KRAFT HEINZ Divests from Russian Baby Food Market

April 1, 2023

Trending News 🌥️

Kraft Heinz ($NASDAQ:KHC) has recently announced plans to divest its Russian baby food business. This move follows their decision to focus more heavily on their core US markets and product lines. Kraft Heinz is a multinational food and beverage company that produces and markets food products across the United States, Canada, Europe, and other parts of the world. The divestment of Kraft Heinz’s Russian baby food business marks a significant shift in the company’s strategy. This move comes at a time when the company is looking to refocus on its core markets in the US and expand its existing product lines to increase profitability.

It is expected that this divestment will enable Kraft Heinz to better allocate resources and focus on the markets where it has a stronger presence. By divesting from a market that is not as profitable, Kraft Heinz can focus on expanding its presence in more lucrative markets. This move will also allow Kraft Heinz to focus more resources on developing new products, innovating existing ones, and connecting with customers in new markets.

Market Price

On Friday, KRAFT HEINZ announced its decision to divest from the Russian baby food market, sending their stock price down by 0.4%. The company opened at $39.0 and closed at $38.7, a decrease from the prior closing price of 38.8. This news caused a drop in the stock, as investors reacted to the news.

In addition, analysts remain cautious on the stock given the uncertainty regarding the decision and its implications. Despite the decreased stock price, KRAFT HEINZ remains optimistic that their decision to withdraw from the Russian baby food market is the right one for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kraft Heinz. More…

| Total Revenues | Net Income | Net Margin |

| 26.48k | 2.36k | 11.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kraft Heinz. More…

| Operations | Investing | Financing |

| 2.47k | -1.09k | -3.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kraft Heinz. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 90.51k | 41.64k | 39.74 |

Key Ratios Snapshot

Some of the financial key ratios for Kraft Heinz are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | -2.9% | 14.7% |

| FCF Margin | ROE | ROA |

| 5.9% | 5.0% | 2.7% |

Analysis

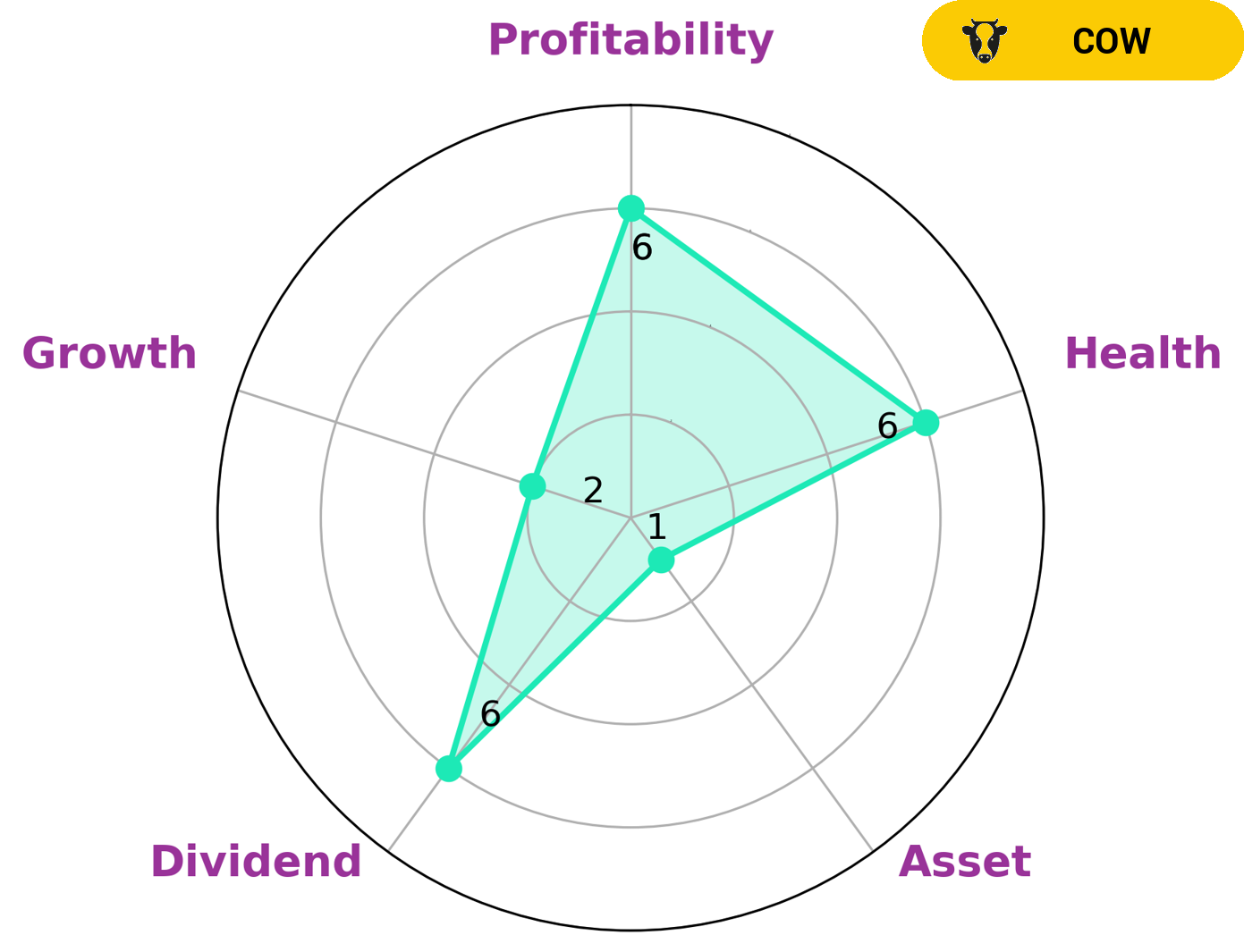

As GoodWhale, I have performed an analysis of KRAFT HEINZ‘s financials. Based on our Star Chart classification of KRAFT HEINZ as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends, this company may be of interest to dividend investors. KRAFT HEINZ has an intermediate health score of 6/10 with regard to its cashflows and debt, which suggests that the company is likely to sustain future operations in times of crisis. Furthermore, the company’s strengths lie in its dividend, profitability and weak asset growth. These factors make KRAFT HEINZ an attractive option for dividend investors looking for a stable return. More…

Peers

The Kraft Heinz Co. is a food and beverage company that offers a variety of products. Its competitors include Kellogg Co, General Mills Inc, and Treehouse Foods Inc.

– Kellogg Co ($NYSE:K)

Kellogg Co is a food manufacturing company that produces cereal, snacks, and other food products. The company has a market cap of $25.03 billion and a return on equity of 33.71%. Kellogg’s products are sold in more than 180 countries and include brands such as Kellogg’s, Keebler, Pop-Tarts, and Eggo. The company has more than 30,000 employees worldwide.

– General Mills Inc ($NYSE:GIS)

General Mills Inc is a food company that produces and markets branded consumer foods in the United States and internationally. The company’s products include cereals, yogurt, snacks, and baking mixes. General Mills Inc has a market cap of 46.37B as of 2022 and a return on equity of 20.18%. The company’s products are marketed under the brands including Cheerios, Lucky Charms, Nature Valley, and Betty Crocker.

– Treehouse Foods Inc ($NYSE:THS)

Treehouse Foods Inc is a food manufacturing company with a market cap of $2.7 billion as of 2022. The company has a return on equity of 0.58%. Treehouse Foods Inc manufactures and sells packaged foods and beverages in the United States. The company offers canned soups, salad dressings, peanut butter, syrups, and other food products. It also provides infant formula and baby food products; and pet food and pet snacks.

Summary

Kraft Heinz, one of the world’s largest food and beverage companies, recently announced the sale of its baby food business in Russia. The move marks the company’s latest effort to streamline its operations and focus on growth opportunities in other markets. Kraft Heinz has been under pressure from investors to cut costs, increase profits, and streamline its portfolio of brands. For investors, this news could mean higher earnings potential in the near term as the company reduces its expenses and redirects funds to more profitable areas. Furthermore, the sale could open up new potential markets for Kraft Heinz to pursue.

However, investors should keep in mind that any new investments may be risky and require careful analysis before committing funds.

Recent Posts