2023 Critical Comparison: Universal Health Realty Income Trust vs. AG Mortgage Investment Trust

March 21, 2023

Trending News ☀️

2023 is shaping up to be a critical year of comparison between two of the biggest players in the real estate investment trust (REIT) industry: Universal Health Realty ($NYSE:UHT) Income Trust and AG Mortgage Investment Trust. Both organizations are global leaders in the field, and each has its own unique strategy for managing its investments. Universal Health Realty Income Trust is a healthcare-focused REIT that invests in medical office buildings, long-term care facilities, senior housing, and associated healthcare services. UHRIT’s goal is to maximize returns by investing in high quality healthcare assets that can generate above-average income and capital appreciation. The trust emphasizes a value-driven approach to its investments, focusing on properties that have strong occupancy rates and long-term leases. It also places an emphasis on diversifying its portfolio across different sectors, geographies, and asset classes. On the other hand, AG Mortgage Investment Trust focuses on investing in residential and commercial mortgage-backed securities (MBS), as well as other structured assets.

The trust’s strategy is to target high-yielding assets with predictable cash flows, while at the same time limiting exposure to prepayment risk. AGMIT also has the flexibility to actively manage its portfolio to maximize returns in changing market conditions. When it comes to their strengths and weaknesses, Universal Health Realty Income Trust has an edge when it comes to long-term growth potential. With its focus on healthcare assets and its diversified portfolio, UHRIT can benefit from an increase in demand for healthcare services over the next few years as the global population ages. On the other hand, AG Mortgage Investment Trust may struggle in a rising interest rate environment since its investments are tied to fixed interest rates. Investors must carefully consider the individual strategies of each trust before making a decision about which one is best suited for their goals.

Price History

On Monday, the stock opened at $48.6 and closed at $49.3, up by 1.7% from the prior closing price of $48.4. This performance makes the company a strong contender for the 2023 critical comparison against AG Mortgage Investment Trust. Many investment analysts suggest both companies have strong potential for returns in the upcoming years. Universal Health Realty Income Trust is well positioned to outperform its companions in the real estate sector and make a positive impact for its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for UHT. More…

| Total Revenues | Net Income | Net Margin |

| 90.62 | 21.1 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for UHT. More…

| Operations | Investing | Financing |

| 46.8 | -36.67 | -25.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for UHT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 607.54 | 378.44 | 17.07 |

Key Ratios Snapshot

Some of the financial key ratios for UHT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 33.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

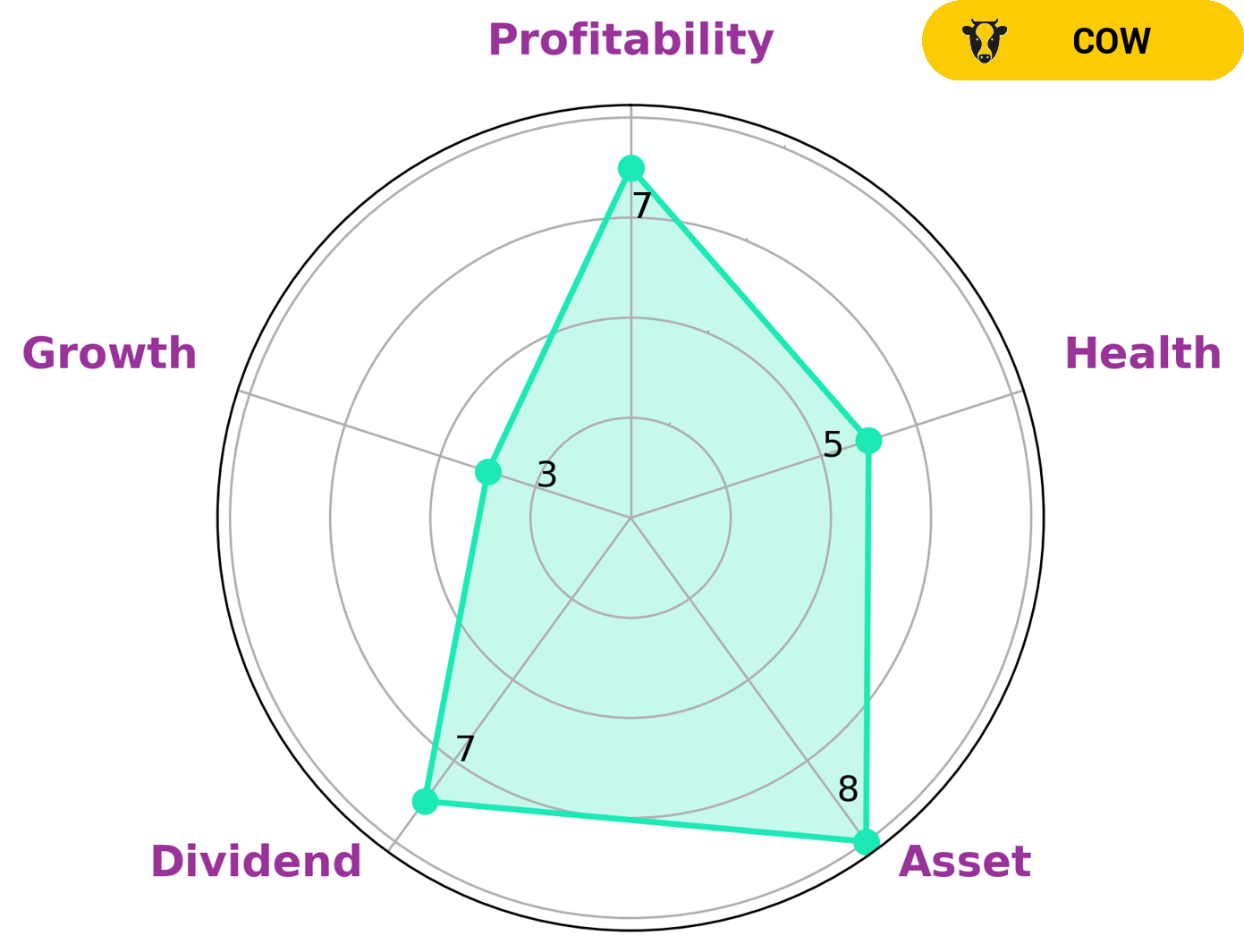

At GoodWhale, we conducted an analysis of the fundamentals of UNIVERSAL HEALTH REALTY. Our Star Chart shows that UNIVERSAL HEALTH REALTY has an intermediate health score of 5/10 with regard to its cashflows and debt, indicating that it might be able to sustain future operations in times of crisis. Moreover, our analysis suggests that UNIVERSAL HEALTH REALTY is strong in asset, dividend, and profitability. However, it is weak in growth. Based on these findings, we classify UNIVERSAL HEALTH REALTY as a ‘cow,’ a type of company that has the track record of paying out consistent and sustainable dividends. Investors looking for steady and reliable income may be interested in UNIVERSAL HEALTH REALTY as an investment option. More…

Peers

The company’s portfolio consists of hospitals, medical office buildings, senior housing, and other healthcare-related properties. Physicians Realty Trust is a similar company that also invests in healthcare real estate. Healthcare Trust of America, Inc. is another healthcare real estate investment trust with a portfolio of hospitals, medical office buildings, senior housing, and other healthcare-related properties. Global Medical REIT Inc. is a healthcare real estate investment trust that focuses on owning and leasing net-leased healthcare facilities.

– Physicians Realty Trust ($NYSE:DOC)

As of 2022, Physicians Realty Trust has a market cap of 3.31B. The company is a healthcare real estate investment trust that primarily acquires, owns, manages and develops healthcare properties that are leased to physicians, hospitals and healthcare delivery systems.

– Healthcare Trust of America Inc ($NYSE:GMRE)

Global Medical REIT is a publicly traded real estate investment trust focused on owning and operating properties leased to clinical healthcare providers. As of December 31, 2020, the Company’s portfolio consisted of 126 net-leased medical facilities across the United States. The Company’s portfolio includes medical office buildings, outpatient surgery centers, freestanding emergency departments, specialty hospitals, acute care hospitals, and other healthcare facilities.

Summary

Universal Health Realty Income Trust (UHT) is a real estate investment trust (REIT) focused on healthcare real estate investments. UHT invests primarily in healthcare related facilities, such as hospitals, nursing homes, medical office buildings, and other health-related facilities. Analysts rate UHT as a “Buy” or “Strong Buy” stock, due to its healthy dividend yield, stable earnings, and solid balance sheet. UHT’s portfolio is diversified and geographically dispersed across the United States, providing it with strong protection against regional economic downturns. UHT has also been able to maintain good occupancy rates and collect rent consistently, while also staying ahead of the curve with its investments in technology and digital health solutions. This is expected to help UHT remain competitive and drive growth and profitability.

In addition, analysts believe that the aging population and an increasing demand for healthcare services bode well for UHT’s future growth prospects.

Recent Posts