Greenbrier Companies Releases Earnings Forecast

January 7, 2023

Trending News 🌥️

Greenbrier Companies ($NYSE:GBX) is a leading supplier of transportation equipment and services to the railroad and related industries. Greenbrier also provides railcar repair and maintenance services, wheels and parts, leasing and other services to customers in North America, Europe, and South America. Recently, Greenbrier Companies released their earnings forecast for the upcoming quarter. This forecast includes a higher demand for the company’s goods and services over the next quarter, as well as a continued increase in efficiency and productivity. Greenbrier Companies has been able to maintain this growth due to their commitment to innovation and customer service. The company has been able to strengthen its relationships with key customers, while continuing to develop innovative new products and services.

Their commitment to quality and customer satisfaction has resulted in increasing demand for their products and services across all markets. The company’s management team is confident in its ability to continue to deliver strong earnings growth over the next quarter. They are confident that their financial performance will remain strong, and that the company will continue to produce innovative products and services that meet their customers’ needs. Greenbrier Companies’ earnings forecast for the next quarter is an indication of the company’s commitment to excellence and customer satisfaction. Investors should look forward to seeing continued growth over the coming months.

Market Price

On Friday, Greenbrier Companies released their earnings forecast which saw their stock plunge by 17.9% from its prior closing price of 34.9. The stock opened at $30.1 and closed at $28.7, a dramatic decrease in its worth. The quarterly earnings report was not what investors had hoped for, causing many to sell their shares in the company. Greenbrier Companies is now looking to find ways to reverse this trend and restore confidence in its stock. The company has a long history of success, but this recent forecast has caused some to question the future of the company. Many investors are wondering how the company will respond to the drop in its stock prices and what impact this will have on their investments. Greenbrier Companies is known for its commitment to excellence and its strong financial position, so it is unlikely that the company will be affected for too long.

However, the company must find ways to increase its stock prices and improve its outlook if it wants to remain a successful business. The company has already taken steps to do this, such as cutting costs and reducing debt, but it may need to take further measures in order to ensure its long-term success. In the short-term, it is important that investors remain patient and give the company time to recover from this setback. Overall, Greenbrier Companies have the potential to make a strong comeback if they are able to adjust their strategy and gain back investor confidence. The future of the company depends on their ability to do this. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Greenbrier Companies. More…

| Total Revenues | Net Income | Net Margin |

| 3.19k | 19.4 | 0.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Greenbrier Companies. More…

| Operations | Investing | Financing |

| -209.2 | -108.3 | 123.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Greenbrier Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.82k | 2.37k | 38.61 |

Key Ratios Snapshot

Some of the financial key ratios for Greenbrier Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.1% | -17.9% | 3.8% |

| FCF Margin | ROE | ROA |

| -14.4% | 6.0% | 2.0% |

VI Analysis

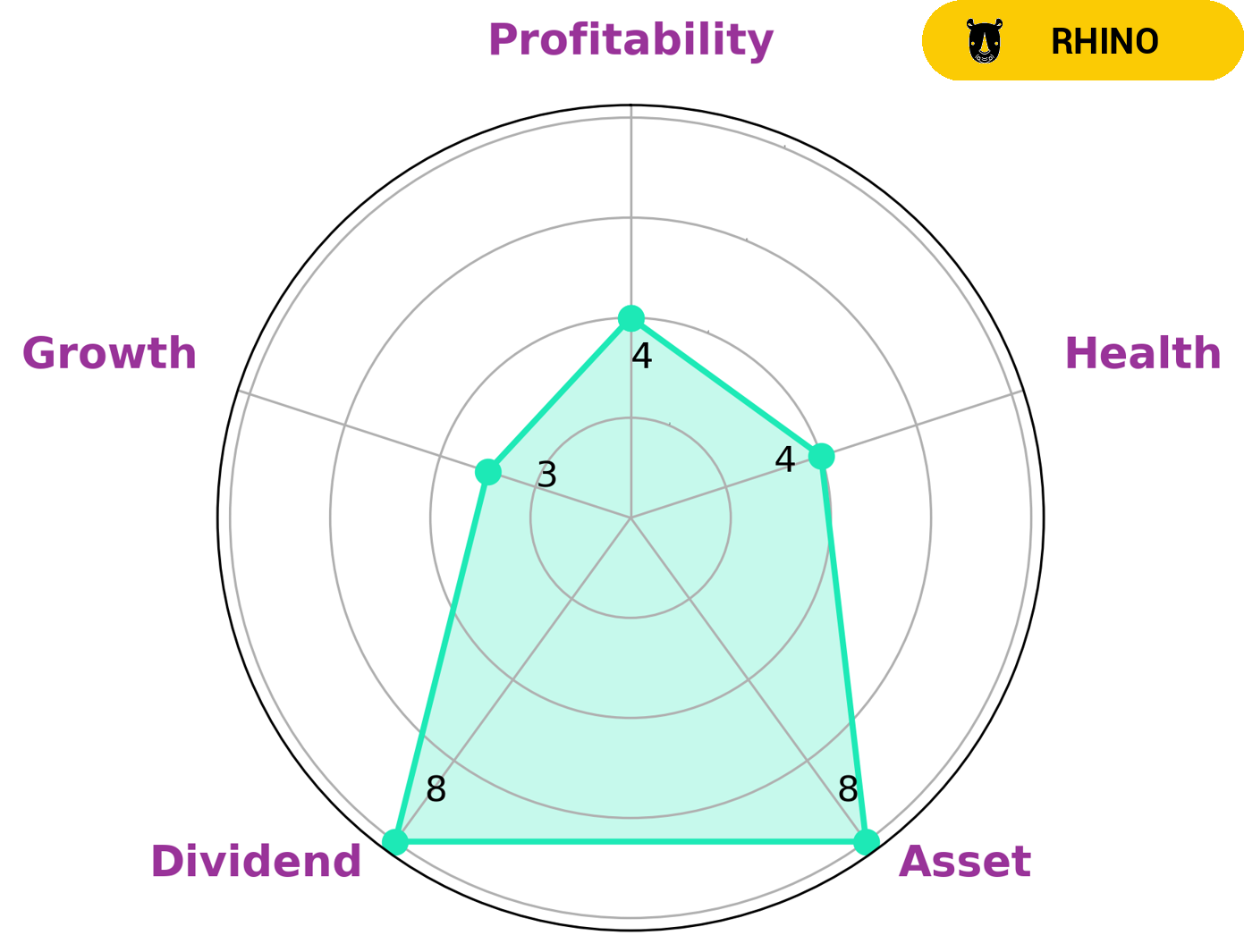

It is classified as a “rhino” which means that it has achieved moderate revenue or earnings growth. Investors that are looking for steady growth and stable returns would be interested in this company. It has an intermediate health score of 4/10 with regard to its cashflows and debt, suggesting that it is able to sustain future operations in times of crisis. Analyzing the company’s fundamentals can be a great way of understanding its long-term potential. Greenbrier has a strong balance sheet and pays out dividends, which are attractive to investors who are looking for steady growth and stability. Its medium growth and profitability suggest that it is not a high-growth company but can still offer returns over time. Its intermediate health score indicates that it is able to weather any financial storms. In conclusion, Greenbrier is a good company for investors who are looking for steady growth and stable returns. Its fundamentals suggest that it has the capacity to sustain future operations in times of crisis and its assets and dividends offer investors the potential for steady growth over time. More…

VI Peers

Greenbrier Companies Inc is an international market leader in the manufacturing and marketing of transportation equipment and services. It operates in the railcar and marine manufacturing industries and provides products and services to railroads, leasing companies, shippers, and other transportation companies. Its main competitors are FreightCar America Inc, National Express Group PLC, and Engenco Ltd. All of these companies are dedicated to providing quality transportation equipment and services to their customers.

– FreightCar America Inc ($NASDAQ:RAIL)

FreightCar America Inc. is a leading manufacturer of freight railcars and other equipment used in the rail industry. The company has a market cap of 55.89M as of 2022, which indicates that it is a small-capitalized business. FreightCar America Inc. also has a Return on Equity of 22.57%, which is considered to be a strong indicator of the company’s financial health and success. This indicates that the company is managing its resources effectively and efficiently, allowing it to generate significant returns on its investments. Overall, FreightCar America Inc. appears to be well-positioned to benefit from the growing demand for freight railcars and other equipment used in the rail industry.

– National Express Group PLC ($LSE:NEX)

National Express Group PLC is a global transportation company that provides bus, coach, rail, and air services in the United Kingdom, Spain, North America, and Germany. It is one of the largest public transport operators in the world, with a market cap of 780.5M as of 2022. The company has a Return on Equity (ROE) of 1.44%, which is below the average for the industry. This suggests that investors are not gaining as much return from their investments compared to other companies in the sector. National Express Group PLC has been able to maintain a strong financial position despite the challenging economic conditions it has faced in recent years. It remains committed to providing quality and reliable services to its customers and shareholders.

– Engenco Ltd ($ASX:EGN)

Engenco Ltd is an Australian industrial engineering, mining, and rail services provider. The company specializes in the design, manufacture, and maintenance of mining, transport, and other large-scale industrial equipment. Engenco Ltd has a strong market capitalization of $132.57M as of 2022, which demonstrates the company’s financial strength and stability. Furthermore, Engenco’s Return on Equity (ROE) of 2.95% is indicative of their ability to generate profits from their investments. This indicates that Engenco is a reliable and profitable company.

Summary

Greenbrier Companies is a leading provider of transportation services and equipment across the globe. Recently, the company released its earnings forecast for the quarter and the stock price moved down the same day. This suggests that investors may be cautious about the outlook of the company. It is important to analyze Greenbrier Companies’ financials and other metrics before investing. Investors should consider factors such as its revenue growth, total debt, and liquidity as well as its geographic and sector-specific performance.

Additionally, investors should pay attention to potential risks such as macroeconomic conditions, geopolitical issues, and other factors that could affect the company’s performance going forward.

Recent Posts