Texas Permanent School Fund Sells 3180 Shares of Douglas Elliman

May 23, 2023

Trending News ☀️

The Texas Permanent School Fund recently sold 3180 shares of Douglas Elliman ($NYSE:DOUG) Inc., according to Defense World. It is the fourth largest residential real estate brokerage firm in the United States and offers a variety of services, including residential and commercial real estate sales, leasing and mortgage services, as well as relocation and property management services. It is publicly traded on the New York Stock Exchange under the ticker symbol DLM.

Share Price

The sale was part of an effort by the Permanent School Fund to diversify its portfolio and maximize returns. It is unclear who the buyer was or what the total amount of the sale was. Douglas Elliman is one of the largest residential real estate brokerages in the United States. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Douglas Elliman. More…

| Total Revenues | Net Income | Net Margin |

| 1.06k | -27.27 | -2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Douglas Elliman. More…

| Operations | Investing | Financing |

| -14.74 | -12.74 | -30 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Douglas Elliman. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 550.4 | 279.94 | 3.19 |

Key Ratios Snapshot

Some of the financial key ratios for Douglas Elliman are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.7% | 308.4% | -3.0% |

| FCF Margin | ROE | ROA |

| -2.2% | -7.4% | -3.6% |

Analysis

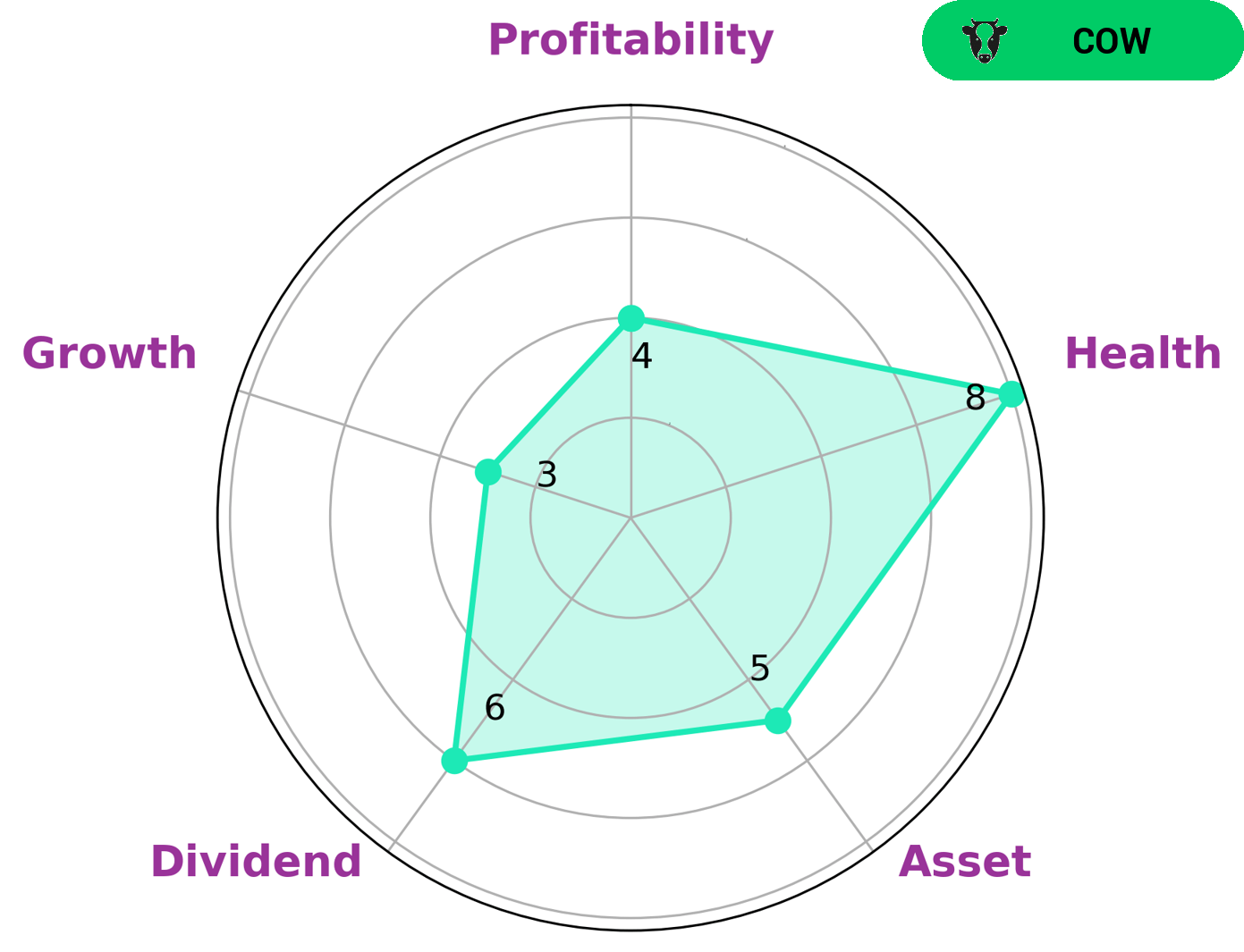

GoodWhale conducted an analysis of DOUGLAS ELLIMAN‘s financials. Our Star Chart classification found that DOUGLAS ELLIMAN is categorized as a ‘cow’, meaning it has proven to be stable and consistent in paying out dividends. Investors who are looking for reliable, steady returns may find this company of interest. Further, DOUGLAS ELLIMAN scored an 8/10 on our Health Score, which indicates it is highly capable of sustaining future operations in times of crisis. We assessed the company to have a strong standing in liquidity and medium standings in assets, dividends, profitability and growth. This suggests that DOUGLAS ELLIMAN is a stable long-term investment opportunity. More…

Peers

The four companies are all real estate service providers. APAC Realty Ltd is a Singapore-based real estate agency. Open House Group Co Ltd is a Hong Kong-based real estate agency. E-House (China) Enterprise Holdings Ltd is a real estate services company based in China.

– APAC Realty Ltd ($SGX:CLN)

The company’s market cap is 198.91M as of 2022 and its ROE is 16.64%. The company is involved in the business of real estate brokerage and development. It is one of the leading real estate companies in Singapore and has a strong presence in the region. The company has a diversified portfolio of properties and is well-positioned to capitalise on opportunities in the market.

– Open House Group Co Ltd ($TSE:3288)

Open House Group Co Ltd, a real estate company, engages in the development, sale, management, and operation of residential and commercial properties in Mainland China, Hong Kong, Macau, and Singapore. The company has a market cap of 645.8B as of 2022 and a Return on Equity of 22.55%. The company operates through the following segments: Property Development, Property Investment, Hotel Operations, and Property Management. The Property Development segment develops residential and commercial properties for sale. The Property Investment segment invests in properties for long-term income generation. The Hotel Operations segment manages and operates hotels. The Property Management segment provides property management services.

Summary

The Texas Permanent School Fund recently sold 3180 shares of Douglas Elliman Inc. This highlights a potential trend in investing away from the company, as the school fund is considered to be a savvy investor. Analysts have noted that Douglas Elliman’s stock price has dropped significantly since the beginning of the year, and many potential buyers have questioned the company’s financial stability. On the other hand, some investors are hopeful that the company’s recent moves to diversify their portfolio and reduce debt could result in higher returns in the future. For those interested in investing in Douglas Elliman, it is important to watch for any further changes in their financials that could affect their long-term prospects.

Recent Posts