Eco-Tek Holdings Experiencing Record High Returns

January 16, 2023

Trending News 🌥️

Eco ($TSXV:EOG)-Tek Holdings is a leading environmental and sustainability company in the world. From its beginnings as a small start-up, Eco-Tek has grown into a global powerhouse and its stock has become a mainstay on the stock exchange. Recently, Eco-Tek Holdings has seen record high returns. The company’s stock has been steadily increasing, with a series of successful investments and developments driving the return on investment. Eco-Tek’s portfolio is diversified and its investments are carefully chosen to maximize returns. The company is also heavily investing in research and development to create new technologies and solutions to reduce emissions and improve energy efficiency. This research is proving to be fruitful, as the company is seeing a steady increase in the returns it is getting from its investments.

Additionally, Eco-Tek has been able to secure major contracts with governments and corporations, providing them with an even larger stream of revenue. Eco-Tek Holdings has become a leader in the green movement and its stock is one of the most sought after in the world. With its impressive returns, the company shows no signs of slowing down anytime soon. As more people become aware of the importance of sustainability, Eco-Tek Holdings is sure to continue to experience record high returns in the future.

Stock Price

Eco-Tek Holdings experienced a record high return on Tuesday when their stock opened at CA$0.3 and closed at CA$0.3. This marked the highest returns the company has seen since its establishment. The surge in stock prices came after the announcement of a new product from the company. The product is a revolutionary innovation that is sure to revolutionize the industry. The company has been working hard to create a product that is both eco-friendly and cost-effective. They have succeeded in doing so, and the new product has been praised for its efficiency and environmental friendliness.

It has caught the attention of many investors, which is why the stock prices have skyrocketed. The surge in stock prices has been beneficial for Eco-Tek Holdings, as it has given them a competitive edge in the industry. With the increased capital, they have been able to expand their research and development efforts, which have led to further innovations. Their innovative eco-friendly product has gained them a lot of attention and their stock price has grown exponentially. This trend is likely to continue as the company continues to bring more revolutionary products to the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eco. More…

| Total Revenues | Net Income | Net Margin |

| 0.05 | -21.83 | -42180.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eco. More…

| Operations | Investing | Financing |

| -16.7 | 0 | 35.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eco. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 67.29 | 5.71 | 0.22 |

Key Ratios Snapshot

Some of the financial key ratios for Eco are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -84.5% | – | -42093.1% |

| FCF Margin | ROE | ROA |

| -34784.3% | -18.6% | -18.8% |

VI Analysis

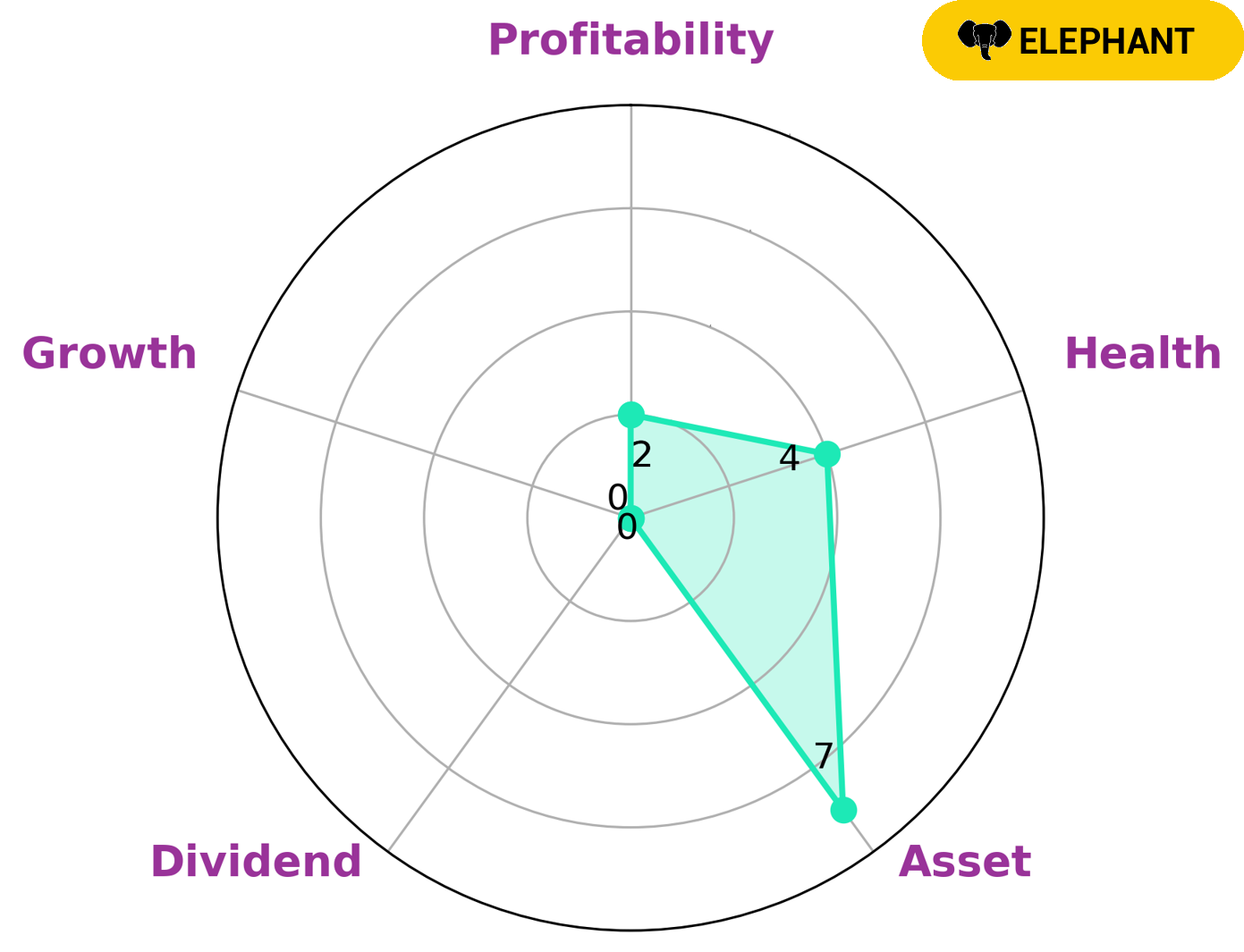

Investors interested in ECO should consider the company’s fundamentals as an indicator of its long term potential. The VI Star Chart provides a simple snapshot of ECO’s financial health, rating it 4/10 due to the company’s cashflows and debt. It is important to note that ECO is strong in terms of assets but weak in other areas such as dividend, growth, and profitability. ECO is classified as an ‘elephant’ company, which is a term used to describe companies that are rich in assets after deducting off liabilities. Such companies may be attractive to investors looking for a steady source of income with a low risk profile. In addition, investors focused on capital appreciation may also benefit from such companies due to their low valuations. Overall, ECO may be an attractive option for investors looking for a stable source of income or those seeking capital appreciation opportunities. However, investors should assess the company’s fundamentals and performance before making any investment decisions. More…

VI Peers

With Canadian Overseas Petroleum Ltd, State Gas Ltd, and U S Oil & Gas PLC all competing for their respective share of the market, Eco (Atlantic) Oil & Gas Ltd is constantly striving to stay ahead of the competition. As such, they have developed innovative strategies to ensure they remain competitive in the industry.

– Canadian Overseas Petroleum Ltd ($LSE:COPL)

Canadian Overseas Petroleum Ltd is an international oil and gas exploration and production company based in Calgary, Alberta. The company operates in various countries, including Nigeria, Liberia, and Ghana. As of 2022, the company has a market capitalization of 53.92 million dollars. This market cap is derived from the total value of all the shares of the company. Canadian Overseas Petroleum Ltd also has a negative return on equity of -19.06%. This indicates that the company has been unable to generate enough profits to cover its equity. The negative return on equity is an indication that the company must improve its operations in order to become more profitable.

– State Gas Ltd ($ASX:GAS)

State Gas Ltd is an energy provider focused on the exploration, development and production of natural gas in Australia. The company has a market cap of 52.84M as of 2022, indicating it is a mid-sized firm. It also has a Return on Equity of 2.71%, which is an indication of the company’s profitability and financial strength. This suggests that State Gas Ltd is able to generate a solid return on the equity capital it has invested and is a relatively sound investment.

Summary

Investors are seeing high returns from Eco-Tek Holdings, making it an attractive option for those looking to invest in the stock market. Analysts attribute this growth to its strong fundamentals and increasing demand for its products. The company has been able to capitalize on the growing need for eco-friendly products and services, with its focus on sustainability and commitment to energy efficiency. It is expected that this trend will continue for the foreseeable future, and that investors will continue to benefit from Eco-Tek Holdings’ strong performance.

Recent Posts