Vertex Energy Intrinsic Stock Value – Vertex Energy Misses Earnings and Revenue Estimates

May 10, 2023

Trending News ☀️

Vertex Energy ($NASDAQ:VTNR), Inc. (VERTEX) recently released their earnings report for the third quarter and it did not meet analysts’ expectations. The company posted a GAAP EPS of $0.04, which missed the estimates by $0.09.

Additionally, the revenue of $691.14M was lower than what was predicted by $63.04M. Vertex Energy operates seven strategic business units which include fuel blending and oil re-refining. They have made a name for themselves by innovating and pushing the boundaries of the industry in order to deliver a profitable solution within the environmental waste management sector.

Market Price

On Tuesday, VERTEX ENERGY reported its fourth quarter results, missing estimates for both earnings and revenue. Investors had been hoping for a more favorable outcome, but the report showed that the company had missed expectations by wide margins. This news caused the stock to fall sharply and VERTEX ENERGY saw its market value take a hit in response. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vertex Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.79k | -5.25 | -1.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vertex Energy. More…

| Operations | Investing | Financing |

| 70.81 | -302.24 | 220.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vertex Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 689.38 | 523.97 | 2.16 |

Key Ratios Snapshot

Some of the financial key ratios for Vertex Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 157.6% | 61.9% | 2.0% |

| FCF Margin | ROE | ROA |

| -0.2% | 24.8% | 5.1% |

Analysis – Vertex Energy Intrinsic Stock Value

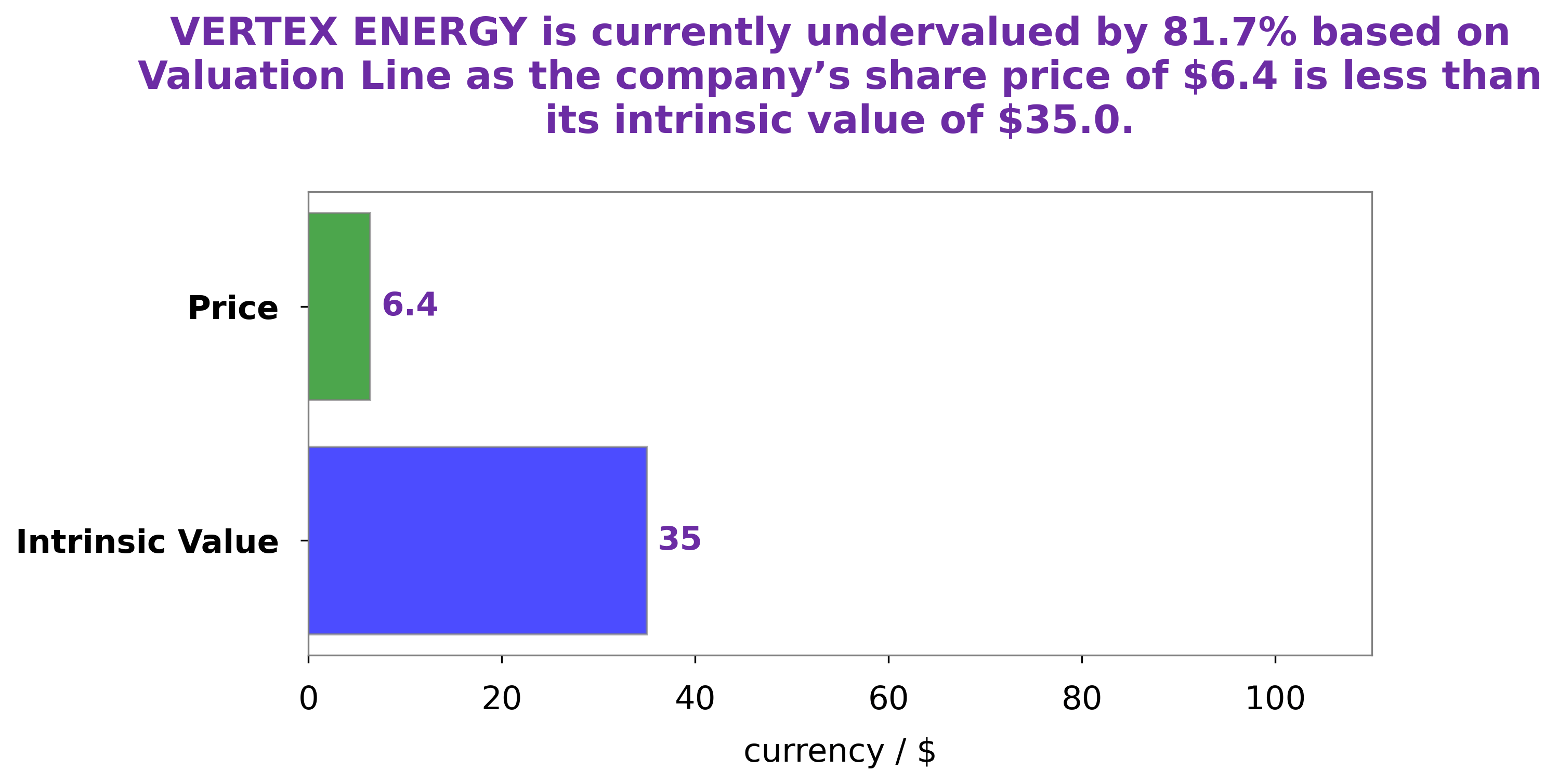

At GoodWhale, we have conducted an in-depth analysis of VERTEX ENERGY‘s wellbeing. After thorough research and calculations, we have determined that the fair value of VERTEX ENERGY share is around $35.0. This was calculated with our proprietary Valuation Line, which is a sophisticated algorithm designed to accurately assess the market value of a company. At the time of writing, VERTEX ENERGY stock is trading at $6.4, which is substantially lower than our estimated fair value. Our analysis reveals that VERTEX ENERGY is currently undervalued by 81.7%. More…

Peers

In the energy sector, competition is fierce among companies striving to be the top provider. This is especially true for those in the oil and gas industry. One company that has been making waves lately is Vertex Energy Inc. This company has been competing against some of the biggest names in the business, such as Rompetrol Rafinare S.A., Neste Corp, and Esso Thailand PCL. So far, Vertex Energy Inc has been holding its own against these much larger competitors.

– Rompetrol Rafinare S.A. ($LTS:0JK8)

Rompetrol Rafinare S.A. is a Romanian oil refining company. It has a market cap of 2.06B as of 2022 and a Return on Equity of -1.8%. The company refines crude oil and sells a variety of petroleum products, including gasoline, diesel, jet fuel, and heavy fuel oil. It also produces and sells asphalt, bitumen, and other petrochemical products. The company has operations in Romania, Bulgaria, Moldova, and Kazakhstan.

– Neste Corp ($OTCPK:NTOIF)

Neste Corp is a Finnish oil refining and marketing company. It has a market cap of 33.36B as of 2022 and a Return on Equity of 22.26%. The company refines crude oil into transportation fuels, such as gasoline, diesel, and aviation fuel, and produces and sells a range of other petroleum products, such as solvents, lubricants, and asphalt.

– Esso Thailand PCL ($SET:ESSO)

Esso Thailand PCL is a petroleum refining and marketing company. It has a market capitalization of 50.18 billion as of 2022 and a return on equity of 40.5%. The company refines and markets petroleum products in Thailand. It also produces and sells petrochemical products.

Summary

Vertex Energy is an oil refining company operating in North America and specializing in the re-refining of used motor oil. On their latest quarterly earnings report, Vertex Energy reported GAAP EPS of $0.04 which was $0.09 lower than analysts had expected. Revenue of $691.14M was also $63.04M lower than analysts had predicted. As a result, the stock price moved down the same day.

Investors should take into consideration the company’s current financial position as it relates to their future prospects. They should also consider other drivers such as the current state of the oil industry and the effect that Vertex Energy’s products may have on the value of their stock. As always, investors should conduct their own research before investing.

Recent Posts