2023: Shanghai Stock Regulator Warns of Need to Strengthen Valuations of China Petroleum & Chemical SOEs

March 14, 2023

Trending News ☀️

The Shanghai Stock Exchange regulator has recently issued a warning that China must take action to improve the stock valuation of its state-owned enterprises, including China Petroleum & Chemical ($SEHK:00386) (Sinopec). This warning stems from the current undervaluation of Sinopec on the stock market, with the share price being significantly lower than the company’s actual value. The regulator has expressed concern that if this undervaluation continues, it could have a knock-on effect on the wider economy, as other companies in related industries may suffer from a decrease in investment or trade opportunities due to the low valuations of the state-owned entities. The government has pledged to take measures to strengthen the value of the shares by 2023 in order to ensure the stability of the stock market and to protect the interests of investors.

In addition, the regulator is also looking into ways to improve transparency in the stock market. There has been an increase in irregular activities such as market manipulation and insider trading, which has caused instability in the market. The regulator is hoping to restore trust in the stock exchange by increasing disclosure and monitoring of transactions. This will help to ensure that investors are better protected and that prices reflect the true value of a company. China Petroleum & Chemical is a key company within the Chinese economy and its undervaluation has been a cause for concern amongst many investors. The Shanghai Stock Exchange regulator has highlighted the need to strengthen the value of its shares by 2023, taking into account the market conditions and investor protection. As such, it is expected that action will be taken by the government in order to improve valuations and restore confidence in the stock market.

Market Price

The news followed a generally positive trend for the company’s stock, which opened at HK$4.5 and closed at HK$4.7, a 4.2% uptick from its last closing price of HK$4.5. The Shanghai Stock Regulator’s warning is meant to emphasize the importance of careful management of SOE stock valuations, particularly in the face of ongoing economic recovery efforts. Given that China Petroleum & Chemical has experienced positive news and performance in the recent past, its stock is likely to remain strong in the near future. Nonetheless, the regulator’s cautionary statement is meant to remind investors to take such trends with a grain of salt, and to remember that stock prices are affected by overall market conditions as well as individual company performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Petroleum & Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 3.19M | 68.37k | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Petroleum & Chemical. More…

| Operations | Investing | Financing |

| 167.67k | -115.04k | -20.84k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Petroleum & Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.05M | 1.13M | 6.45 |

Key Ratios Snapshot

Some of the financial key ratios for China Petroleum & Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.5% | 15.8% | 3.4% |

| FCF Margin | ROE | ROA |

| 1.1% | 8.6% | 3.3% |

Analysis

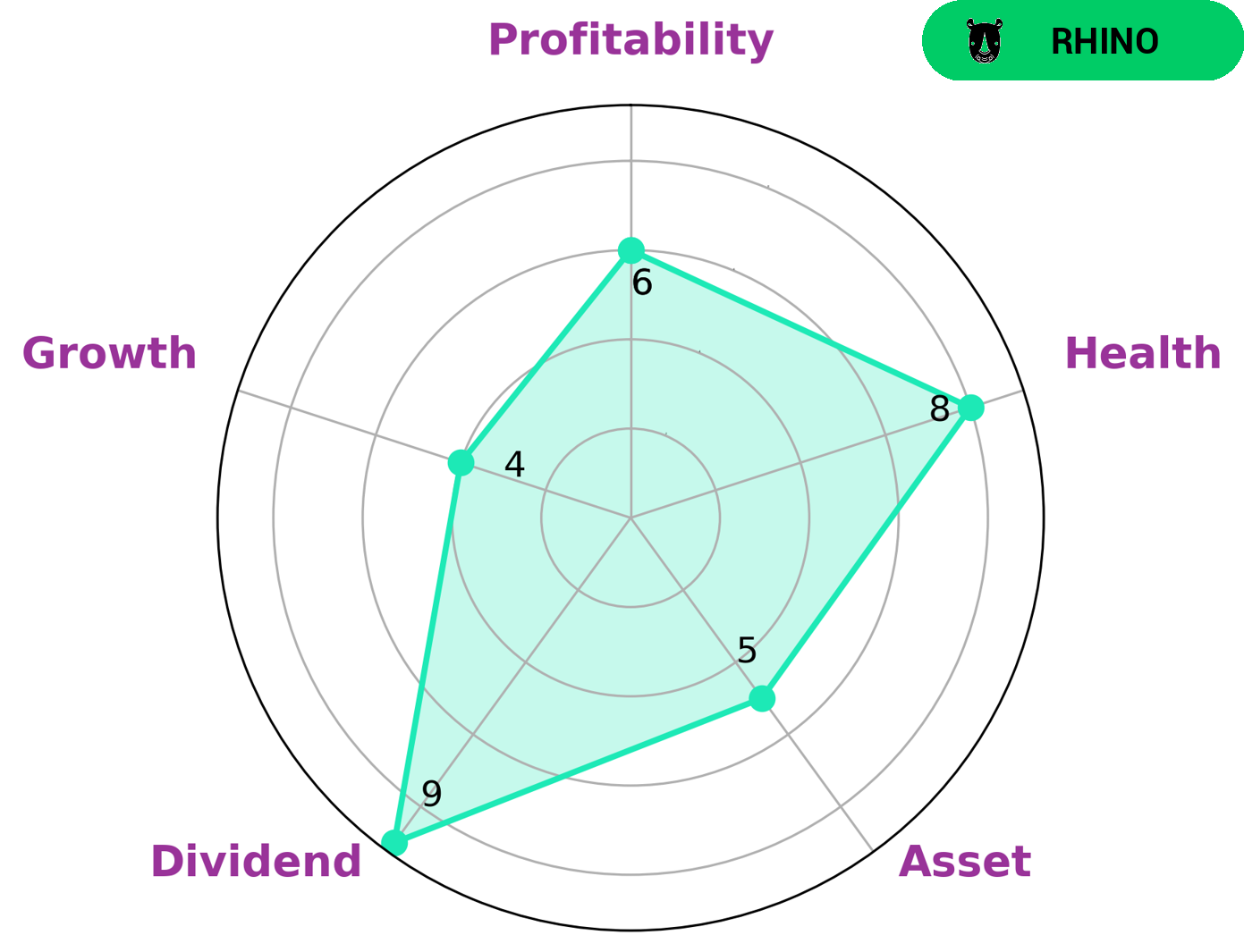

At GoodWhale, we provide comprehensive and insightful financial analysis of CHINA PETROLEUM & CHEMICAL. According to our Star Chart, the company has a high health score of 8/10 with regard to its cashflows and debt, meaning that it is capable to safely ride out any crisis without the risk of bankruptcy. When it comes to other indicators of financial performance, CHINA PETROLEUM & CHEMICAL is strong in dividend, and medium in asset, growth, and profitability. That being said, this company is classified as ‘rhino’, which means that it has achieved moderate revenue or earnings growth. Given its financial standing, this company may be a good opportunity for investors looking for steady returns. We at GoodWhale believe that CHINA PETROLEUM & CHEMICAL is a great investment opportunity for all types of investors. More…

Peers

China Petroleum & Chemical Corp, or Sinopec, is an oil and gas company based in Beijing. It is engaged in the exploration, production, refining, and marketing of petroleum products and chemicals. The company operates in China, Hong Kong, Macau, and Taiwan. It has upstream and downstream operations in China. The company’s competitors include PetroChina Co Ltd, CNOOC Ltd, AAG Energy Holdings Ltd.

– PetroChina Co Ltd ($SHSE:601857)

PetroChina Co Ltd is a Chinese state-owned oil and gas company and one of the largest integrated energy companies in the world. The company has a market cap of 874.45B as of 2022 and a Return on Equity of 10.48%. PetroChina is involved in the exploration, development, production, and marketing of crude oil and natural gas, as well as the refining, transportation, and sale of petroleum products. The company also produces and sells chemicals, fertilizers, and other petrochemical products.

– CNOOC Ltd ($SEHK:00883)

CNOOC Ltd is a Chinese multinational oil and gas company. It is the largest producer of crude oil and natural gas in China, and also the largest offshore oil and gas producer in China. The company has a market cap of 505.91B as of 2022 and a Return on Equity of 18.82%.

– AAG Energy Holdings Ltd ($SEHK:02686)

AAG Energy Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the coal business. The Company operates its business through three segments. The Coal Segment is engaged in the exploration, development, production, washing and sales of coal. The Coalbed Methane Segment is engaged in the exploration and development of coalbed methane. The New Energy Segment is engaged in the provision of solar power generation services.

Summary

China Petroleum & Chemical Corporation, a state-owned company, attracted attention when the Shanghai Stock Regulator issued a warning of the need to strengthen its valuations. Although news of the stock has been mostly positive, the stock price moved up marginally on the same day. Investors should take note of this, as any changes in valuation could affect the stock price in the future. Analysts suggest doing due diligence to understand the fundamentals of the company and watch out for any changes in its performance metrics or other factors that could drive up or down its stock price.

Additionally, investors should watch for any regulatory changes that could impact the company’s valuations.

Recent Posts