire State Realty Trust Lights Up the Sky to Celebrate Super Bowl LVII!

February 16, 2023

Trending News ☀️

The Empire State Realty ($NYSE:ESRT) Trust is lighting up the sky to celebrate Super Bowl LVII. Themed displays will feature the teams competing in the Super Bowl and the scores of each quarter throughout the night. The virtual scoreboard display will also include creative animations, designed by the talented team at ESRT, that will give viewers at home an immersive experience of the Super Bowl.

The show will be viewable for miles around and broadcast live on various digital platforms for those who can’t make it to New York City. With this Super Bowl celebration sure to be no exception, ESRT is proud to honor the teams competing in this year’s game with this synchronized light show!

Share Price

The dazzling show received positive sentiments from both the locals and the visitors, who praised the company for its creativity. Furthermore, ESRT stock opened at $7.9 on Monday and closed at $8.0, up by 1.4% from the last closing price. This positive development has been credited with the light show, indicating the potential of effective and creative marketing initiatives in rallying investor sentiments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ESRT. More…

| Total Revenues | Net Income | Net Margin |

| 706.1 | 20.63 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ESRT. More…

| Operations | Investing | Financing |

| 212.44 | -212.74 | -93.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ESRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.2k | 2.53k | 10.36 |

Key Ratios Snapshot

Some of the financial key ratios for ESRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

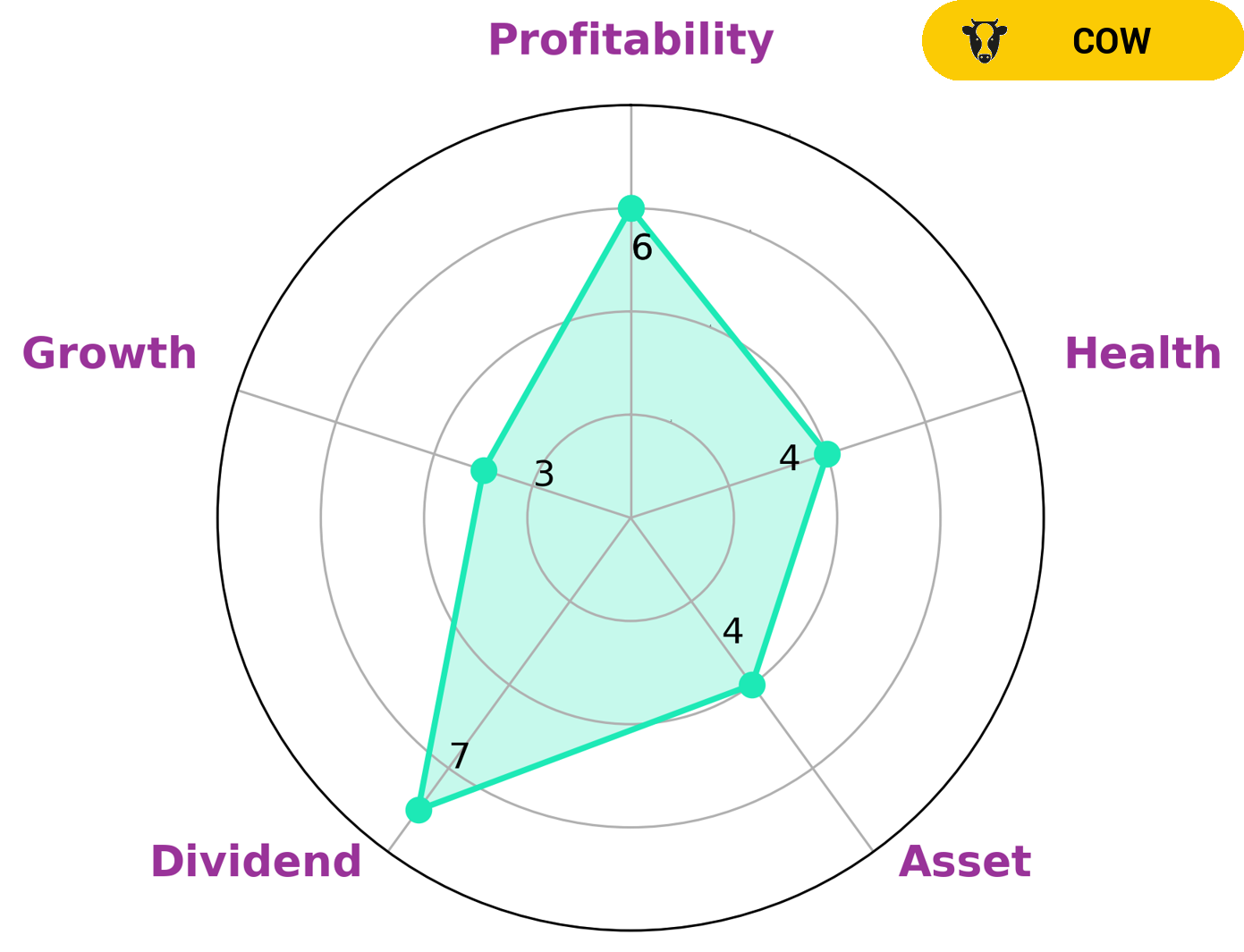

At GoodWhale, we specialize in analyzing financials of different companies and recommending investments based on our analysis. Today, we will take a closer look at EMPIRE STATE REALTY TRUST, an American real estate company, and offer some insight on what type of investors might be interested in such a company. According to our Star Chart system, EMPIRE STATE REALTY TRUST is classified as a ‘cow’, which means it has a track record of paying out consistent and sustainable dividends. It is strong in dividend, medium in asset, profitability and weak in growth. Furthermore, our metric system evaluates EMPIRE STATE REALTY TRUST with an intermediate health score of 4/10 with regard to its cashflows and debt, which suggests it might be able to safely ride out any crisis without the risk of bankruptcy. Therefore, investors who want a more conservative approach and are looking for consistent dividend payments might find EMPIRE STATE REALTY TRUST to be an interesting investment choice. More…

Peers

ESRT’s portfolio includes the Empire State Building, the world’s most famous office building. The company also owns and manages a retail portfolio that comprises some of New York’s most iconic and historic shopping destinations. ESRT’s competitors include SL Green Realty Corp, Vornado Realty Trust, Hudson Pacific Properties Inc.

– SL Green Realty Corp ($NYSE:SLG)

SL Green Realty Corp is a real estate investment trust that focuses on acquiring, managing, and developing office properties in the United States. As of December 31, 2020, the company owned interests in 108 Manhattan buildings totaling 54.4 million square feet.

– Vornado Realty Trust ($NYSE:VNO)

Vornado Realty Trust is a publicly traded real estate investment trust (REIT) that owns, manages and develops commercial real estate, primarily in the United States. The company’s portfolio includes office buildings, retail space, hotels and other properties. Vornado’s market capitalization is $4.44 billion as of 2022. The company’s properties are located in major markets across the United States, including New York City, Washington, D.C., Chicago and San Francisco.

– Hudson Pacific Properties Inc ($NYSE:HPP)

Hudson Pacific Properties Inc is a real estate investment trust that focuses on acquiring, developing, and operating office properties in the United States. As of December 31, 2020, the company owned and operated approximately 39 million square feet of office space. Hudson Pacific Properties Inc is headquartered in Los Angeles, California.

Summary

Empire State Realty Trust has been in the spotlight recently due to its celebratory lighting of the Empire State Building in honor of Super Bowl LVII. The company owns and operates a portfolio of office and retail properties located in Manhattan and the greater New York metropolitan area. Analysts see strong upside potential for the company, citing its steady dividend yield, low debt load and experienced management team who have a proven track record of success. Ultimately, Empire State Realty Trust is a viable choice for investors seeking reliable returns.

Recent Posts