Alaska Disposes of 425 Shares of Ingredion Incorporated

January 14, 2023

Trending News ☀️

Ingredion Incorporated ($NYSE:INGR) is a global food, beverage, and industrial ingredient supplier. They are headquartered in Illinois, United States and are listed on the New York Stock Exchange. They are a leading provider of sweeteners, starches, nutrition ingredients, and biomaterials. Recently, the Department of Revenue of the State of Alaska has disposed of 425 shares of Ingredion Incorporated. This comes after the company’s stock has been performing well over the past few months. The 425 shares disposed by the Department of Revenue represent a small portion of the company’s total shares outstanding.

The disposal is likely a result of Alaska’s government attempting to take advantage of Ingredion’s current success and make a profit from their investment. The disposal of these 425 shares by the Department of Revenue shows that Alaska is confident in the company’s potential and is willing to take profits from their investments in the company. This could be seen as a sign of confidence in Ingredion’s future performance and could lead to more investors buying into the stock as a result. It shows confidence in the company’s potential and could lead to more investors buying into the stock. With its strong performance over the past few months, Ingredion Incorporated’s stock could continue to rise in the near future.

Share Price

Alaska recently made the decision to dispose of 425 shares of Ingredion Incorporated, one of the leading global ingredients solutions providers. At the time of writing, news coverage has generally been positive. On Wednesday, Ingredion Incorporated’s stock opened at $98.8 and closed at $99.3, representing a 0.5% increase from the prior closing price of 98.8. This is a positive indication for the company and a sign that investors are optimistic about its future prospects. The company has always been focused on providing high quality, innovative solutions for customers in the food, beverage, pharmaceutical, and industrial markets. In recent years, the company has also increased its focus on sustainability, investing in renewable energy and promoting environmental responsibility in its operations.

The decision to dispose of 425 shares of Ingredion Incorporated is likely a strategic move by Alaska to diversify its portfolio and reduce risk. It is possible that they may decide to reinvest in the company at a later date, however, given the current market conditions and positive outlook for Ingredion Incorporated’s future prospects, this seems unlikely. Overall, this news indicates that Ingredion Incorporated is in a strong position and looks set to continue its success in the future. The company’s commitment to sustainability and innovation makes it an attractive option for investors and should help ensure that its stock remains stable in the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ingredion Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 7.71k | 445 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ingredion Incorporated. More…

| Operations | Investing | Financing |

| 213 | -299 | -15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ingredion Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.4k | 4.22k | 47.43 |

Key Ratios Snapshot

Some of the financial key ratios for Ingredion Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | 0.5% | 9.1% |

| FCF Margin | ROE | ROA |

| -1.1% | 14.0% | 5.9% |

VI Analysis

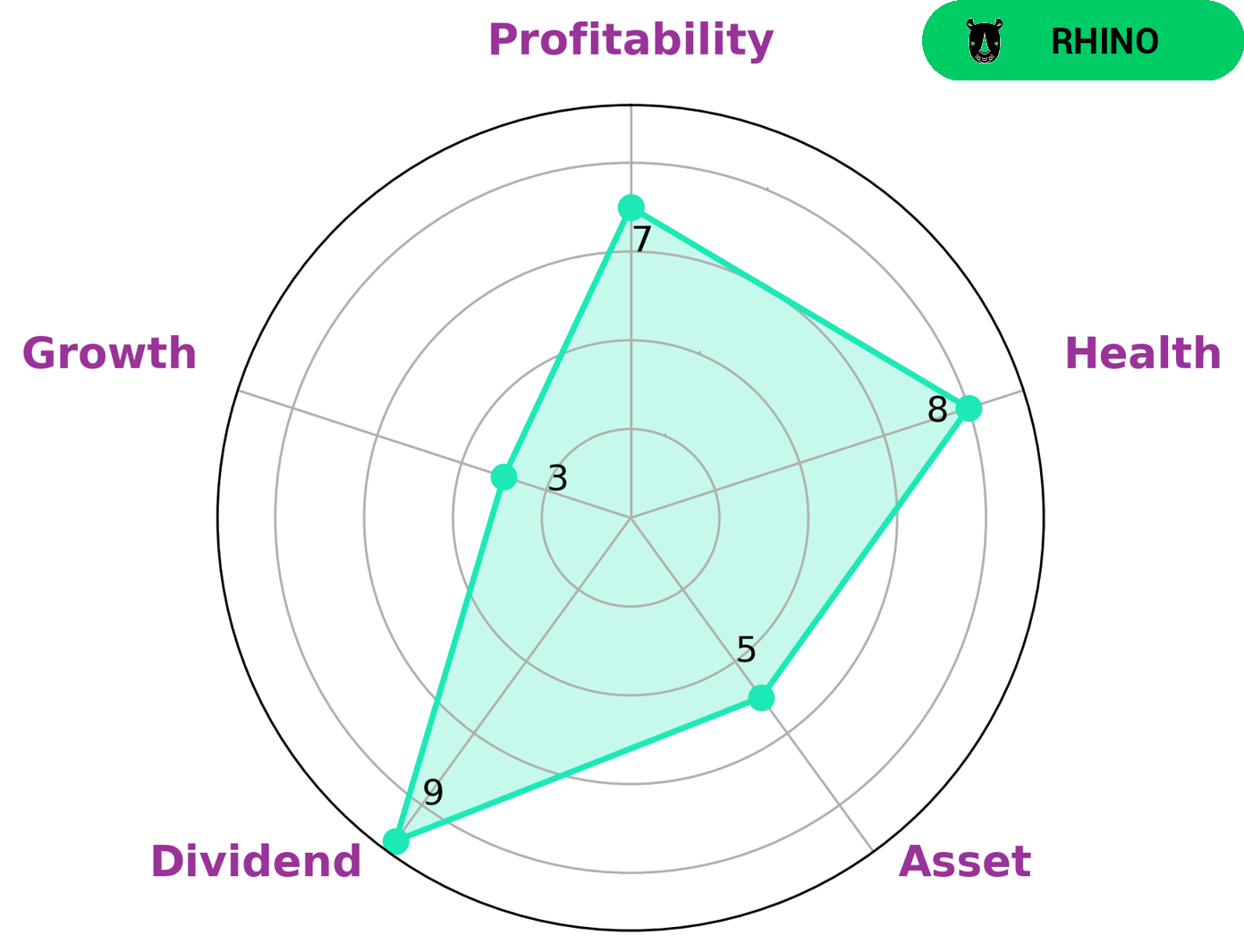

Investors interested in a secure and reliable long-term return may be attracted to INGREDION INCORPORATED due to its high health score of 8/10 according to the VI Star Chart. This score reflects the company’s strong cashflow and lack of debt, which makes it well-equipped to safely ride out any crisis without the risk of bankruptcy. Furthermore, INGREDION INCORPORATED is strong in dividend payouts, profitability, and medium in asset. However, its weakest area is growth, as it is classified as a ‘rhino’, meaning it has achieved moderate revenue or earnings growth. The company’s fundamental analysis is made simple by the VI app, which shows the company’s strengths and weaknesses. In addition, investors can use the app to assess INGREDION INCORPORATED’s ability to work through a crisis and its ability to generate returns. Overall, investors looking for a reliable long-term return may be attracted to INGREDION INCORPORATED due to its strong cash flow, lack of debt and moderate growth potential. As such, investors may find this company to be a good fit for their portfolio. More…

VI Peers

The competition between Ingredion Inc and its competitors, Procter & Gamble Co, Nestle SA, and Edita Food Industries S.A.E., is fierce as each company strives to be the leader in the global food and beverage industry. From product innovation and marketing to pricing and distribution, each company is looking for the edge that will give them the upper hand in the competitive landscape.

– Procter & Gamble Co ($NYSE:PG)

Procter & Gamble Co is a multinational consumer goods giant, headquartered in Cincinnati, Ohio. The company manufactures a wide range of household products, from laundry detergents to toothpaste. As of 2022, the company has a market capitalization of 362.18B and a Return on Equity of 25.38%. The company’s size and profitability are demonstrative of its success in the consumer goods industry. With a large market cap and high return on equity, Procter & Gamble Co has established itself as an industry leader.

– Nestle SA ($LTS:0QR4)

Nestle SA is one of the world’s largest food and beverage companies, serving consumers in over 190 countries. Its market cap of 305.36B as of 2022 is a testament to its success and industry leadership. The company’s return on equity (ROE) of 14.82% is also impressive, indicating that the company is efficiently utilizing the capital it has available to generate profit and create value for its shareholders. This impressive market cap and ROE are indicative of the strength of Nestle SA’s business model and its ability to remain competitive in an ever-changing industry.

– Edita Food Industries S.A.E ($LSE:66XD)

Edita Food Industries S.A.E. is a leading food manufacturing and distribution company based in Egypt. The company has a market capitalization of 371.8 million as of 2022 and has achieved a return on equity of 33.89%. This indicates that the company is financially healthy and is able to generate returns on its investments. Edita produces and markets a wide range of baked goods, snacks and confectionery products, including cakes, pastries, rusks and biscuits, in addition to providing products for specialty markets. It also provides ready-made meals, frozen fruits and vegetables, and frozen ready-meals for catering services. The company is well-positioned to benefit from the growing demand for convenience food products in Egypt and across the region.

Summary

Ingredion Incorporated is an American publicly traded ingredients solutions provider, known for its corn-based products. The company has seen a recent increase in investor interest, due to their decision to dispose of 425 shares of their stock. At the time of writing, news coverage of the event has been mostly positive. With a solid balance sheet and strong growth prospects, Ingredion Incorporated remains an attractive investment opportunity for investors who are looking for a consistent, reliable return.

Recent Posts