. Sees Unusually High Options Volume

April 22, 2023

Trending News 🌥️

Mr. Cooper ($NASDAQ:COOP) Group Inc. is a publicly traded financial services company that offers mortgage and loan servicing products and solutions for homeowners. Recently, the company has been the target of unusually high options trading activity. Analysts and market watchers are taking note of this activity as the trading volume for Mr. Cooper’s options has been significantly higher than the average daily volume for the stock.

This increase in activity could be signaling that investors are expecting a move in the stock price or are trying to capitalize on a potential move in either direction. Whatever the reason, it is certainly garnering attention as investors seem to have a keen interest in the company.

Market Price

The stock opened at $44.2 and closed at $45.0, representing a 1.9% increase from its last closing price of 44.1. This surge in options trading activity is unprecedented and appears to have been caused by investors attempting to capitalize on the company’s recent performance. It is possible that investors are expecting the stock to gain further momentum in the near future, and are positioning themselves to take advantage of any potential gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mr. Cooper. More…

| Total Revenues | Net Income | Net Margin |

| – | 923 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mr. Cooper. More…

| Operations | Investing | Financing |

| 3.77k | -1.32k | -2.78k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mr. Cooper. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.78k | 8.72k | – |

Key Ratios Snapshot

Some of the financial key ratios for Mr. Cooper are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.4% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

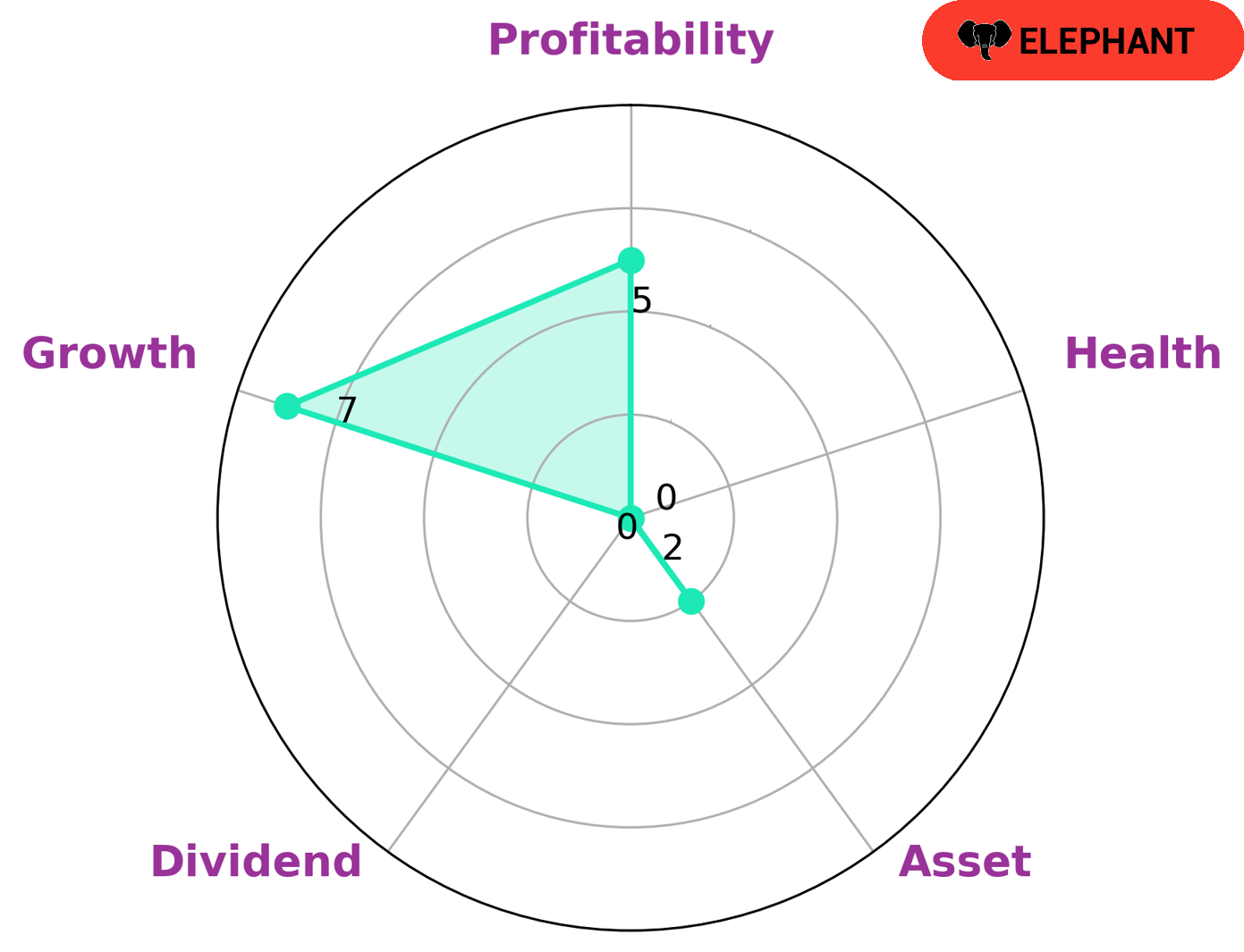

GoodWhale has conducted an evaluation of the fundamentals of Mr. Cooper. Our Star Chart analysis revealed that the company has a low health score of 0/10 with regard to its cashflows and debt, indicating that it is less likely to pay off debt and fund future operations. Additionally, MR. COOPER is classified as an ‘elephant’, a type of company we conclude is rich in assets after deducting off liabilities. This type of company is likely to appeal to investors who are looking for long-term investments or are focused on growth opportunities. MR. COOPER is strong in terms of growth, medium in profitability and weak in asset, dividend. As such, investors who want to benefit from a company’s potential rather than its current stability may be interested in investing in Mr. Cooper. More…

Peers

The company is engaged in providing mortgage loan servicing and origination services. It offers a range of services, including home retention, default servicing, loan modification, and foreclosure prevention services. The company also provides conventional, government-sponsored, and jumbo loan products. Mr. Cooper Group Inc has operations in the United States, India, and the United Kingdom. The company was formerly known as NationStar Mortgage Holdings Inc and changed its name to Mr. Cooper Group Inc in August 2018. Mr. Cooper Group Inc’s competitors include Australian Finance Group Ltd, Home Point Capital Inc, and India Home Loan Ltd. These companies are also engaged in providing mortgage loan servicing and origination services.

– Australian Finance Group Ltd ($ASX:AFG)

The company’s market capitalization is $498.63 million as of April 2021. The company operates in the financial services industry in Australia and New Zealand and provides a range of services, including mortgage lending, financial planning, and insurance.

– Home Point Capital Inc ($NASDAQ:HMPT)

Home Point Capital Inc is a mortgage lender that offers a variety of home loan products to borrowers across the United States. The company has a market capitalization of $242.17 million as of 2022. Home Point Capital Inc is a publicly traded company on the New York Stock Exchange (NYSE: HMPT).

– India Home Loan Ltd ($BSE:530979)

With a market cap of 460.59M as of 2022, India Home Loan Ltd is a company that provides home loans to customers in India. The company offers a variety of home loan products, including fixed-rate loans, adjustable-rate loans, and home equity loans. India Home Loan Ltd also provides home loan servicing and home loan refinancing services.

Summary

Investors have been increasing their interest in Mr. Cooper Group Inc. lately, as unusually high levels of options trading has led to speculation of a potential major move. Analysts are expecting the company to make a significant announcement soon, and have been closely monitoring the stock. Financial experts believe that the stock is currently undervalued and that a positive announcement could significantly increase the share price. Investors should be aware of the uncertainty surrounding the stock, but also consider the potential reward that could come with a successful investment.

The company has consistently demonstrated strong financial performance, which could give investors confidence in the stock’s potential. Analysts also suggest that investors perform their own due diligence before investing in Mr. Cooper Group Inc.

Recent Posts