Great West Life Assurance Co. Invests in The Greenbrier Companies, with Purchase of 3,991 Shares.

February 3, 2023

Trending News ☀️

The company designs, manufactures, and markets freight car components and provides other related services to the railroad industry. It also provides parts and services for marine vessels, barges, tank cars, and other transportation related products. The company has a strong presence in the United States, Canada, Mexico, and Europe, providing quality solutions for railcar owners, operators, shippers, and other entities in the transportation industry. The company also offers a variety of leasing, repair, and maintenance services to customers.

Additionally, they offer turnkey solutions tailored to customer needs including custom designs, engineering solutions, and complete supply chain solutions. They also have a strong focus on innovation and developing new technologies to improve their customer’s operations. With the purchase of this stock, investors can be assured that they are investing in a well-established company with a history of providing quality solutions to meet customer needs. As the transportation industry continues to grow and evolve, investors can be sure that Greenbrier Companies ($NYSE:GBX) will continue its commitment to offering the best products and services available on the market.

Price History

So far, news sentiment about the purchase has been positive, with many investors taking it as an encouraging sign for the future of the company. On Thursday, GREENBRIER COMPANIES stock opened at $30.7 and closed at $31.8, up by 4.6% from its last closing price of 30.4. This marks a significant increase in the company’s stock price, and is likely due to the investment made by Great West Life Assurance Co. Their products range from freight cars and marine vessels to wheels, parts, and repair services.

The company has established itself as a leader in its field and is well-positioned to benefit from the continued growth in the rail industry. This move should be seen as another positive sign for the future of the company and their stock performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Greenbrier Companies. More…

| Total Revenues | Net Income | Net Margin |

| 3.19k | 19.4 | 0.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Greenbrier Companies. More…

| Operations | Investing | Financing |

| -209.2 | -108.3 | 123.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Greenbrier Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.82k | 2.37k | 38.61 |

Key Ratios Snapshot

Some of the financial key ratios for Greenbrier Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.1% | -17.9% | 3.8% |

| FCF Margin | ROE | ROA |

| -14.4% | 6.0% | 2.0% |

Analysis

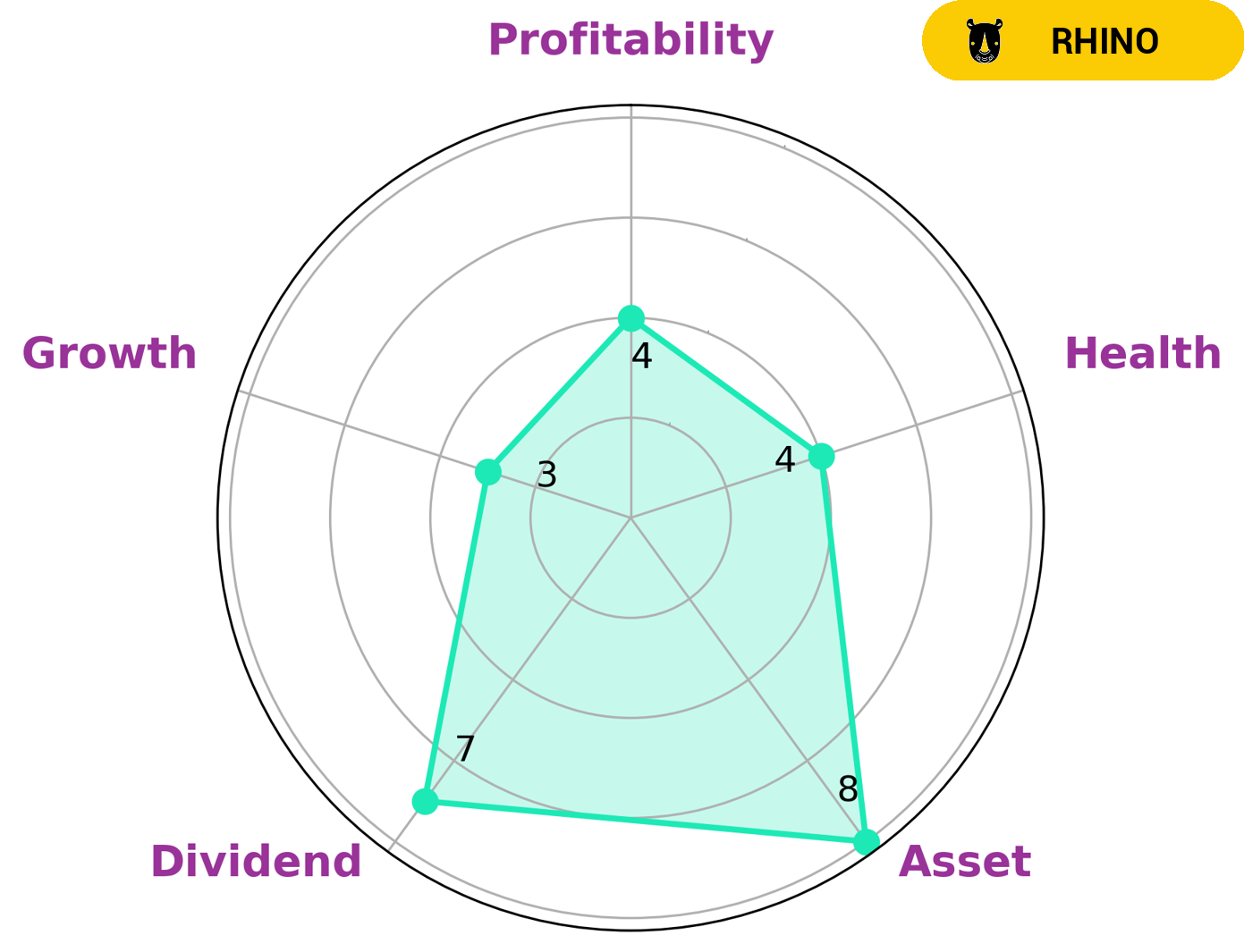

Greenbrier Companies is a transportation company that operates in North America and Europe. Analyzing its fundamentals, GoodWhale has concluded that Greenbrier Companies is strong in asset and dividend, and medium in profitability. However, it is weak in growth, with an intermediate health score of 4/10 with regard to its cashflows and debt. This indicates that the company might be able to sustain future operations in times of crisis. Greenbrier Companies is classified as a ‘Rhino’, which is a type of company that has achieved moderate revenue or earnings growth. Such companies may be of interest to value investors, who look for companies with low prices relative to their fundamentals. Income investors may also be interested in Greenbrier Companies, as its dividend yield is higher than the industry average. In addition, those who believe in the long-term potential of the company may be interested in Greenbrier Companies, as it has a strong asset base which could potentially be leveraged for future growth. Furthermore, given its intermediate health score and ability to sustain operations during times of crisis, the company may be seen as a safe bet for long-term investors. Overall, although Greenbrier Companies is not a high-growth company, it may still be attractive to certain types of investors. Value investors, income investors and long-term investors may be interested in its strong asset base, higher-than-average dividend yield and its intermediate health score. More…

Peers

Greenbrier Companies Inc is an international market leader in the manufacturing and marketing of transportation equipment and services. It operates in the railcar and marine manufacturing industries and provides products and services to railroads, leasing companies, shippers, and other transportation companies. Its main competitors are FreightCar America Inc, National Express Group PLC, and Engenco Ltd. All of these companies are dedicated to providing quality transportation equipment and services to their customers.

– FreightCar America Inc ($NASDAQ:RAIL)

FreightCar America Inc. is a leading manufacturer of freight railcars and other equipment used in the rail industry. The company has a market cap of 55.89M as of 2022, which indicates that it is a small-capitalized business. FreightCar America Inc. also has a Return on Equity of 22.57%, which is considered to be a strong indicator of the company’s financial health and success. This indicates that the company is managing its resources effectively and efficiently, allowing it to generate significant returns on its investments. Overall, FreightCar America Inc. appears to be well-positioned to benefit from the growing demand for freight railcars and other equipment used in the rail industry.

– National Express Group PLC ($LSE:NEX)

National Express Group PLC is a global transportation company that provides bus, coach, rail, and air services in the United Kingdom, Spain, North America, and Germany. It is one of the largest public transport operators in the world, with a market cap of 780.5M as of 2022. The company has a Return on Equity (ROE) of 1.44%, which is below the average for the industry. This suggests that investors are not gaining as much return from their investments compared to other companies in the sector. National Express Group PLC has been able to maintain a strong financial position despite the challenging economic conditions it has faced in recent years. It remains committed to providing quality and reliable services to its customers and shareholders.

– Engenco Ltd ($ASX:EGN)

Engenco Ltd is an Australian industrial engineering, mining, and rail services provider. The company specializes in the design, manufacture, and maintenance of mining, transport, and other large-scale industrial equipment. Engenco Ltd has a strong market capitalization of $132.57M as of 2022, which demonstrates the company’s financial strength and stability. Furthermore, Engenco’s Return on Equity (ROE) of 2.95% is indicative of their ability to generate profits from their investments. This indicates that Engenco is a reliable and profitable company.

Summary

The news sentiment was generally positive, and the stock price for Greenbrier was up the same day. This is a promising sign for investors interested in Greenbrier, as it could indicate a positive outlook for the company’s future. Further analysis of Greenbrier’s financial performance, competitive landscape, and other factors will be needed to make more accurate assumptions about their stock performance. However, this initial investment from Great West Life Assurance Co. is an encouraging sign that Greenbrier may be a lucrative option for investors.

Recent Posts