Multiple Insiders Show Confidence in TriMas Corporation as Stock Acquisitions Increase

May 19, 2023

Trending News ☀️

TRIMAS ($NASDAQ:TRS): TriMas Corporation is a diversified manufacturer of engineered and applied products, with operations in the United States, Europe, Asia, and Mexico. They serve a variety of industries including automotive, aerospace, industrial, and consumer products. Recently, their stock has been on the rise with multiple insiders investing in the company. When multiple insiders of TriMas Corporation purchase stock, it can be seen as a very positive sign for the company. This is because when a significant amount of insiders are investing in the company, it demonstrates their faith in its future success.

Insiders can make an informed decision on where to put their money, as they have access to insider information regarding the company’s performance and direction. This acquisition of stock by insiders can be seen as a sign of growth and stability for the TriMas Corporation. These stock acquisitions by TriMas insiders have investors speculating about the company’s potential growth. Their faith in the future success of the company shows that they believe in its potential for growth.

Stock Price

On Tuesday, TRIMAS CORPORATION experienced a 1.1% decrease in stock prices, as the stock opened at $25.4 and closed at $25.3. Despite the marginal decrease in stock prices, multiple insiders have shown confidence in the company and have increased their stock acquisitions. These acquisitions further suggest that the company’s performance is expected to remain strong in upcoming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trimas Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 874.98 | 56.91 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trimas Corporation. More…

| Operations | Investing | Financing |

| 76.59 | -31.79 | -51.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trimas Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.32k | 670.61 | 15.67 |

Key Ratios Snapshot

Some of the financial key ratios for Trimas Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.1% | -10.7% | 10.3% |

| FCF Margin | ROE | ROA |

| 3.2% | 8.7% | 4.3% |

Analysis

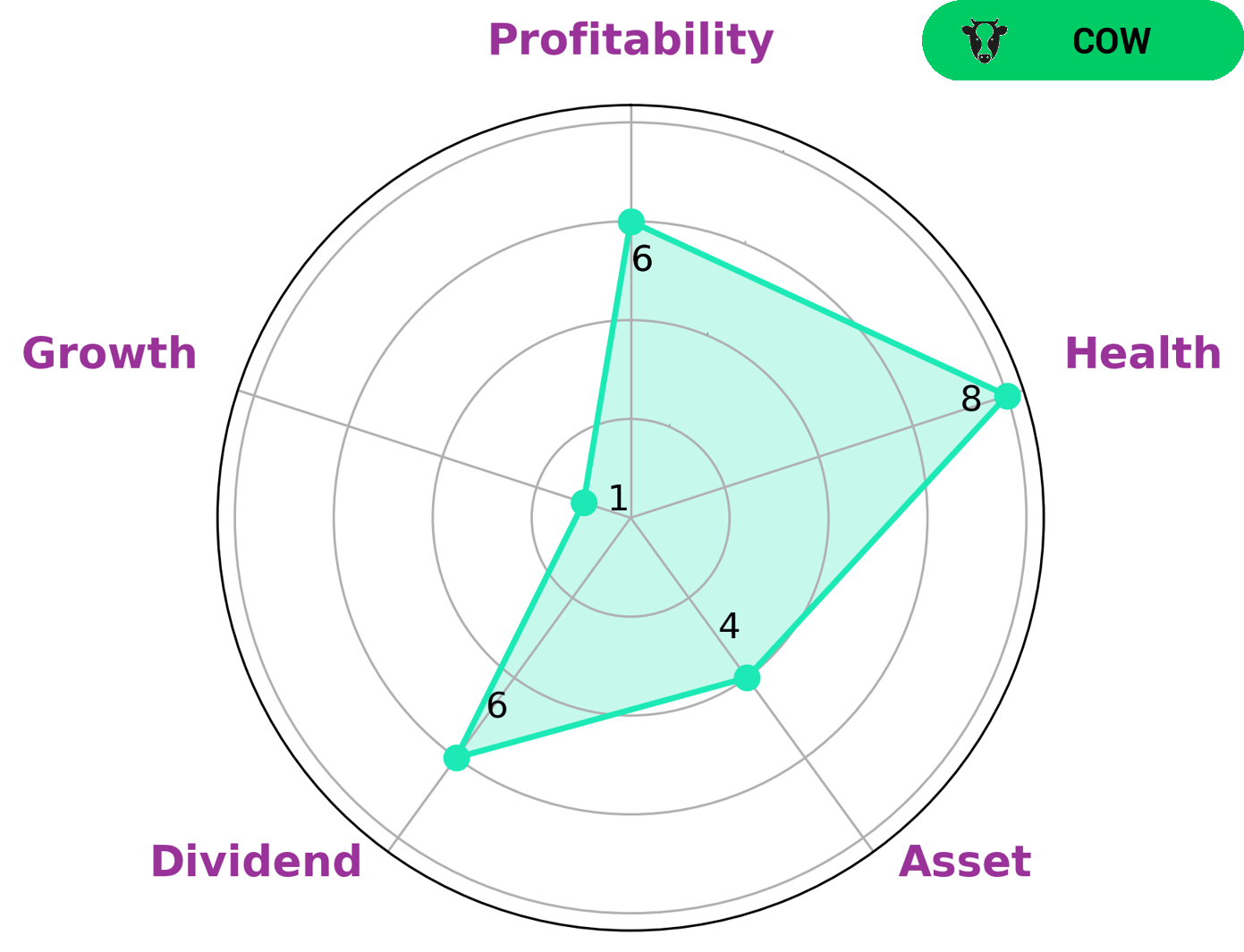

GoodWhale recently conducted an analysis of TRIMAS CORPORATION‘s wellbeing, and based on our Star Chart, they have a high health score of 8/10. This is due to their cash flows and debt being in a good position that allows them to pay off debt and fund future operations. TRIMAS CORPORATION is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. Therefore, investors who are looking for steady and reliable income streams will be interested in investing in this company. Our analysis also found that TRIMAS CORPORATION is strong in terms of assets, dividend, profitability, and weak in terms of growth. We believe this makes them an attractive option for investors looking for value investments rather than rapid growth. More…

Peers

The company competes with other companies in the same industry, such as Altra Industrial Motion Corp, Cummins Inc, and EnPro Industries Inc.

– Altra Industrial Motion Corp ($NASDAQ:AIMC)

Altra Industrial Motion Corp is a global designer, producer and marketer of a range of mechanical power transmission products. The company’s products are used in a variety of industries, including food and beverage, material handling, packaging, automotive, aerospace, construction, mining, oil and gas, and others. Altra Industrial Motion Corp has a market cap of 2.43B as of 2022 and a Return on Equity of 3.09%. The company’s products are used in a variety of industries, including food and beverage, material handling, packaging, automotive, aerospace, construction, mining, oil and gas, and others. Altra Industrial Motion Corp is headquartered in Braintree, Massachusetts, and has manufacturing facilities in the United States, Europe, Asia, and South America.

– Cummins Inc ($NYSE:CMI)

Cummins Inc is a company that manufactures engines and other power generation products. As of 2022, the company has a market capitalization of 31.69 billion dollars and a return on equity of 19.85%. The company has a long history dating back to 1919, and it is headquartered in Columbus, Indiana, in the United States. Cummins is a global leader in the design, manufacture, and distribution of engines and related technologies, including fuel systems, controls, air handling, filtration, emission solutions, and electrical power generation systems. The company operates in more than 190 countries and territories through a network of approximately 600 company-owned and independent distributors and 6,500 dealers.

– EnPro Industries Inc ($NYSE:NPO)

EnPro Industries Inc is a diversified industrial company with a focus on engineered products and industrial services. The company’s market cap as of 2022 is 2.01B, and its ROE is 11.96%. EnPro operates in three segments: sealing products, industrial products, and services. Sealing products includes gaskets, seals, and packing products for a variety of applications in the automotive, aerospace, and other industries. Industrial products includes bearings, power transmission products, and other products for the industrial and transportation markets. Services includes repair and replacement services for bearings, seals, and other products, as well as technical services.

Summary

TriMas Corporation has recently experienced a surge in insider buying, which is seen as a positive sign by investors. This trend indicates that corporate insiders believe the stock is currently undervalued and that the stock price will increase in the near future. Furthermore, TriMas Corporation has strong fundamentals, including a solid balance sheet, a healthy dividend yield and a history of consistent profits. With these factors in mind, TriMas Corporation appears to be a solid investment opportunity and could offer investors a potential return on investment.

Recent Posts