L.B. Foster Sells Precision Measurement Business for $6.6M, Revises 2023 Sales Forecast

April 4, 2023

Trending News 🌥️

L.B. ($NASDAQ:FSTR) Foster is a publicly traded company that provides infrastructure solutions and materials for the railroad, energy, construction and transportation industries. The company recently sold its precision measurement business for $6.6 million, which has caused them to revise their 2023 sales forecast downwards. The acquisition of the precision measurement business was part of L.B. Foster’s strategy to shift its focus from traditional rail and energy markets to transportation and construction markets. The company believes this move will enable them to capitalize on the growth potential in these markets and provide greater value for customers. The sale of the precision measurement business is not expected to have a material impact on L.B. Foster’s financials in the long-term, as the amount of revenue generated from the business was relatively small.

However, the sale has allowed the company to free up resources and focus on other initiatives that will help drive future growth.

Share Price

On Monday, L.B. FOSTER announced that it has sold its precision measurement business to an unnamed buyer for a cash sale price of $6.6 million. This sale has resulted in a slight revision of the company’s 2023 sales forecast. The stock opened at $11.7 and closed at $11.8, up by 2.8% from its prior closing price of 11.5. This news has been welcomed by investors as it indicates L.B. FOSTER is serious about optimizing its business and generating profits.

The company is likely to use the proceeds from the sale to further strengthen its balance sheet and focus on its core operations. Furthermore, this move is expected to drive long-term growth for L.B. FOSTER. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for L.b. Foster. More…

| Total Revenues | Net Income | Net Margin |

| 497.5 | -45.56 | -8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for L.b. Foster. More…

| Operations | Investing | Financing |

| -10.58 | -56.42 | 60.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for L.b. Foster. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 365.31 | 227.71 | 12.73 |

Key Ratios Snapshot

Some of the financial key ratios for L.b. Foster are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.8% | -68.9% | -1.1% |

| FCF Margin | ROE | ROA |

| -3.7% | -2.3% | -1.0% |

Analysis

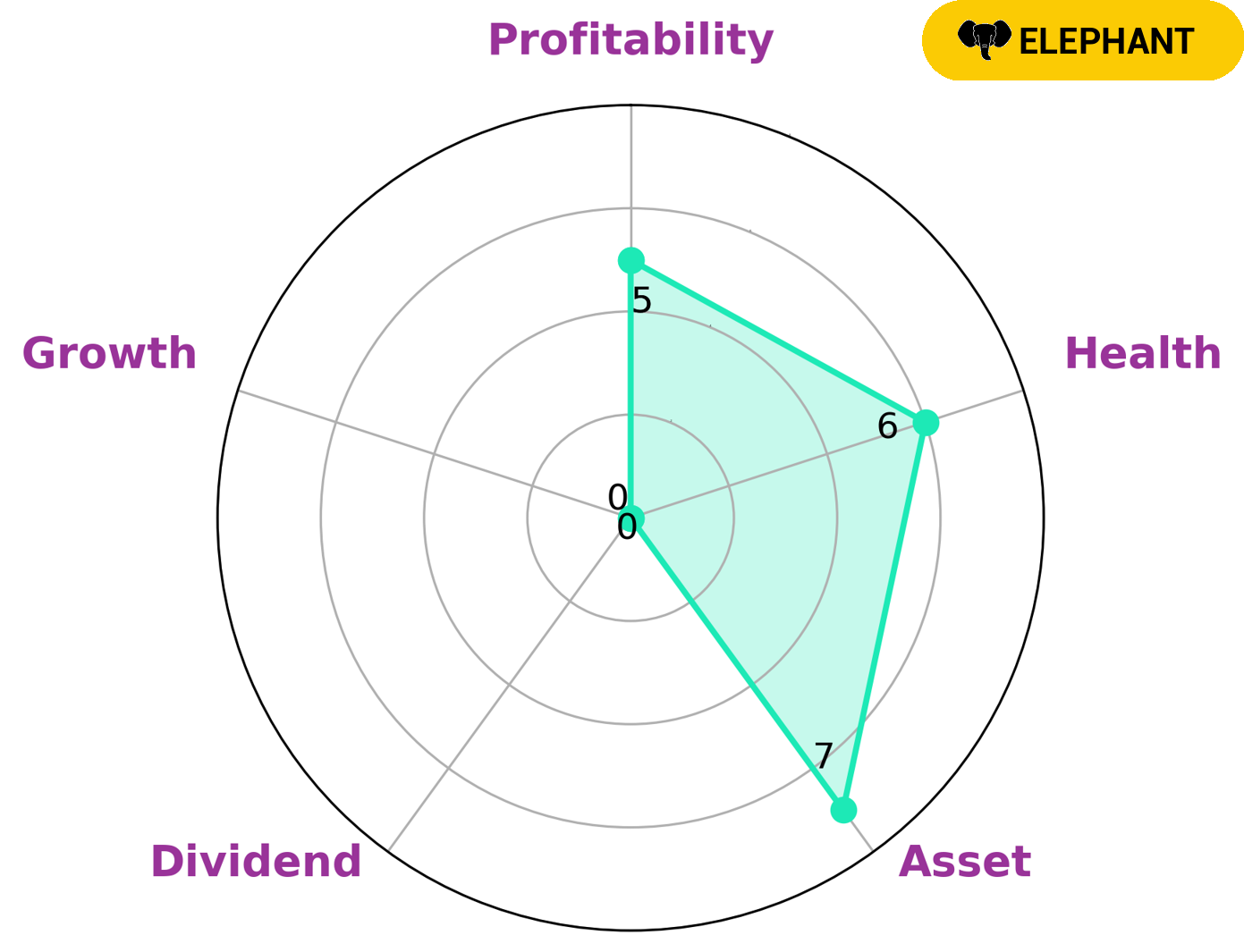

GoodWhale has performed an analysis of L.B. FOSTER‘s financials and determined that it is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Our star chart shows that L.B. FOSTER is strong in asset, medium in profitability, and weak in dividend and growth. Considering its cashflows and debt, we rate L.B. FOSTER’s intermediate health score to be 6/10, meaning that it might be able to pay off debt and fund future operations. Given the company’s characteristics, we believe that value investors and income investors may be interested in investing in L.B. FOSTER. Value investors may be attracted to the company’s ability to pay off its debt and the potential of future growth, while income investors may be interested in the company’s track record of asset strength and medium profitability. More…

Peers

The Company’s primary competitors are Beijing Tieke Shougang Railway-Tech Co Ltd, Komatsu Wall Industry Co Ltd, and Cos Targoviste SA.

– Beijing Tieke Shougang Railway-Tech Co Ltd ($SHSE:688569)

Beijing Tieke Shougang Railway-Tech Co Ltd is a railway transportation company that provides services including railway passenger and freight transportation, railway infrastructure construction, and railway equipment manufacturing. The company has a market cap of 4.04B as of 2022 and a return on equity of 8.73%. The company’s railway passenger and freight transportation services include the transportation of passengers and freight by rail. The company’s railway infrastructure construction services include the construction of railway tracks, tunnels, bridges, and other infrastructure. The company’s railway equipment manufacturing services include the manufacture of locomotives, rolling stock, and other railway equipment.

– Komatsu Wall Industry Co Ltd ($TSE:7949)

Komatsu Wall Industry Co Ltd is a Japanese company that manufactures and sells construction equipment, air conditioners, and other products. The company has a market cap of 17.04B as of 2022 and a Return on Equity of 3.05%. Komatsu Wall Industry Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Cos Targoviste SA ($LTS:0FJ5)

Targoviste SA is a Romanian company that produces and sells construction materials. The company has a market cap of 254.75M as of 2022 and a Return on Equity of -13.87%. The company’s products include cement, concrete, bricks, and tiles. Targoviste SA is a publicly traded company listed on the Bucharest Stock Exchange.

Summary

L.B. Foster has recently announced the disposal of its precision measurement business for $6.6M, as well as a lowered 2023 sales guidance. Investors will likely remain bearish on the stock because of the sale and lowered guidance, as the long-term fundamentals of the business are less attractive following the sale and shrinkage in sales guidance. In the medium term, it will be important for investors to monitor the company’s performance and potentially capitalize on any short-term volatility in the stock price.

Recent Posts