Analysts Positive on Cromwell E-Reit for Attractive Distribution Yield and Stable Operating Metrics.

May 25, 2023

Trending News ☀️

Analysts have been positive on Cromwell European Real ($SGX:CWBU) Estate Investment Trust (E-Reit) for its attractive distribution yield and stable operating metrics. The Singapore-listed E-Reit is a high-yielding and diversified fund that invests in a portfolio of predominantly European real estate assets such as offices, industrial, and retail properties. In addition to having a high distribution yield, the E-Reit is well managed and has a strong asset base to back it up. The trust is well positioned to benefit from growth in Europe and should continue to be a safe and high yielding investment option for investors.

Share Price

This Wednesday, the stock of CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST opened at SG$1.5 and closed at the same price, representing a marginal drop of 0.7% from its previous closing price of SG$1.5. These attributes make it an attractive investment for portfolio diversification and potential capital appreciation. The Reit has a resilient portfolio of assets that are well diversified geographically and across all property types, including offices, retail and industrial properties in Germany, the Netherlands, France, Belgium and the United Kingdom. This should enable the Reit to maintain its stable distribution yield and operating metrics during times of market volatility.

In addition, the Reit has a prudent and conservative approach to capital management, which should help to preserve its unitholders’ capital over the long term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CWBU. More…

| Total Revenues | Net Income | Net Margin |

| 222.1 | 39.63 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CWBU. More…

| Operations | Investing | Financing |

| 92.35 | -106.34 | -9.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CWBU. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.59k | 1.17k | 2.53 |

Key Ratios Snapshot

Some of the financial key ratios for CWBU are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 56.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

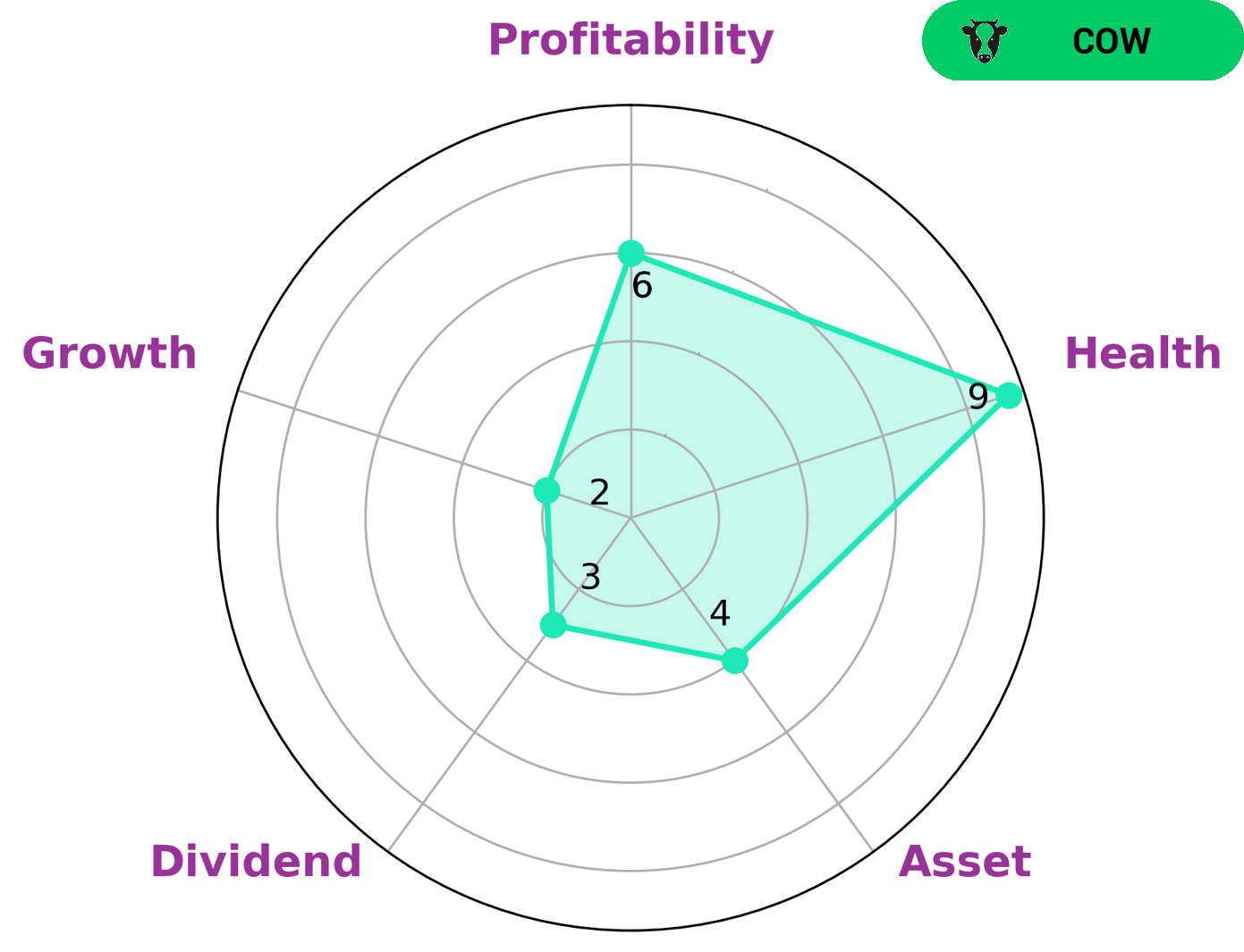

GoodWhale has performed an analysis of CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST’s wellbeing, and based on the Star Chart, CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST has a high health score of 9/10 with regard to its cash flows and debt, and is capable to pay off debt and fund future operations. CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST is strong in medium asset, profitability and weak in dividend, growth. We classify CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST as a ‘cow’, a type of company which has the track record of paying out consistent and sustainable dividends. With this knowledge, we can conclude that investors interested in consistent, sustainable dividends may be interested in investing in CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST. More…

Peers

Cromwell European REIT is one of the leading entities in the real estate investment trust (REIT) industry, competing with a range of other companies in the sector, such as Nextensa, Lendlease Global Commercial REIT, and MREIT Inc. Each of these entities offer a range of services and products in the area of real estate investment, and compete for the capital investments of customers. Cromwell European REIT is well-positioned to succeed in this highly competitive market, with a range of innovative products and services that set it apart from its competitors.

– Nextensa ($BER:L3R)

Nextensa is a technology company focused on developing innovative solutions for the modern enterprise. With a market cap of 498.84M as of 2022, Nextensa has become one of the fastest growing and most successful companies in the tech industry. The company’s resources, talent, and expertise have enabled them to develop unique solutions for businesses of all sizes, from small startups to large corporations. Nextensa’s products range from software and hardware solutions to cloud computing services and more. The company is constantly striving to stay ahead of the competition by offering products that are both innovative and reliable. By investing heavily in research and development, Nextensa has managed to stay ahead of the curve and remain one of the most sought-after technology companies in the world.

– Lendlease Global Commercial REIT ($SGX:JYEU)

Lendlease Global Commercial REIT is a Singapore-based real estate investment trust (REIT) that owns a portfolio of commercial properties in key markets around the world. As of 2022, the REIT has a market capitalization of approximately 1.59 billion Singapore dollars. Its portfolio includes office, retail, industrial, and hospitality assets located in Tokyo, London, Paris, Sydney, Melbourne, and other cities. The REIT is managed by Lendlease Investment Management, an experienced and respected global real estate manager. The REIT’s objective is to provide a reliable and regular income stream to its unitholders through the acquisition and management of a diversified portfolio of commercial properties.

– MREIT Inc ($PSE:MREIT)

MREIT Inc is a publicly traded real estate investment trust (REIT) with a market cap of 30.54 billion as of 2022. The company specializes in the acquisition, ownership, and management of residential and commercial real estate properties throughout the United States. MREIT Inc has a portfolio of approximately 28,000 apartment units, 1.6 million square feet of office space, and 1.3 million square feet of retail space. Its assets also include more than 7,000 single-family homes and over 3,000 acres of undeveloped land. The company earns income from rental properties and capital appreciation from both its real estate holdings and mortgage-backed securities. It provides investors with a steady stream of income and potential long-term capital gains through its portfolio of real estate investments.

Summary

Cromwell European Real Estate Investment Trust (Cromwell E-REIT) has been met with positive sentiment from analysts, who are attracted to its attractive distribution yield and stable operating metrics. The REIT has experienced solid performance in terms of occupancy rates, rental income and net property income, while its portfolio of assets has remained largely unaffected by the pandemic. Its current focus on core markets in Europe is expected to ensure stability and potential for growth. Analysts believe that the REIT is well-positioned to take advantage of any opportunities that may arise from the current economic conditions.

Recent Posts