H&R Block: Proven History of Weathering Economic Downturns Makes It a Smart Investment

April 6, 2023

Trending News 🌧️

H&R ($NYSE:HRB) Block is a trusted provider of financial services and products that has proven its ability to weather economic downturns. The company’s long-term success is due in part to its ability to adapt to changing economic conditions. The company was able to offer assistance during this time and diversify its offerings, meaning that it not only provided tax preparation services, but also began offering financial products to customers, such as prepaid cards and loan products. H&R Block is also a reliable stock option due to its stable performance through multiple recessions and other market fluctuations. This makes it a great choice for investors who are looking for a steady investment with the potential to grow over the long term.

Overall, H&R Block is a great choice for anyone looking to invest in a proven company with a solid track record of success. Whether you’re looking for tax help or investing in the stock market, H&R Block is an excellent option that will continue to thrive over time.

Market Price

H&R Block has proven its resilience through economic downturns over the years, making it a smart investment option. On Wednesday, H&R Block stock opened at $33.8 and closed at $34.5, up by 0.6% from its previous closing price of 34.3. This indicates that investors are confident that H&R Block will weather any economic downturns and remain a solid choice for their portfolio.

The company has long been successful at providing taxpayers with tax solutions and services, even during tough times, which bodes well for its future performance. The strong financial performance of H&R Block makes it an ideal choice for investors looking for a secure and reliable investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for H&r Block. More…

| Total Revenues | Net Income | Net Margin |

| 3.46k | 503.88 | 14.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for H&r Block. More…

| Operations | Investing | Financing |

| 941.65 | -118.19 | -978.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for H&r Block. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.59k | 3.24k | -1.7 |

Key Ratios Snapshot

Some of the financial key ratios for H&r Block are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.6% | 7.0% | 20.6% |

| FCF Margin | ROE | ROA |

| 25.4% | -98.1% | 17.2% |

Analysis

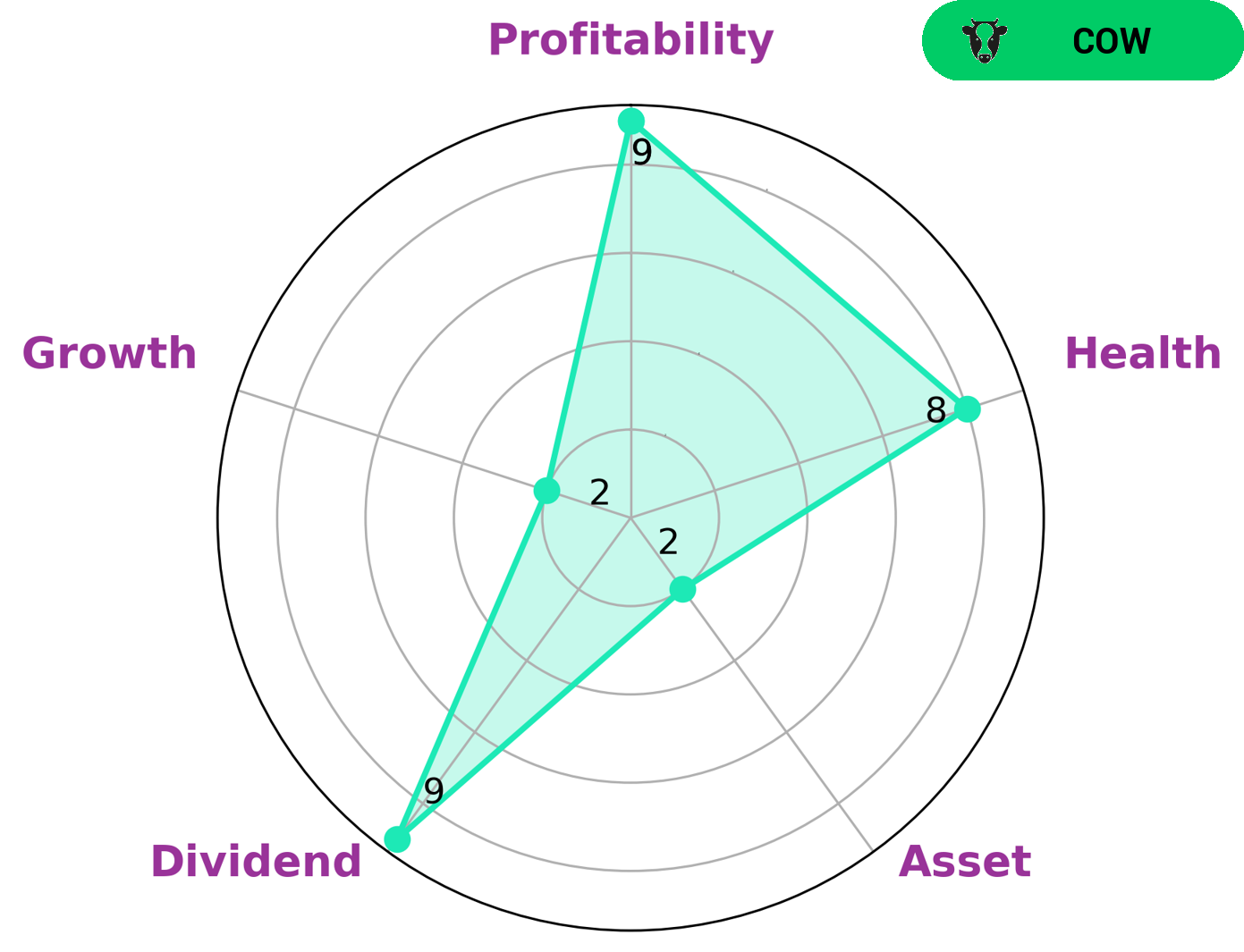

At GoodWhale, we conducted an analysis of the wellbeing of H&R Block. Our Star Chart shows that H&R Block is strong in dividend and profitability, but weak in asset and growth. Additionally, our health score for H&R Block was 8 out of 10, indicating that the company is capable to sustain future operations in times of crisis as per our assessment of its cashflows and debt. We classify H&R Block as a ‘Cow’, a type of company we conclude has the track record of paying out consistent and sustainable dividends. Investors who are looking for a steady source of dividend income would likely be interested in this type of company. More…

Peers

The company offers a variety of services, including online and in-person tax preparation, bookkeeping, and financial planning. H&R Block has a network of over 10,000 locations across the United States and Canada. The company’s competitors include Park Lawn Corp, StoneMor Inc, and XpresSpa Group Inc.

– Park Lawn Corp ($TSX:PLC)

Park Lawn Corporation is a provider of death care products and services in Canada and the United States. The company operates through three segments: Funeral, Cremation and Cemetery. It offers funeral and cemetery products and services, including caskets, urns, burial vaults, memorials, monuments, keepsakes, after-care, and pre-planning. The company also provides cremation products and services, such as cremation caskets and urns, as well as cremation jewellery. Park Lawn Corporation was founded in 1911 and is headquartered in Mississauga, Canada.

– StoneMor Inc ($NYSE:STON)

StoneMor Inc is a publicly traded death care company in the United States. It is headquartered in Trevose, Pennsylvania. The company was founded in 1996. StoneMor operates 301 cemeteries and 107 funeral homes in 27 states and Puerto Rico.

– XpresSpa Group Inc ($NASDAQ:XSPA)

As of 2022, XpresSpa Group Inc has a market cap of 65.62M. The company has a Return on Equity of -0.19%. XpresSpa Group Inc is a company that provides express spa services. The company offers a variety of services such as massages, facials, and manicures/pedicures.

Summary

H&R Block is a financially resilient public company with good long-term returns, making it a good buy for investors. Its financial stability is due to its diversified revenue sources, which include tax preparation services, financial advisory services, and other financial products and services. The company has a strong base of loyal customers and has been able to maintain its financial performance despite the recent economic downturn. Its long-term success is built on its strong brand recognition and record of innovation in the tax and financial services industry.

H&R Block continues to expand its offerings and has grown both organically and through strategic acquisitions. Its stock price has been volatile over the past year, but has shown signs of a potential rebound. Investors interested in long-term returns should consider H&R Block as an attractive investment option.

Recent Posts