Hormel Foods Poised to Overcome Short-Term Challenges

April 8, 2023

Trending News ☀️

Hormel Foods ($NYSE:HRL) Corporation is a well established firm in the food industry and has a long track record of success. As a result, investors have confidence that the company is well-positioned to overcome short-term challenges. The company produces and distributes a range of high-quality and widely recognized food products, such as its iconic SPAM, Applegate and Dinty Moore products. Recently, the company has faced several headwinds including increased competition and rising costs related to its raw materials. Despite this, the company is optimistic that these challenges are of a temporary nature and will be successfully managed in the near future. The company has continued to invest in innovation and new product development, which has allowed it to remain competitive in a rapidly changing food industry. This includes investing in new technologies, such as artificial intelligence, to increase efficiency and identify new opportunities for growth. Additionally, the company is focusing on cost-saving measures and improving its supply chain. This should help to offset the rising cost of inputs, such as agricultural commodities.

In addition, the company’s focus on premium products has allowed it to maintain healthy margins and remain competitive in a crowded market. This includes a range of products that appeal to health-conscious consumers, such as organic and vegan products. Furthermore, the company’s presence in both domestic and international markets has allowed it to capitalize on growth opportunities regardless of geographic location. Overall, despite recent headwinds, Hormel Foods is well-positioned to overcome these challenges due to its strong financial position, focus on innovation and cost-saving measures, and presence in both domestic and international markets. With these measures in place, investors can have confidence that the company will be able to overcome any short-term challenges in the years ahead.

Price History

HORMEL FOODS opened on Thursday at $40.7 and closed at $40.3, indicating a slight decline of 0.4% from the last closing price of $40.5. Despite the minor dip, HORMEL FOODS looks poised to overcome its short-term challenges. The company has been taking a number of steps to streamline its business, such as divesting non-core assets and focusing on more profitable products.

Additionally, HORMEL FOODS has also been investing heavily in marketing and research and development, which is expected to create long-term value for the company. These initiatives have been gaining traction in the market and have been reflected in the company’s performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hormel Foods. More…

| Total Revenues | Net Income | Net Margin |

| 12.39k | 978.13 | 7.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hormel Foods. More…

| Operations | Investing | Financing |

| 954.85 | -659.83 | -504.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hormel Foods. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.28k | 5.66k | 13.93 |

Key Ratios Snapshot

Some of the financial key ratios for Hormel Foods are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 3.2% | 10.6% |

| FCF Margin | ROE | ROA |

| 5.6% | 10.9% | 6.2% |

Analysis

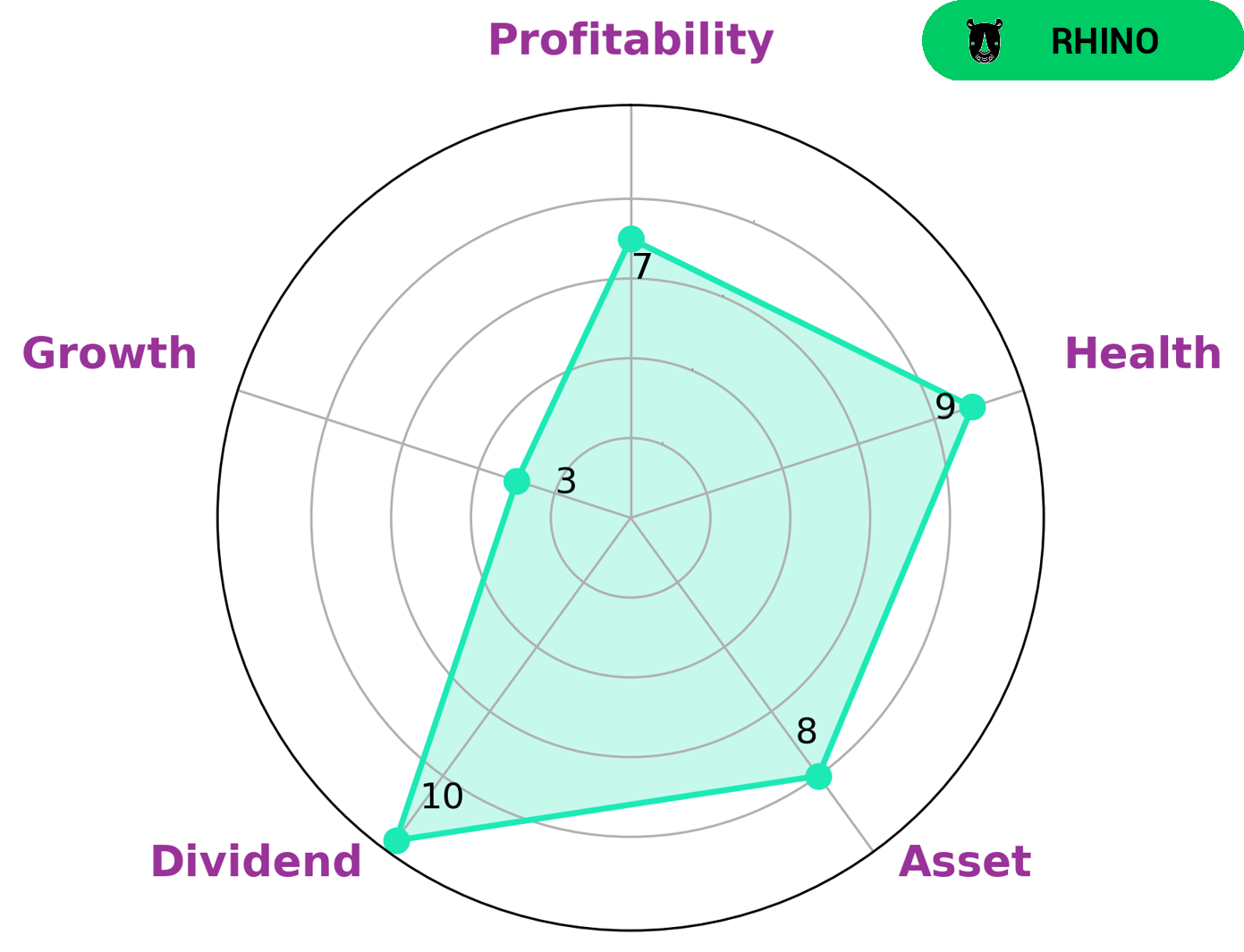

GoodWhale has recently conducted an analysis of HORMEL FOODS‘ wellbeing. We used the Star Chart method to gain an overall picture of the health of the company. The results showed that HORMEL FOODS scored a very high 9/10 in terms of its health, taking into account its cashflows and debt. The results further showed that the company is capable of paying off its debt and funding future operations. In terms of specifics, HORMEL FOODS performed well in asset management, dividend payouts, and profitability. The only area that they were weaker in was growth, which is why we classified them as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Given this information, investors looking for a stable, dividend-paying company might find HORMEL FOODS an attractive option. They could benefit from their reliable income and feel secure knowing that HORMEL FOODS has the capability to pay off debt and fund future operations. More…

Peers

In the food industry, Hormel Foods Corp competes with JM Smucker Co, Fleury Michon, and Bell Food Group Ltd. These companies all produce similar products, so the competition is fierce. Hormel Foods Corp has an advantage because it is a well-established company with a strong brand.

– JM Smucker Co ($NYSE:SJM)

The J. M. Smucker Company has a market capitalization of $15.24 billion as of March 2022 and a return on equity of 7.19%. The company manufactures and markets branded food and beverage products in North America and internationally. Its products include coffee, peanut butter, shortening and oils, ice cream toppings, fruit spreads, syrups, and frozen desserts. The company was founded in 1879 and is headquartered in Orrville, Ohio.

– Fleury Michon ($LTS:0J75)

Fleury Michon is a French company that specializes in the production of prepared foods. The company has a market cap of 79.9 million as of 2022 and a return on equity of 1.6%. Fleury Michon is a publicly traded company listed on the Euronext Paris stock exchange. The company was founded in 1887 and is headquartered in Vire, France.

– Bell Food Group Ltd ($LTS:0RFX)

BFG Ltd’s market cap is 1.43B as of 2022 and has a ROE of 7.15%. The company is a food group that manufactures and supplies food products. It offers a range of products including meat, poultry, fish, vegetables, and desserts. The company has a strong presence in the UK and Ireland, with a network of over 30 manufacturing sites and a workforce of around 23,000 people.

Summary

Hormel Foods Corporation is a leading producer and marketer of a variety of meat and food products. Its range of products includes bacon, sausages, deli meats, chili, and other food items. Despite strong sales in recent quarters, Hormel is facing some headwinds that may dampen its near term performance. These include rising input costs, increased competition, and softer demand from certain key retail customers.

Nonetheless, the company remains well positioned for the long term through its strong brand portfolio, diverse product lineup, and efficient cost structure. Investors should keep an eye on the company’s efforts to manage input costs, maintain market share and deliver innovative products going forward.

Recent Posts