Imperial Oil Stock Drops on Wednesday, Underperforming Market

January 17, 2023

Trending News 🌥️

Imperial Oil ($TSX:IMO) is one of Canada’s largest integrated oil and gas companies, with a long history of operations and experience. It engages in the exploration, production, refining, and marketing of oil and natural gas products. Imperial Oil’s stock has been on a steady climb over the past few years, but it experienced a major drop on Wednesday, underperforming the broader market. Imperial Oil’s stock had previously been up by around 4% over the past month, so the drop was particularly surprising. Analysts attribute the drop in Imperial Oil’s stock to the company’s inability to capitalize on rising oil prices. Brent crude futures, which are used to price international oil, rose to their highest level since October last week, but Imperial Oil’s stock did not keep up with the gain. Other energy stocks, such as Cenovus Energy and Suncor Energy, were able to benefit from the increase in oil prices.

The drop in Imperial Oil’s stock could also be attributed to concerns about the company’s dividend policy. Imperial Oil has not increased its dividend for several years, and investors are concerned that there may not be any increases in the near future. As a result, investors have become increasingly cautious about investing in Imperial Oil’s stock. Overall, Imperial Oil’s stock dropped on Wednesday, lagging behind the broader market. Analysts have attributed this to the company’s inability to capitalize on rising oil prices and concerns about its dividend policy. Investors will be watching closely to see if Imperial Oil can turn things around and make up for the losses incurred on Wednesday.

Stock Price

Media coverage of the company has been mostly mixed up to this point. Imperial Oil opened at CA$64.8 and closed at CA$63.6, down by 0.8% from its prior closing price of 64.2. This was likely due to investors showing some caution on the oil and gas sector, which has been volatile this week. Despite this, Imperial Oil has made strategic investments in renewable energy, including solar and wind power, with plans to expand these investments in the future. These initiatives have been well-received by investors and analysts, but the current market volatility is causing some investors to remain cautious.

It remains to be seen if the company’s long-term strategies will pay off in the face of such economic uncertainty. For now, Imperial Oil’s stock continues to underperform the market, despite its efforts to remain competitive and sustainable. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Imperial Oil. More…

| Total Revenues | Net Income | Net Margin |

| 50.36k | 2.48k | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Imperial Oil. More…

| Operations | Investing | Financing |

| 9.32k | -544 | -7.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Imperial Oil. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 44.89k | 22.91k | 35.94 |

Key Ratios Snapshot

Some of the financial key ratios for Imperial Oil are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.4% | 34.6% | 9.4% |

| FCF Margin | ROE | ROA |

| 15.6% | 9.7% | 5.1% |

VI Analysis

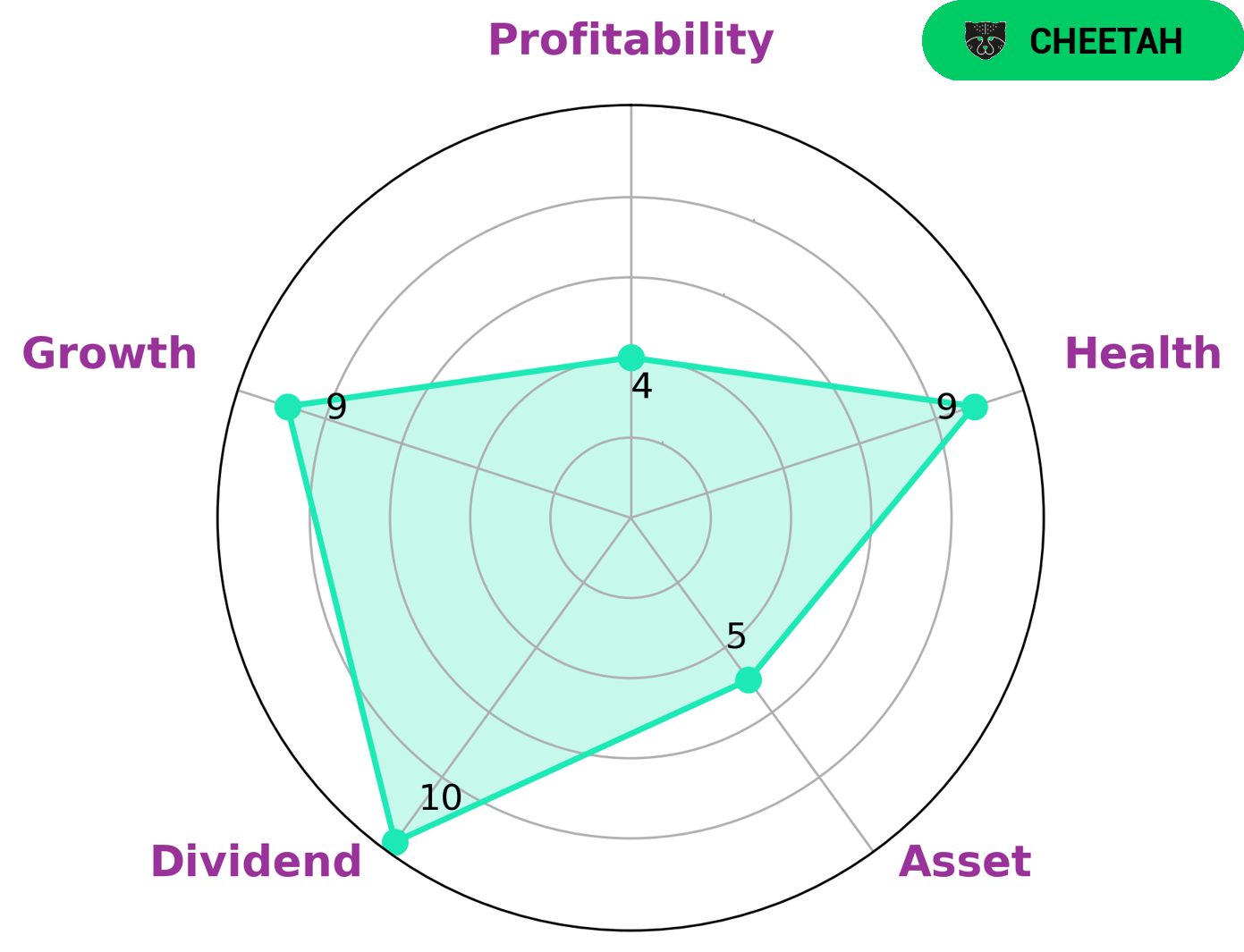

Imperial Oil is a strong company with regards to its fundamentals, as reflected by its high health score of 9/10 on the VI Star Chart. This indicates that the company is capable of paying off its debt and funding future operations with its healthy cashflow. In addition, Imperial Oil is also strong in dividend and growth, and medium in asset and profitability. It is classified as a ‘cheetah,’ a type of company that has achieved considerable revenue or earnings growth but is considered less stable due to lower profitability. Given its status as a cheetah, investors who are looking for higher growth potential but are willing to take on higher risk may be interested in investing in Imperial Oil. Such investors should evaluate Imperial Oil’s fundamentals carefully and keep an eye out for any changes in the company’s financial health. They should also consider the company’s dividend policy, as well as any risks associated with its operations, before making any investment decision. Furthermore, investors should also take into account the wider industry and macroeconomic environment in which Imperial Oil operates, as this could have an impact on the company’s performance and future prospects. More…

VI Peers

Its main competitors include Cenovus Energy Inc, YPF SA, and Equinor ASA. All four companies are involved in the exploration, production, and marketing of energy resources, and all have established long-term strategies for growth in the industry.

– Cenovus Energy Inc ($TSX:CVE)

Cenovus Energy Inc is a Calgary-based integrated oil and natural gas company that focuses on the development, production and marketing of crude oil, natural gas and natural gas liquids. As of 2022, Cenovus Energy Inc has a market capitalization of 47.01 billion, making it one of the largest oil and gas companies in Canada. The company also boasts a solid Return on Equity of 19.76%, which is higher than the industry average of 18.2%. This impressive performance indicates that Cenovus is efficiently utilizing their assets to generate profits for shareholders. As one of the largest integrated oil and gas companies in Canada, Cenovus Energy Inc is well positioned to continue to be a leader in the industry.

– YPF SA ($BER:YPF)

YPF SA is an integrated oil and gas company based in Argentina. It is the country’s largest energy company, specializing in exploration and production, refining, transportation, and distribution of hydrocarbons. The company’s market cap of 2.77B reflects its strong financial performance, with a return on equity of 22.79%. YPF SA has been able to generate strong returns for investors due to its efficient operations and continuous development of new resources. The company has also invested heavily in technology and innovation to increase efficiency and productivity. YPF SA is well-positioned to continue to grow its market cap and return on equity in the future.

– Equinor ASA ($OTCPK:STOHF)

Equinor ASA is a multinational energy company based in Norway. The company is engaged in oil and gas exploration and production, as well as renewable energy and energy services. As of 2021, the company has a market capitalization of 111.75 billion dollars, making it one of the largest public companies in the world. Additionally, the company has an impressive return on equity of 116.26%, reflecting strong performance in its core business segments. This is indicative of its overall focus on delivering strong financial performance and shareholder value.

Summary

Investing in Imperial Oil can be a risky venture due to the company’s stock dropping on Wednesday, underperforming the market. Media coverage has been mixed and investors should be aware of the potential risks when considering Imperial Oil as an investment. Imperial Oil has significant operations in Canada, with a focus on the production and refining of crude oil and natural gas products. The company also produces petroleum products, such as gasoline, diesel, jet fuel, and lubricants.

Imperial Oil has a large network of retail and wholesale sites to distribute its products. Investors should consider Imperial Oil’s long-term outlook, balance sheet strength, dividend yield, historical performance, and management team when researching the company.

Recent Posts