GuocoLand Crowned ‘King of Lentor’ by DBS Research

April 11, 2023

Trending News 🌥️

GUOCOLAND ($SGX:F17): GuocoLand Limited, a Singapore-based property developer, has recently been crowned the “King of Lentor” by DBS Group Research. This follows the successful joint bid by GuocoLand and Hong Leong Holdings’ Intrepid Investments for a residential site at Lentor Gardens. GuocoLand Limited is a Singapore-listed property developer with regional presence in Singapore, Malaysia, China, Vietnam, Hong Kong and Indonesia. It has a diversified portfolio of high quality residential, commercial and hospitality properties.

Notable projects include Goodwood Residence, Leedon Residence, Martin Modern and Wallich Residence. With the successful acquisition of the Lentor Gardens site, GuocoLand has further strengthened its presence in the Singapore residential market. GuocoLand is well positioned to benefit from the current upturn in the property market and DBS Research has identified it as one of the top picks in the sector.

Share Price

On Wednesday, DBS Research released a report that crowned GUOCOLAND LIMITED as ‘King of Lentor’. This report had a direct impact on their stock, which opened at SG$1.6 and closed at the same level, down by 0.6% from their previous closing price. While the stock did not move much on the day, this report from DBS Research was a major boost for the company, as it provides investors with an optimistic outlook on their prospects in the future. The report by DBS Research highlighted the strength of GUOCOLAND LIMITED’s fundamentals and their ability to generate cash flows despite challenging market conditions.

Their diversified portfolio also serves as a buffer against any unforeseen market volatility. Furthermore, the report also indicated that the company’s strong balance sheet should enable them to weather any future market shocks better than their competitors. Overall, with this elevated rating given by DBS Research, GUOCOLAND LIMITED is well positioned to ride out any current or future market turbulence and enjoy further success in the years ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Guocoland Limited. More…

| Total Revenues | Net Income | Net Margin |

| 1.17k | 384.24 | 27.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Guocoland Limited. More…

| Operations | Investing | Financing |

| 753.09 | -189.18 | -836.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Guocoland Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.95k | 6.69k | 3.89 |

Key Ratios Snapshot

Some of the financial key ratios for Guocoland Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.4% | 3.1% | 56.4% |

| FCF Margin | ROE | ROA |

| 64.1% | 8.9% | 3.5% |

Analysis

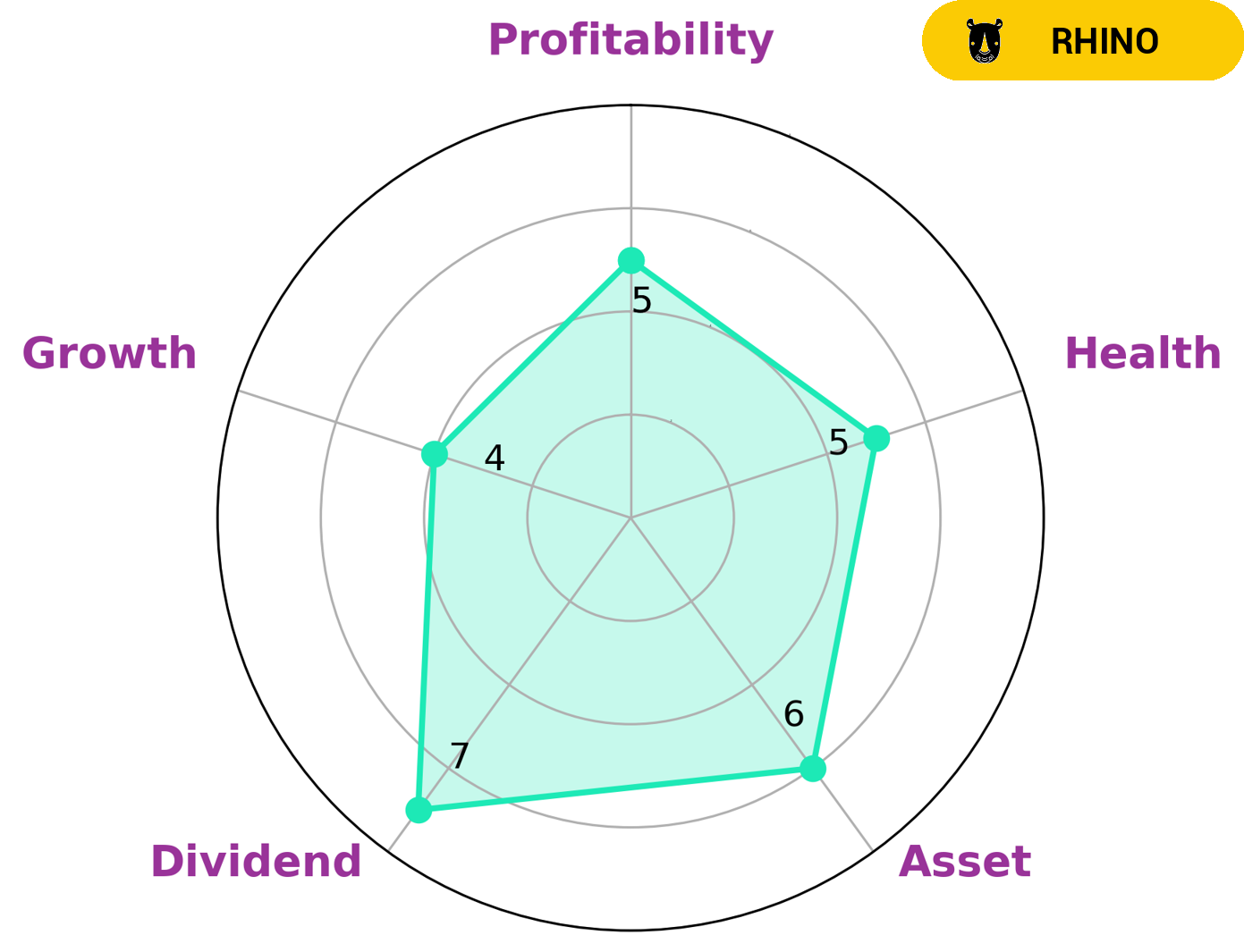

As a GoodWhale analysis of GUOCOLAND LIMITED‘s fundamentals shows, the company is classified as a ‘rhino’ in the Star Chart, indicating that it has achieved moderate revenue or earnings growth. This makes it an attractive prospect for value investors looking for a stable, dividend-paying stock; however, more growth-oriented investors may find its asset, growth, and profitability scores to be only medium. In terms of its health score, GUOCOLAND LIMITED has an intermediate score of 5/10 with regard to its cashflows and debt. This suggests that the company is likely to safely ride out any crisis without the risk of bankruptcy, making it a reliable investment for investors who are risk-averse. More…

Peers

It competes with other prominent real estate developers such as Asian Pac Holdings Bhd, IOI Properties Group Bhd, and Sinarmas Land Ltd. These competitors have strong presences in the international market and all offer attractive real estate developments in the region.

– Asian Pac Holdings Bhd ($KLSE:4057)

Asian Pac Holdings Bhd is a Malaysian-based investment holding company. It has a broad portfolio of investments, including construction, property development, and investments in other companies. The company’s market cap as of 2022 is 178.66M, reflecting its position as a major player in the industry. Its Return on Equity (ROE) of 1.34% indicates that it is making efficient use of its equity base to generate returns. This is a sign that the company is successfully creating value for its shareholders.

– IOI Properties Group Bhd ($KLSE:5249)

IOI Properties Group Bhd is a Malaysian-based real estate and property development company. It is a subsidiary of IOI Corporation Berhad, one of the largest palm oil companies in the world. The company primarily focuses on developing commercial and residential properties, as well as hospitality and leisure properties in Malaysia, Singapore, China, and the United States. As of 2022, IOI Properties Group Bhd has a market cap of 6B, with a Return on Equity of 4.69%. This indicates that the company is performing well financially, as their ROE is higher than the industry average. The company’s strong financial performance has enabled it to invest in more projects and expand its reach into new markets.

– Sinarmas Land Ltd ($SGX:A26)

Sinarmas Land Ltd is a real estate and property development company based in Indonesia. It has a market capitalization of 761.67 million dollars as of 2022, making it one of the largest companies in the sector. Its Return on Equity (ROE) is 10.27%, which represents a reasonable level of profitability for the company. Sinarmas Land Ltd is engaged in the development and construction of residential, commercial, and industrial developments in Indonesia, as well as in other parts of Asia. The company also provides real estate related services, such as land acquisition, development, design, and marketing. As a result of its diverse operations and solid financial performance, Sinarmas Land Ltd has established itself as a leader in the Indonesian real estate market.

Summary

GuocoLand Limited is an attractive investment opportunity for investors. Additionally, the company is also involved in several projects that could drive future growth, including the joint bid with Hong Leong Holdings’ Intrepid Investments for the residential site at Lentor Gardens. Furthermore, the company has established a track record of strong returns on capital employed, and it has a healthy balance sheet with an ample cash reserve. Overall, GuocoLand Limited is an appealing option for those looking to expand their portfolio into real estate and other related industries.

Recent Posts