CK Asset Holdings Limited Sees Huge Increase in Short Interest in March

April 20, 2023

Trending News ☀️

CK ($SEHK:01113) Asset Holdings Limited has seen a huge increase in its short interest in March, with the figure rising by 87.4%, according to Defense World. The company is one of the largest real estate investment companies in Hong Kong, with its portfolio covering a wide range of asset classes such as office buildings, shopping malls, industrial properties, and residential projects. The surge in short interest may be attributable to recent news regarding CK Asset Holdings Limited’s plans to expand into new markets. According to reports, the company is looking at investing in overseas markets such as London, Tokyo, and Singapore, while also exploring joint venture projects with domestic companies.

The company’s financial success has also seen its stock price increase significantly over recent months. The company is expanding its portfolio and exploring new markets, while also generating impressive financial returns. As such, it appears that CK Asset Holdings Limited has plenty of potential for further growth in the near future.

Stock Price

The stock opened at HK$47.8 and closed at HK$48.2, a 0.4% increase from its prior closing price of HK$48.0. This jump in short interest indicates that investors are expecting the stock price to drop in the near future. It also reflects an overall bearish sentiment towards the company, as more investors are opting to bet on a potential decline in price.

The increase in short interest could be attributed to the current market conditions, which remain highly volatile and unpredictable. As such, investors may be seeking to limit their investment risk by betting against any potential increase in CK ASSET‘s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ck Asset. More…

| Total Revenues | Net Income | Net Margin |

| 56.34k | 21.68k | 36.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ck Asset. More…

| Operations | Investing | Financing |

| 6.57k | 47.47k | -58.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ck Asset. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 514.82k | 121.11k | 107.5 |

Key Ratios Snapshot

Some of the financial key ratios for Ck Asset are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.9% | -17.4% | 42.3% |

| FCF Margin | ROE | ROA |

| 7.3% | 3.9% | 2.9% |

Analysis

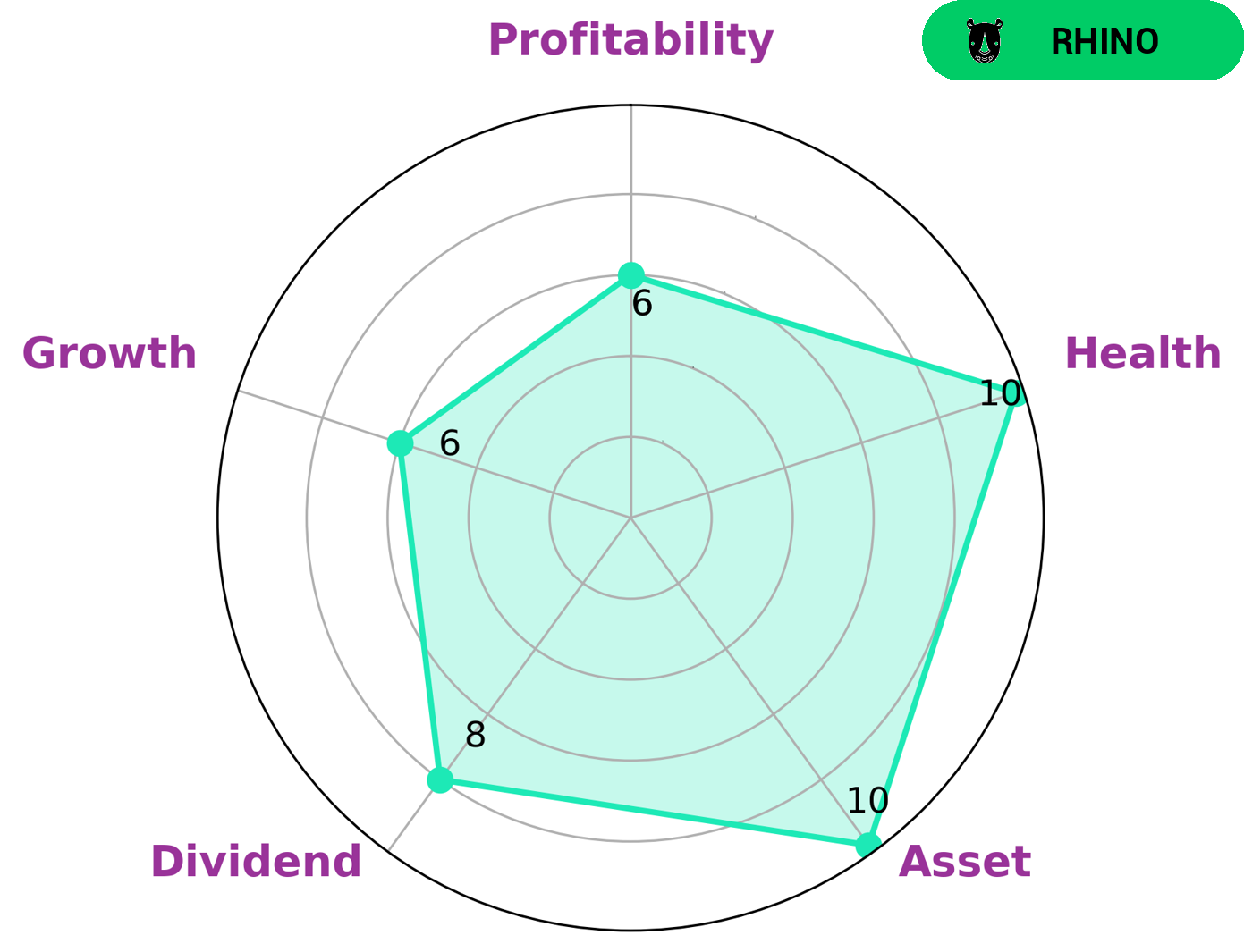

After analyzing the fundamentals of CK ASSET, GoodWhale has classified the company as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. CK ASSET has a high health score of 10/10 with regard to its cashflows and debt, which indicates that it is capable to sustain future operations in times of crisis. Additionally, the company is strong in asset, dividend, and medium in growth, profitability. Given the moderate growth and strong health scores, investors who are looking for a stable investment with potential for growth could find CK ASSET attractive. Investors who are looking for more aggressive growth may also find the company’s dividends appealing. Therefore, CK ASSET could be an attractive choice for a range of different investors. More…

Peers

It is a publicly traded company and has seen considerable success as one of the top players in the region. While CK Asset Holdings Ltd commands a strong presence in the industry, it faces competition from other notable developers such as Hongkong Land Holdings Ltd, Sun Hung Kai Properties Ltd, and Henderson Land Development Co Ltd.

– Hongkong Land Holdings Ltd ($SGX:H78)

Hongkong Land Holdings Ltd is a leading property investment, management, and development company based in Hong Kong. Founded in 1889, the company is focused on owning and managing prime commercial real estate in key Asian cities and providing premier office space and other related services. As of 2022, Hongkong Land Holdings Ltd has a market capitalization of 9.91 billion, making it one of the largest companies in the region. The company also has a return on equity of 2.19%, indicating that it is generating a good return for its investors. The company is well-positioned to benefit from future economic growth in the region.

– Sun Hung Kai Properties Ltd ($SEHK:00016)

Sun Hung Kai Properties Ltd. is a leading real estate developer in Hong Kong, with a diversified portfolio of residential, office, retail and industrial properties in Hong Kong, mainland China, and other countries. As of 2022, the company has a market capitalization of 284.73 billion USD, making it one of the largest public companies in Hong Kong. Sun Hung Kai Properties Ltd. also has a strong balance sheet with a return on equity of 3.52%. This is an indicator of the company’s ability to generate profits relative to its shareholders’ equity and demonstrates its financial strength.

– Henderson Land Development Co Ltd ($SEHK:00012)

Henderson Land Development Co Ltd is a leading property developer in Hong Kong. With a market capitalisation of 125.87 billion dollars as of 2022, the company is one of the largest listed companies on the Hong Kong Stock Exchange. Its Return on Equity (ROE) of 2.69% indicates that it is highly profitable and has been consistently delivering positive results over the years. The company is involved in property development, investment, hotel and property management, and also retail and infrastructure projects.

Summary

CK Asset Holdings Limited has seen a sharp rise in its short interest this past month, with a total of 87.4% of its shares now held in short positions. This is a warning sign for investors, as high short interest can often be an indicator of a company’s declining stock price. Analysts have noted that the company’s share price has been weakening in recent weeks, and this could be a sign of further declines in the near future.

It is recommended that investors closely monitor the situation in CK Asset and be prepared to sell any holdings they may have if the share price weakens further. It is also important to note that short interest can be used to speculate on a company’s future performance, and that this should not be taken as an indication of a company’s long-term prospects.

Recent Posts