TATTOOED CHEF Warned by Nasdaq for Noncompliance

April 6, 2023

Trending News 🌧️

Tattooed Chef ($NASDAQ:TTCF) has been warned by Nasdaq for noncompliance. The company, listed on the Nasdaq Stock Market, is a leading innovator in plant-based foods and creator of unique culinary experiences. The noncompliance letter issued by Nasdaq was due to Tattooed Chef failing to meet the minimum stockholders’ equity requirements. The company is now required to submit a plan to the exchange outlining how it intends to regain compliance with the rules. If the plan is accepted, Tattooed Chef will be given an opportunity to regain compliance with the listing requirements.

Tattooed Chef is taking this situation very seriously and has already taken steps to address the issue. The company has announced a series of strategic initiatives designed to improve its financial position, including cost-reduction efforts, debt restructuring, and a potential capital raise. In this difficult time, Tattooed Chef wants to assure its shareholders that it is working diligently to rectify the issue and restore full compliance with Nasdaq’s listing requirements. The company has been transparent and proactive in its response to the issue and will continue to work to ensure that it meets all regulatory requirements.

Share Price

Its stock opened at $1.5 and closed at $1.5, down by 0.7% from the last closing price. This is the second warning the company has received from Nasdaq this year. As a result, the company is now out of compliance with Nasdaq’s filing requirements. TATTOOED CHEF has yet to respond to the warning and investors are watching closely to see if and how the company will address the noncompliance issue. In the meantime, shareholders remain cautious as they wait to see how the company will handle the issue. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tattooed Chef. More…

| Total Revenues | Net Income | Net Margin |

| 237.31 | -98.96 | -41.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tattooed Chef. More…

| Operations | Investing | Financing |

| -85.46 | -46.92 | 17.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tattooed Chef. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 244.69 | 103.28 | 1.69 |

Key Ratios Snapshot

Some of the financial key ratios for Tattooed Chef are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -41.2% |

| FCF Margin | ROE | ROA |

| -50.4% | -38.6% | -25.0% |

Analysis

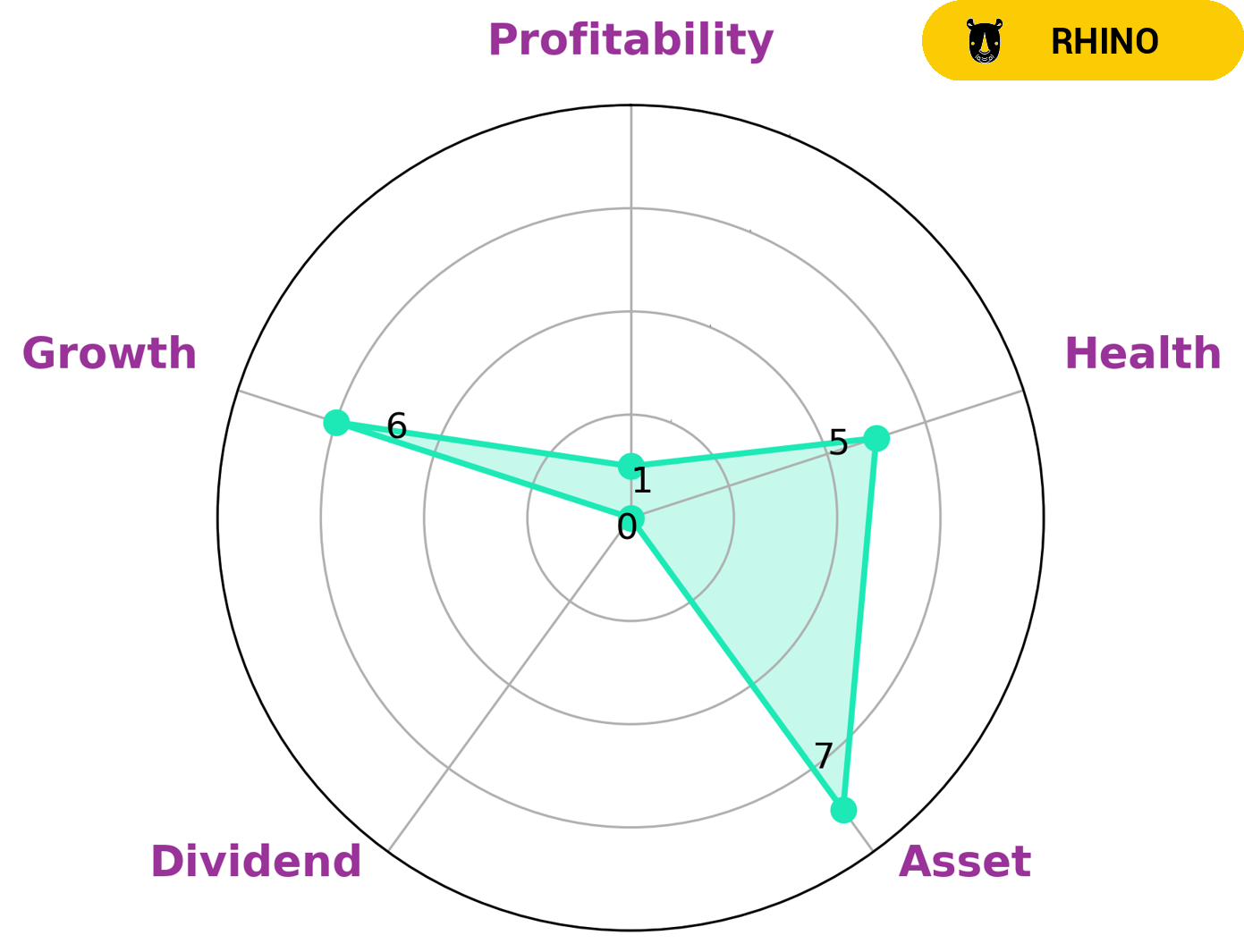

As GoodWhale, we performed an in-depth analysis of TATTOOED CHEF‘s fundamentals. After reviewing our Star Chart, we determined that TATTOOED CHEF is classified as a “Rhino” company – this classification is typically given to firms that have achieved moderate revenue or earnings growth. Given this categorization, we believe that TATTOOED CHEF may be attractive to patient investors looking to purchase and hold their stocks for the long-term. We have found that TATTOOED CHEF is strong in terms of assets, medium in terms of growth, and weak in terms of dividends and profitability. Additionally, TATTOOED CHEF has an intermediate health score of 5/10, indicating that the company is likely to be able to pay off debt and fund future operations. More…

Peers

In the world of food, there is stiff competition between companies that want to be the best in the business. One such company is Tattooed Chef Inc, which competes against The Planting Hope Co Inc, Sovos Brands Inc, and The Fresh Factory B.C. Ltd. All of these companies want to provide the best product possible to their customers, and they all have different strategies for doing so. The Planting Hope Co Inc is a company that focuses on organic and sustainable foods, and they use eco-friendly packaging to appeal to their customers. Sovos Brands Inc is a company that focuses on healthy and nutritious foods, and they use attractive packaging to appeal to their customers. The Fresh Factory B.C. Ltd is a company that specializes in fresh and frozen foods, and they use convenient packaging to appeal to their customers.

– The Planting Hope Co Inc ($TSXV:MYLK)

Planting Hope Co Inc is a company that provides plant-based solutions to the food industry. The company has a market cap of 55.42M as of 2022 and a return on equity of 4.27%. Planting Hope Co Inc’s products are based on the latest scientific research and are designed to provide the best possible nutrition for the food industry. The company’s products are available in a variety of forms, including powders, capsules, and liquids.

– Sovos Brands Inc ($NASDAQ:SOVO)

The company’s market cap is 1.4B as of 2022, a Return on Equity of -1.89%. The company’s products include apparel, footwear, and accessories for men, women, and children. The company operates in the United States, Canada, Europe, and Asia.

– The Fresh Factory B.C. Ltd ($OTCPK:FRFAF)

The Fresh Factory B.C. Ltd is a company that produces fresh fruits and vegetables. It has a market cap of 24.28M as of 2022. The company is based in Canada and its products are sold in North America and Europe.

Summary

Tattooed Chef is a publicly traded company on the Nasdaq exchange. Recently, the company received a noncompliance letter from the Nasdaq. This news has many investors concerned, as Tattooed Chef’s stock price has been volatile in recent months. It is important for investors to closely monitor the situation and assess any potential negative impacts on the company’s financial health.

Additionally, investors should review the company’s financial statements and analyze the prospects of a turnaround in the stock price in order to make an informed decision about investing in Tattooed Chef.

Recent Posts