2023: Healthcare of Ontario Pension Plan Trust Fund Invests $421000 in Teradyne,

March 7, 2023

Trending News ☀️

The Healthcare of Ontario Pension Plan Trust Fund has recently invested $421000 in Teradyne ($NASDAQ:TER), Inc., a leading provider of advanced industrial automation and electronic test solutions. This investment represents an exciting opportunity for Teradyne, Inc. as they continue to expand their operations and pursue new innovations in the industrial automation space. Teradyne, Inc. is a leader in providing solutions and services to the semiconductor testing industry as well as in the wireless consumer and commercial markets. Their products are utilized in the production processes of many companies in this industry, including those that produce medical equipment and consumer electronics.

This large injection of capital from the Healthcare of Ontario Pension Plan Trust Fund will enable Teradyne, Inc. to continue to focus on their research and development efforts, ultimately improving their products and furthering their presence in this highly competitive market. With this strategic investment, Teradyne Inc. can look forward to an exciting future with an established partner that brings a wealth of resources and experience in the healthcare sector. It is with optimism that the Healthcare of Ontario Pension Plan Trust Fund and Teradyne, Inc. have joined forces, aiming to position Teradyne, Inc. for long-term success and achieve impressive returns for the 2023 fiscal year.

Market Price

This price surge highlighted market sentiment that the investment from the HOOPP Trust Fund was a sound economic decision that would likely pay dividends for Teradyne shareholders in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teradyne. More…

| Total Revenues | Net Income | Net Margin |

| 3.16k | 715.5 | 23.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teradyne. More…

| Operations | Investing | Financing |

| 577.92 | 43.75 | -892.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teradyne. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.5k | 1.05k | 14.47 |

Key Ratios Snapshot

Some of the financial key ratios for Teradyne are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.2% | 16.3% | 26.9% |

| FCF Margin | ROE | ROA |

| 13.1% | 23.5% | 15.2% |

Analysis

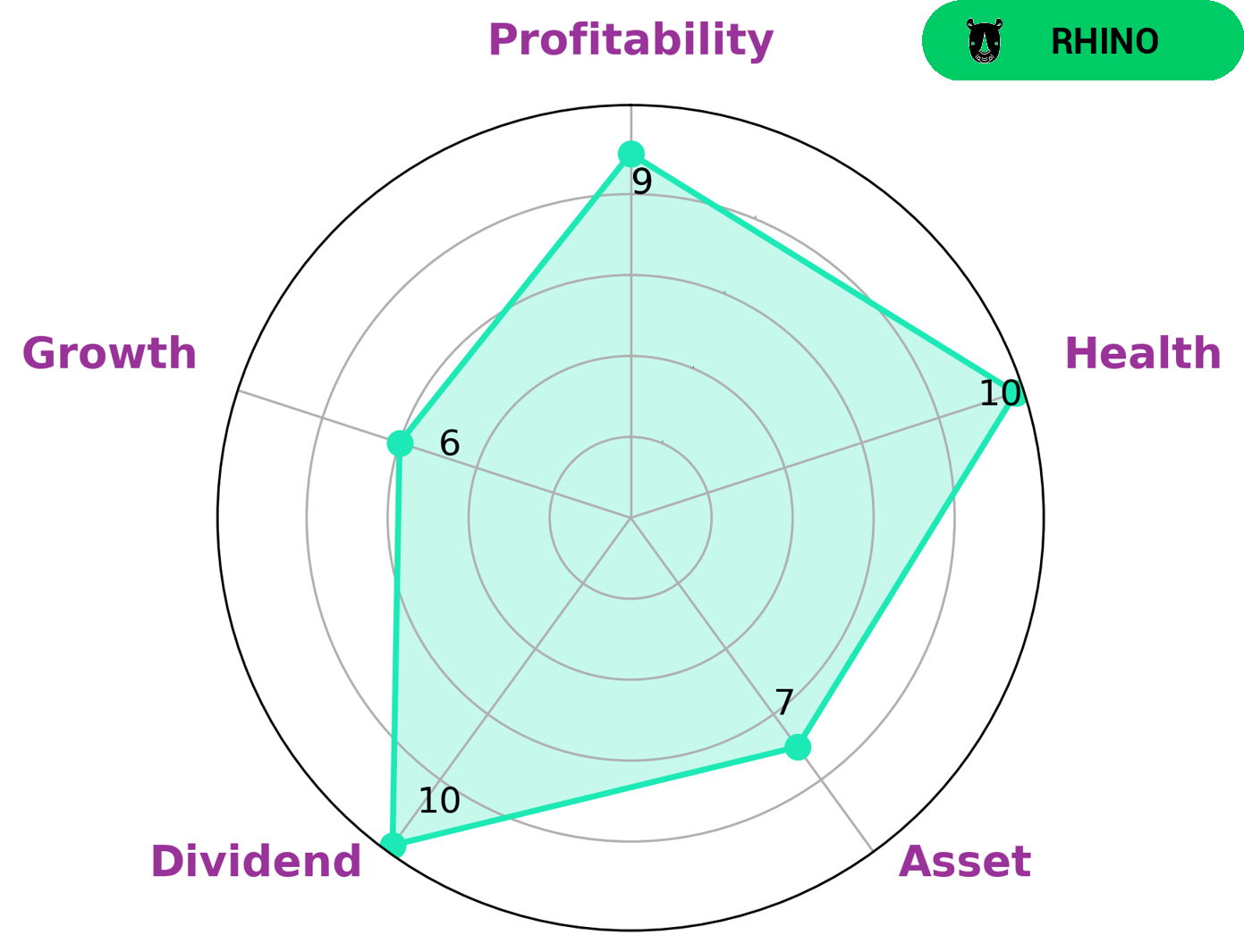

At GoodWhale, we have performed a financial analysis of TERADYNE. The Star Chart shows that TERADYNE has an impressive health score of 10/10, which means that it is highly capable of sustaining future operations even in times of crisis due to its sound cashflows and debt management. Additionally, TERADYNE scores high in terms of asset, dividend and profitability; and it is classified as ‘rhino’, which indicates that the company has achieved moderate growth in terms of revenue or earnings. Given these metrics, we believe that TERADYNE will be an attractive investment opportunity for many types of investors, such as dividend investors who are looking for consistent income, or value investors who are looking for long-term value potential. Moreover, long-term investors who seek moderate growth and stability may also be interested in TERADYNE. More…

Peers

The competition between Teradyne Inc and its competitors is fierce. Lam Research Corp, Taiwan Semiconductor Manufacturing Co Ltd, and Apple Inc are all major players in the market. Teradyne Inc has been able to stay ahead of the competition by innovating and developing new products.

– Lam Research Corp ($NASDAQ:LRCX)

Lam Research Corporation is an American company that manufactures semiconductor processing equipment used in the fabrication of integrated circuits. The company was founded in 1980 and is headquartered in Fremont, California. Lam Research has a market capitalization of $51.81 billion as of March 2021 and a return on equity of 54.63%. The company’s products are used in a variety of applications, including memory chips, microprocessors, and graphics processors.

– Taiwan Semiconductor Manufacturing Co Ltd ($TWSE:2330)

With a market cap of 9.75T as of 2022, Taiwan Semiconductor Manufacturing Co Ltd is one of the largest companies in the world. The company’s return on equity is 22.34%, meaning that it generates a significant amount of profit for shareholders. Taiwan Semiconductor Manufacturing Co Ltd is a leading provider of semiconductor manufacturing services and one of the largest manufacturers of semiconductors in the world. The company’s products are used in a wide range of electronic devices, including computers, mobile phones, and consumer electronics.

– Apple Inc ($NASDAQ:AAPL)

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. The company’s products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of consumer and professional software applications, iCloud, and iTunes. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple was incorporated as Apple Computer, Inc., in 1977. The word “Computer” was removed from the company’s name in 2007, as its traditional focus on personal computers shifted towards consumer electronics.

Summary

This is a strong vote of confidence from a reliable source and indicates that the company is likely to experience solid growth in the future.

Additionally, the current media sentiment around Teradyne, Inc. is mostly positive, indicating that the trust fund’s decision to invest is well justified. As a result of this investment, potential and current shareholders should consider investing in Teradyne, Inc. as it is likely to increase in value in the near future. Furthermore, investment analysts suggest that Teradyne, Inc. could be a good long-term option for investors looking to diversify their portfolios while still reaping the potential benefits of a potential market growth. All in all, this recent investment is a great sign for Teradyne, Inc. and looks to be a good opportunity to invest in the company for both short-term and long-term gains.

Recent Posts