Analyzing Par Pacific Holdings’ Financial Health: A Closer Look.

April 12, 2023

Trending News 🌥️

Analyzing Par Pacific ($NYSE:PARR) Holdings’ financial health is an important task for any investor. Par Pacific Holdings, Inc. is a publicly traded company in the oil and gas industry that is headquartered in Houston, Texas. In order to get a better insight into the company’s financial health, it is important to look at their balance sheet. The balance sheet is the primary tool used to evaluate the financial performance of a company. It shows the financial position of the company at a specific point in time, including their total assets and liabilities. By analyzing the balance sheet, one can determine whether the company is in a strong financial position or whether there are potential risks that should be considered.

In the case of Par Pacific Holdings, their balance sheet indicates that the company is in a good financial position. This indicates that the company has sufficient liquidity to meet its short-term financial obligations. Overall, Par Pacific Holdings’ balance sheet indicates that the company has strong financial health and stability. Investors should feel confident in investing in the company as they have a solid asset base and enough liquidity to cover their short-term financial needs.

Market Price

On Tuesday, PAR PACIFIC stock opened at $28.4 and closed at $28.3, down by 0.2% from prior closing price of 28.4. As such, it is important to analyze the financial health of PAR PACIFIC in order to understand its performance. One key indicator of financial health is the company’s debt-to-equity ratio. This ratio measures the company’s total liabilities divided by its total shareholders’ equity, which indicates the amount of leverage used to finance the company’s assets. A higher ratio means that more debt is being used to finance the company’s assets, which can be risky. It is important to analyze this ratio to ensure that the company is not over leveraged and can pay its debts.

Another important indicator for financial health is the cash flow statement. This statement shows the company’s cash inflows and outflows from its operations, investments, and financing activities. Analyzing this statement can give investors an idea of how well the company is managing its operations and generating cash flows. Analyzing Par Pacific‘s financial health is important in order to understand its performance and determine whether or not it is a good investment opportunity. By looking at the debt-to-equity ratio and cash flow statement, investors can get a better sense of how the company is doing and make informed decisions on whether or not to invest in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Par Pacific. More…

| Total Revenues | Net Income | Net Margin |

| 7.32k | 364.19 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Par Pacific. More…

| Operations | Investing | Financing |

| 452.61 | -87.31 | 13.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Par Pacific. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.28k | 2.64k | 10.66 |

Key Ratios Snapshot

Some of the financial key ratios for Par Pacific are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 42.5% | 5.9% |

| FCF Margin | ROE | ROA |

| 5.5% | 45.4% | 8.3% |

Analysis

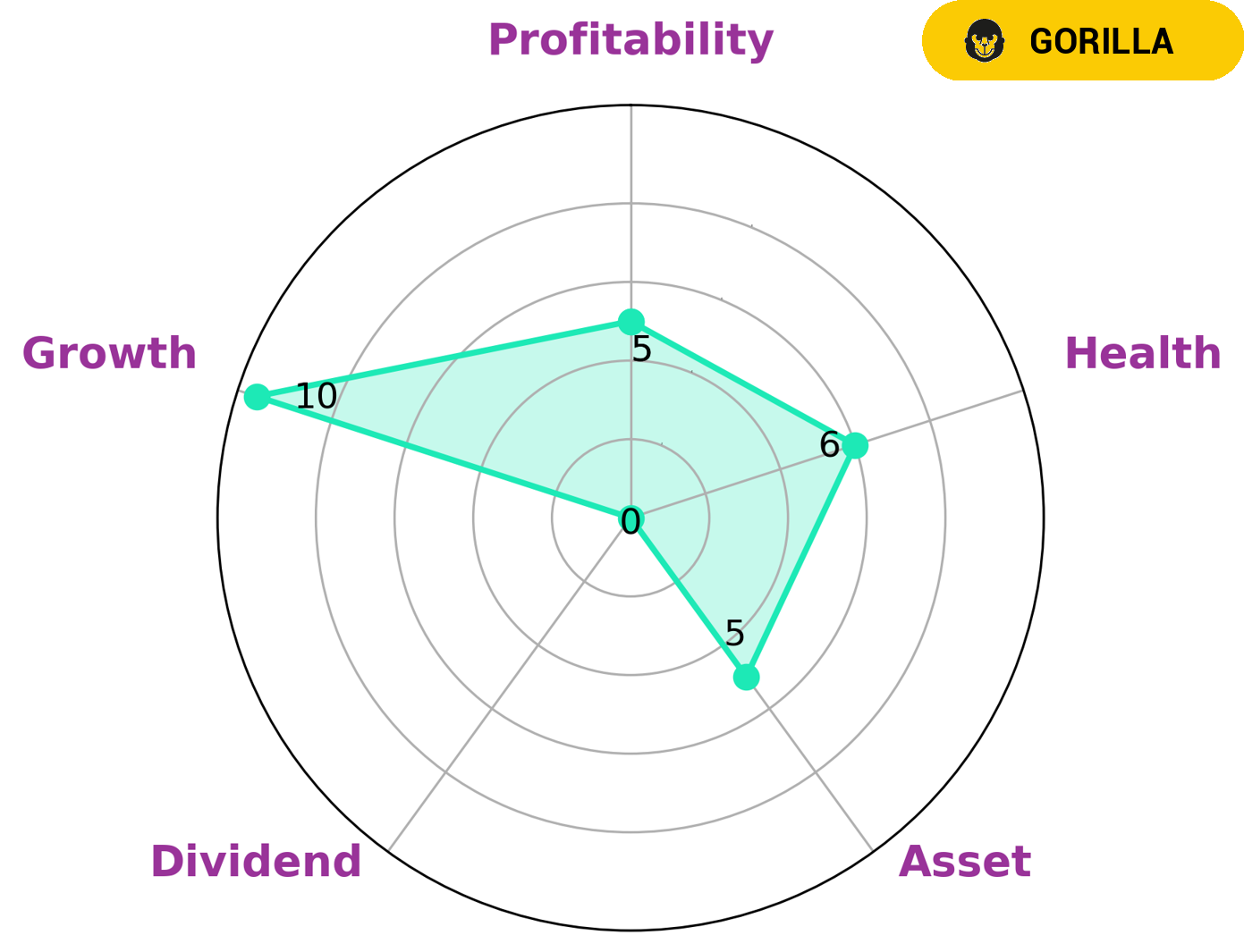

As GoodWhale, we performed an analysis of PAR PACIFIC‘s wellbeing. Our Star Chart shows that the company has an intermediate health score of 6/10, implying that it might be able to sustain future operations in times of crisis. In terms of its overall financial performance, PAR PACIFIC is strong in growth, medium in asset, profitability and weak in dividend. We have classified the company as a ‘gorilla’, which we define as a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given its financial performance, PAR PACIFIC would likely be attractive to investors seeking a stable, long-term investment opportunity. These types of investors may include pension funds, endowments, mutual funds, and others. More…

Peers

The competition among Par Pacific Holdings Inc and its competitors is fierce. CVR Energy Inc, HF Sinclair Corp, and PBF Energy Inc are all major players in the petroleum refining industry, and each company is striving to gain market share. The company’s innovative approach to refining has allowed it to quickly gain market share and become a major competitor.

– CVR Energy Inc ($NYSE:CVI)

CVR Energy Inc. is a petroleum refining and marketing company. It owns and operates two petroleum refineries in the United States. CVR Energy’s operations are conducted through its subsidiaries, CVR refining LP and CVR Partners LP. The company was founded in 2008 and is headquartered in Sugar Land, Texas.

– HF Sinclair Corp ($NYSE:DINO)

Sinclair Broadcast Group, Inc. is one of the largest and most diversified television broadcasting companies in the country. The company owns, operates and/or provides services to more than 190 television stations in 89 markets. Sinclair is the leading local news provider in the country, as well as a producer of sports content. Sinclair’s content is delivered via multiple-platforms, including over-the-air, multi-channel video program distributors, and digital platforms. The company also owns and operates the Tennis Channel and the Ring of Honor professional wrestling promotion.

– PBF Energy Inc ($NYSE:PBF)

PBF Energy Inc is an American oil refining and marketing company. The company owns and operates oil refineries in the United States. PBF Energy Inc has a market cap of 5.73B as of 2022 and a Return on Equity of 52.76%. The company’s primary business is the refining of crude oil into petroleum products. PBF Energy Inc also owns and operates a petrochemical plant in Delaware City, Delaware.

Summary

Par Pacific Holdings is an energy holding company that owns and operates energy and infrastructure businesses. While the company has a history of consistent revenue growth and strong financial performance, it is important to evaluate the health of its balance sheet when investing. Par Pacific’s debt-to-equity ratio is below industry averages, which is a sign of financial strength since the company is able to cover its debts with its equity. Overall, Par Pacific Holdings appears to have a healthy balance sheet.

Recent Posts