Wealthcare Advisory Partners LLC Invests in The St. Joe Company During First Quarter

August 12, 2023

🌥️Trending News

The St. Joe ($NYSE:JOE) Company is a real estate development, asset management, and operating company located in Northwest Florida. Its portfolio includes residential, commercial, and resort properties throughout the region. The stock is traded on the New York Stock Exchange (NYSE) under the symbol JOE. The size of the stake is not yet known, but it is believed to be valued at several million dollars. The move marks a significant investment in the company and is expected to provide further capital for its ongoing development projects.

The St. Joe Company has been actively expanding its operations in recent years, with new acquisitions and projects planned throughout the region. The company is well-positioned to benefit from the growth of the Northwest Florida economy and its strategic investments have been well-received by investors. The investment from Wealthcare Advisory Partners LLC adds further credibility to the company’s efforts and will likely attract more investments in the near future.

Stock Price

JOE was priced at $60.1, and at the close of the day, their stock had risen by 2.9% to $62.1. This closing price was up from the previous day’s closing price of $60.4. The investment has been met with optimism, as it is seen as a sign of the company’s future potential for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for St. Joe. More…

| Total Revenues | Net Income | Net Margin |

| 320.36 | 85.59 | 24.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for St. Joe. More…

| Operations | Investing | Financing |

| 72.14 | -129.77 | 103.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for St. Joe. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.52k | 840.39 | 11.39 |

Key Ratios Snapshot

Some of the financial key ratios for St. Joe are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.0% | 32.6% | 42.3% |

| FCF Margin | ROE | ROA |

| -50.0% | 13.0% | 5.6% |

Analysis

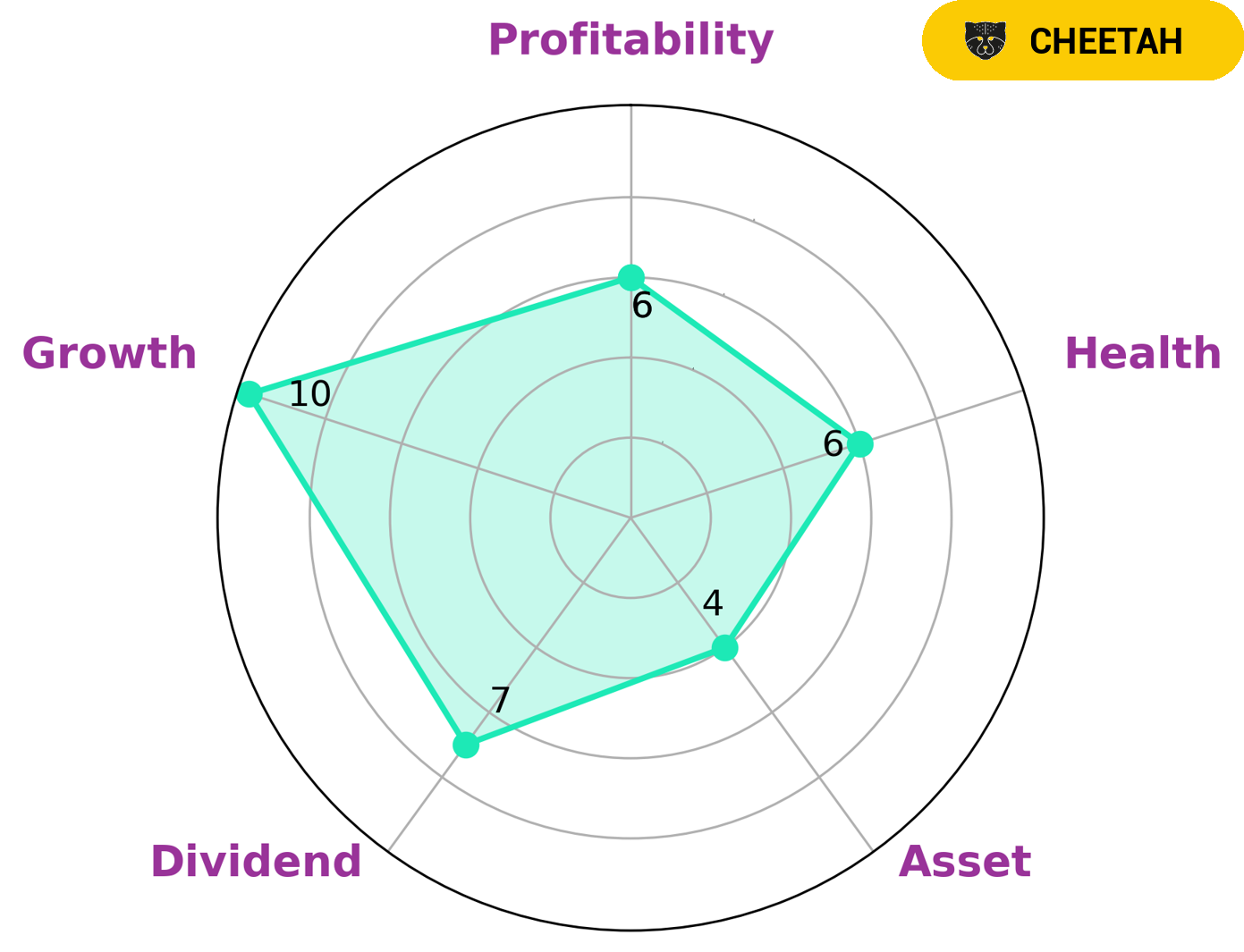

GoodWhale has conducted a wellbeing analysis of ST. JOE and our Star Chart shows that ST. JOE has a health score of 8/10 taking into consideration its cashflows and debt, suggesting it is capable to sustain future operations even in times of crisis. JOE is strong in growth, its asset, dividend and profitability scores are medium, classifying it as a ‘cheetah’ – a type of company we conclude that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given these characteristics, investors looking for short-term gains may be interested in such companies as they offer an opportunity for rapid growth. For investors looking for more stability, it may be better to look for companies with higher asset and profitability scores. More…

Peers

As of February 2021, it ranked #426 on the Fortune 500 list of the largest United States corporations by total revenue. The company’s main competitors are Rockwell Land Corp, Bresler & Reiner Inc, and Cebu Landmasters Inc.

– Rockwell Land Corp ($PSE:ROCK)

Rockwell Land Corp is a real estate company that develops, manages, and markets properties in the Philippines. As of 2022, the company had a market capitalization of 7.95 billion US dollars and a return on equity of 10.07%. The company was founded in 1976 and is headquartered in Makati, Philippines. Rockwell Land Corp is one of the largest real estate developers in the Philippines and is known for developing luxury residential and commercial properties.

– Bresler & Reiner Inc ($OTCPK:BRER)

Bresler & Reiner Inc is a company that provides services to the oil and gas industry. It has a market cap of 3.83 million as of 2022 and a return on equity of -3.56%. The company has been in business for over 50 years and has a strong reputation in the industry. It is headquartered in Houston, Texas.

– Cebu Landmasters Inc ($PSE:CLI)

Cebu Landmasters Inc is a publicly-listed company in the Philippines with a market capitalization of PHP 9.25 billion as of March 31, 2022. The company is engaged in the business of real estate development, marketing, and selling of horizontal and vertical residential, office, retail, and industrial projects. As of December 31, 2020, Cebu Landmasters Inc had total assets of PHP 50.6 billion and total equity of PHP 30.4 billion. The company’s ROE for 2020 was 22.0%.

Summary

Investors have been showing more interest in The St. Joe Company, as evidenced by Wealthcare Advisory Partners LLC’s purchase of new shares during the first quarter. Analysts have been bullish about the company’s long-term prospects, citing its strong position in the Florida real estate market, its diversified portfolio, and its recent initiatives to unlock value from its land assets. Investors should weigh both the risks and rewards associated with investing in St. Joe, given the current uncertain economic environment. Analysts suggest that investors take a long-term approach when considering an investment in St. Joe, due to its strong real estate assets and its strategic initiatives to unlock value.

Recent Posts