Yousif Capital Management LLC Exits Trinity Industries, Stake After Holding for 8 Years (2023)

March 29, 2023

Trending News 🌥️

The 14510 shares were sold off at the end of 2023, finally exiting the company. The decision to sell off their shares was made in order to pursue other opportunities. While Yousif Capital Management LLC may no longer hold an interest in Trinity Industries ($NYSE:TRN), Inc., the company will continue to thrive and grow in the future. With their expertise in public infrastructure and heavy machinery, Trinity Industries, Inc. remains a reliable partner for many different industries.

Stock Price

Monday saw the stock open at $23.6, and close at $23.6, up 1.4% from the prior closing price of 23.2. This news comes at a largely positive time, with widespread news coverage having a more optimistic outlook on the company’s prospects. This could be seen as a sign of confidence in the company’s future successes, and is a major step in the right direction for them. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trinity Industries. More…

| Total Revenues | Net Income | Net Margin |

| 1.98k | 60.1 | -1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trinity Industries. More…

| Operations | Investing | Financing |

| -12.8 | -260.7 | 265.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trinity Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.72k | 7.45k | 12.48 |

Key Ratios Snapshot

Some of the financial key ratios for Trinity Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -13.0% | -21.5% | 16.9% |

| FCF Margin | ROE | ROA |

| -49.5% | 20.7% | 2.4% |

Analysis

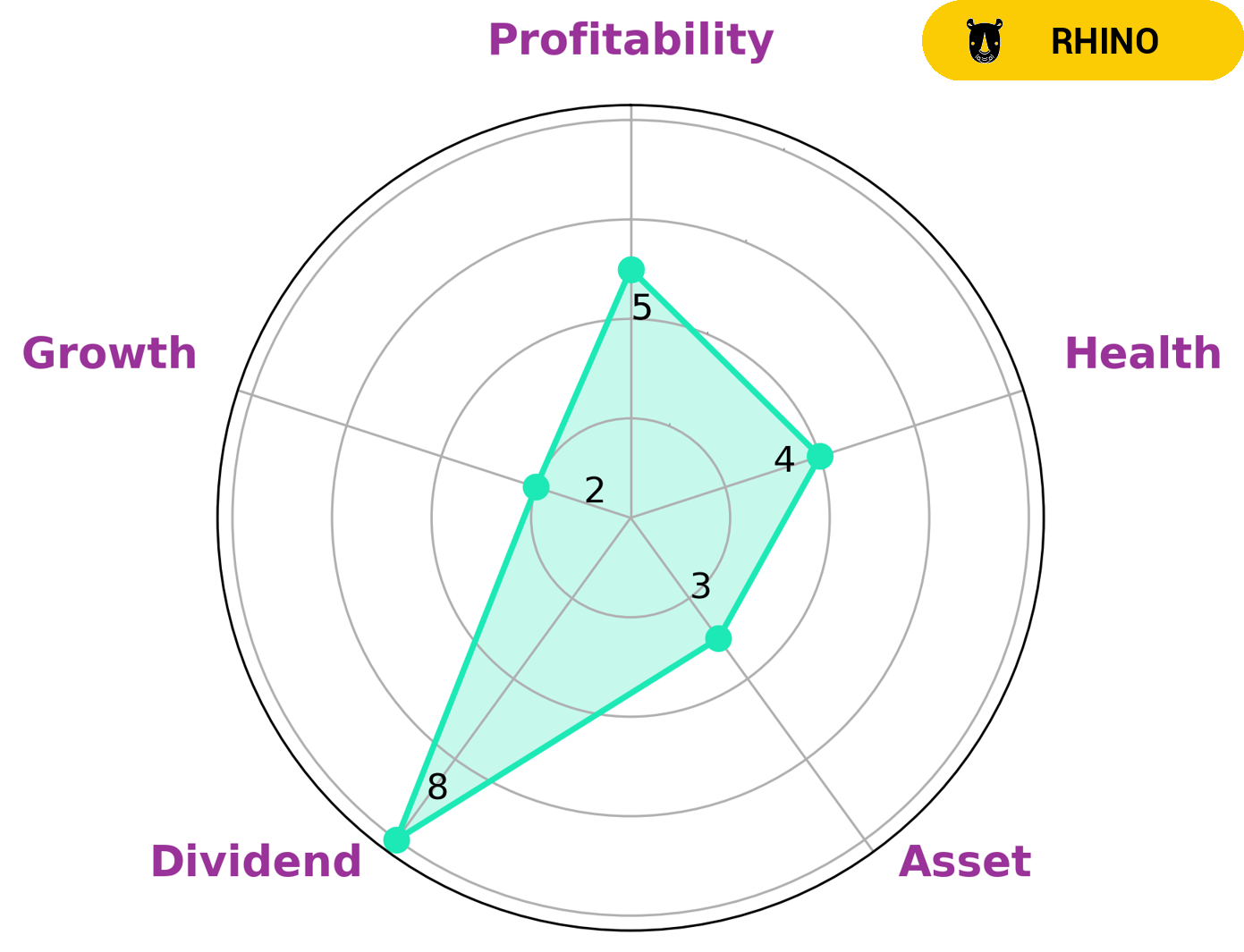

At GoodWhale, we have conducted an analysis on the fundamentals of TRINITY INDUSTRIES. Our Star Chart evaluation gave TRINITY INDUSTRIES an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that this company is likely to pay off debt and fund future operations. Additionally, TRINITY INDUSTRIES scored well in dividends, moderately in profitability and weakly in asset and growth. Given this, we’ve classified TRINITY INDUSTRIES as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. Investors looking for a stable company with moderate growth might be interested in TRINITY INDUSTRIES. This type of investor is likely to be drawn to the company’s strong dividends and satisfactory cashflow and debt management. With its steady growth, TRINITY INDUSTRIES could be a tempting option for investors looking for a reliable long-term investment. More…

Peers

Trinity Industries Inc, a leading provider of transportation products and services, competes with FreightCar America Inc, Seaco Ltd, and GATX Corp. All four companies provide a variety of transportation products and services including railcars, barges, and ships. Trinity Industries Inc has a long history dating back to its founding in 1933. The company has a strong reputation for quality products and services.

– FreightCar America Inc ($NASDAQ:RAIL)

FreightCar America Inc. is a publicly traded company with a market capitalization of $73.48 million as of 2022. The company is involved in the design and manufacture of railcars for the transportation of freight. The company has a negative return on equity of 42.6%.

– Seaco Ltd ($OTCPK:SEAOF)

GATX Corporation is an American railcar leasing company. The company was founded in 1898 and is headquartered in Chicago, Illinois. As of 2018, GATX had a fleet of over 100,000 railcars and owned or managed nearly 200,000 more. The company operates in three segments: Rail North America, Rail International, and Portfolio Management.

Summary

Trinity Industries, Inc. (TRIN) has been an attractive investment opportunity in recent years. Fundamental analysis suggests that its revenue and earnings growth have been steady, while its debt to equity ratio is low and it has strong cash flow. Analysts have also noted that its return on equity is strong, its dividend yield is attractive, and its price-to-earnings ratio is attractive. Overall, Trinity Industries, Inc. appears to be a good long-term investment opportunity for those looking to invest in a well-established company.

Recent Posts